Thinking about moving to Mexico? Want to know about how to have good health coverage in the country? Here you can find out everything you need to ensure your safety in case of emergencies! Keep reading!

There are several things you need to do before moving to another country – have a stay to settle down, look for jobs, understand the bureaucracies, buy your tickets, go after learning the new language…

But one task that sometimes people don’t remember or don’t know they need is to secure their health insurance.

Living in Mexico can be very enriching: you will enjoy incredible weather, wonderful nature and great food, while probably reducing your cost of living!

Mexico is a relaxed and friendly country. Highways are good, healthcare is excellent and affordable. The immigration system is surprisingly uncomplicated, and long-term life in Mexico is possible for many retirees and remote workers — no lawyers or agents needed.

The country has something for everyone: funky cities and stylish resorts, hundreds of beaches, world-class diving and snorkeling, lush jungles, high-altitude deserts, snow-capped mountains and beautiful Spanish colonial towns. Whether you like a warm climate with a constant sea breeze, a hot dry semi-arid or desert climate, or you want to be somewhere cool enough to need to wear a jacket at night all year round, Mexico has you covered. unlimited.

But in addition to talking about your international health insurance options as an expatriate in Mexico, let’s first talk a little bit about how Mexico’s health system is structured, what is the difference between travel insurance and expat insurance, which is the coverage you will need, and more.

(And be sure to read to the end of the article to learn more about the different types of visas you can use to start living, studying or working in Latin America!)

How does the health system work in Mexico?

Mexican Healthcare is a 3-tier system. Some healthcare systems are described as “two-tier” systems, which are a mix of public and private facilities. But interestingly, Mexico has a 3-tier system.

The most commonly spoken level is known as IMSS. It is essentially Mexico’s social security program and covers both private industry and public service employees.

Another level in Mexico’s healthcare system is the Seguro Popularprogram. Seguro Popular was created to provide to those who do not qualify for the IMSS level, either for financial reasons or because of pre-existing conditions.

The final level in Mexico’s healthcare system is provided through private insurance. Like most private insurance programs, it offers patients a greater degree of comfort and convenience when seeking medical care. However, compared to IMSS and Seguro Popular, it is much more expensive.

Do expats need to have health insurance in Mexico?

Simply put: yes! Health care in Mexico is mandatory for expatriates to have a resident visa or work permit.

So, it’s essential that you insure yourself with one of the coverages I’ve selected from the list below 🙂

But in addition to being mandatory, an international health plan gives you more peace of mind. Especially being in a new country, different from your own, with laws, structures and a language you may not know, and unpredictable healthcare costs.

So, by securing international health insurance coverage you will be assured that you are covered in any emergency or unexpected situation. In addition, there are several other benefits that you can get with an international plan (as I will say in the next question).

As an immigrant in Mexico, should you get an international health plan like the ones recommended in the list below? Or should you get a national plan?

So, this is a choice that will depend on you, as only you know your specific medical needs, the specific coverage you will need in your insurance, from the duration of your stay in Mexico to the options available from national plans.

An international health insurance plan must meet your in-country coverage requirements. If you choose to get an international plan, be sure to check with Turkish government embassies to find out if there is and what is the minimum insurance coverage required.

I’ve never lived in Mexico so I don’t know enough about the national plans that might be available and so I can’t say much about them.

With that in mind, below are some of the reasons you might want to choose an international health insurance plan over public coverage:

- Compared to the costs you may incur, international health insurance may have cheaper monthly fees;

- International health insurance may be easier to use if your stay is short in Mexico, as you can choose exactly how long you want your plan to be;

- International health insurance has greater flexibility as you can cancel or extend it at any time;

- International health insurance provides coverage in other countries, not just Mexico (hence “international” health insurance).

Who do these international health insurance policies cover?

The health insurance companies I have listed below are for the following citizens living in Mexico as expatriates, immigrants, workers, or even students:

- Americans

- Canadians

- Australians

- Brazilians

- Citizens of the European Union (Portuguese, French, German, Dutch, Spanish, Polish, Belgian, Swedish)

- Argentines

- British (English, Scottish, Welsh, Irish)

- New Zealanders

- And for citizens of almost any other country

In addition to expatriates/immigrants residing in Mexico, these companies also operate for residents living in:

- the United States;

- Canada;

- Europe (European Union and United Kingdom);

- Australia;

- And for expats living in almost any other country in the world.

Overall, as they are plans and international companies, they can be used by virtually anyone anywhere, since they have worldwide coverage!

Why can’t I get travel insurance when I move to Mexico? What is the difference between travel insurance and expat insurance?

Travel insurance is important and necessary for any trip, as it will not only cover problems you may experience in case of emergencies and unexpected medical problems, but also for problems with travel, such as lost baggage or flight cancellation.

It is important to know that travel insurance is not ideal for immigrants. Although it is possible to have travel insurance for longer periods, it is only for travelers with temporary stays in a country. Travel insurance covers are not valid for someone who will stay in another country for the long term.

In addition, travel insurance will not meet your health insurance coverage required by law to live in Mexico.

So, you’ll really want to choose an insurance plan that specifically covers expats. And that is exactly what I will help you with the list below.

What are the 7 best health insurance for expatriates and immigrants in Mexico?

I know it’s stressful to find the right insurance plan. With that in mind, take a look at the company comparison table I recommend below. So you can quickly see what are the pros and cons of each company and make the best choice for you!

After the table, I will make a longer description of each of the companies, their plans, main benefits and more!

So the biggest advice I can give is to quickly quote each of the companies on this list before making your decision. It may take a while, but at the end of the day, you can save a lot of money!

|

|

|

|

|

|||

| BENEFIT | LIMIT | LIMIT | LIMIT | LIMIT | LIMIT | LIMIT | LIMIT |

| Benefit Information | |||||||

| Medical Maximum | Unlimited (for the Platinum plan) | $8,000,000 | The site doesn’t specify | Unlimited | US$1,000,000 per year | The site doesn’t specify | $1,000,000 |

| U.S. In-Network Coinsurance | You choose. From 70%(100% thereafter) to 100% | 100% | No | 60% for maximum coinsurance and then 100% | Yes, for higher fees | Only in emergencies | Yes |

| U.S. Out-of-Network Coinsurance | You choose. From 70%(100% thereafter) to 100% | 90% to $5,000 (100% thereafter) | Yes, for higher fees | 100% | 100% | 100% | 100% |

| Mental Health Availability | No waiting period | 12-month waiting period | Co-payment of $25 per visit, waived deductible | 75% up to 40 visits / 60% after that | No | Waiting period of 10 months | Depends on the plan |

| Mental Health Benefit | Inpatient and Outpatient: $5,000 lifetime maximum to paid in full depending on the plan | Inpatient and Outpatient: $50,000 lifetime maximum | Co-payment of $250 after deductible | 100% up to 60 days | International and ambulance: limit not specified | ||

| Inpatient Prescription Drugs | $500 to paid in full depending on the plan | Up to $8,000,000 | Yes | Complete reimbursement | Yes | Yes | |

| Outpatient Prescription Drugs | None, unless you buy the International Outpatient Option | Up to $8,000,000 | Complete reimbursement | Yes | Yes | ||

| Evacuation and Repatriation of Remains | Paid in full | Up to $8,000,000 | Yes | Up to $25,000 | No | Up to 10,000 euros | Yes |

| Accidental Death & Dismemberment | Depends on the plan | Rider available, limit depends on age. | $50,000 | Depends on the plan | |||

| Emergency Dental | Paid in full | Up to $8,000,000 | Optional | 1,000 per year, $ 200 per tooth | Yes, however you need to pay an extra fee on top of your plan | Depending on the plan, it’s unlimited | It has coverage in the Diplomat Long Term and Diplomat International plans |

| Treatment Necessary as Result of Terrorism | Up to the amount of the coverage | Rider available up to $50,000-lifetime maximum | Clause available up to maximum of $50,000 in lifetime payments | ||||

| Amateur Sports | Unlimited | Rider available up to $10,000 | No | Yes | No | No | No |

| Newborn Care | |||||||

| Routine Nursery Care of a Newborn Child of a Covered Pregnancy | $25,000 to $156,000 depending on the plan | $1,000 additional deductible, $50,000 lifetime maximum, $200 wellness benefit for first 12 months | Yes | Depends on the plan | Can be unlimited depending on the plan | Can be unlimited depending on the plan | |

| Children born as a result of fertility treatment (such as IVF or surrogacy) | Only after the baby is 90 days old | Excluded | Depends on the plan | Excluded | No | ||

| Neonatal Intensive Care Unit | Check website for updated information | $250,000 maximum for first 31 days | No | Up to $250,000 for the first 31 days | No | ||

| Pre-existing Conditions | |||||||

| Pre-existing condition exclusion period | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness |

| Pre-existing condition look back period | Any time prior to effective date | Any time prior to effective date | Any time prior to effective date | Any time prior to effective date | Any time prior to the effective date | Any time prior to the effective date | Any time prior to the effective date |

| Pre-existing annual maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Unlimited depending on the plan | Unlimited depending on the plan | Full reimbursement | Unlimited depending on the plan | Unlimited depending on the plan |

| Pre-existing lifetime maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Unlimited depending on the plan | Unlimited depending on the plan | Full reimbursement | Unlimited depending on the plan | Unlimited depending on the plan |

Attention: This article and table are made for informational purposes as the information contained here is subject to changes and updates.

In my opinion, the best international health insurance companies for expats are:

- Cigna

- IMG

- Now Health

- Aetna

- SafetyWing

- Global Underwriters

- Foyer Global Health

1. Cigna ![]()

First, Cigna. It is a company founded in the United States but has a large role in Europe. It’s a great choice when it comes to international health insurance.

With more than 60 years in this area in the market, Cigna has great recognition because of its insurance and worldwide they have more than 170 million customers. My partner, Nikki, actually purchased a health plan from Cigna to fulfill the validation requirements of her residence card in Sweden.

Cigna is a company with high diversity of plans for you to choose, including specific plans for expatriates (and that work great if you are moving to Mexico! ), in addition to individual and family plans).

There are individual or family plans for you who are moving to Mexico. One advantage of Cigna’s plans is that you have the possibility to add benefits to your plan according to your specific needs and the type of medical care you need to cover.

You can choose between the Silver, Platinum or Gold plan, which has coverage in more than 200 countries and territories around the world.

If you are looking for a cheaper insurance plan for Mexico, a great option is the Cigna Close Care plan. This plan is particularly the most affordable that Cigna has, because the coverage is only for its country of origin and the country where it intends to reside (Mexico in this case).

Advantages of an international health insurance plan with Cigna:

- Service available 24 hours, every day of the week

- Flexibility to change plans tailored to your needs

- Has coverage for COVID-19 and PCR testing

- You do not need to register to make a quote

- It has a digital system to find hospitals and clinics with care close to your location

- Cigna, for the most part, pays healthcare providers directly, without the need for a refund system

Disadvantages of an international health insurance plan with Cigna:

- Some plans do not cover motherhood

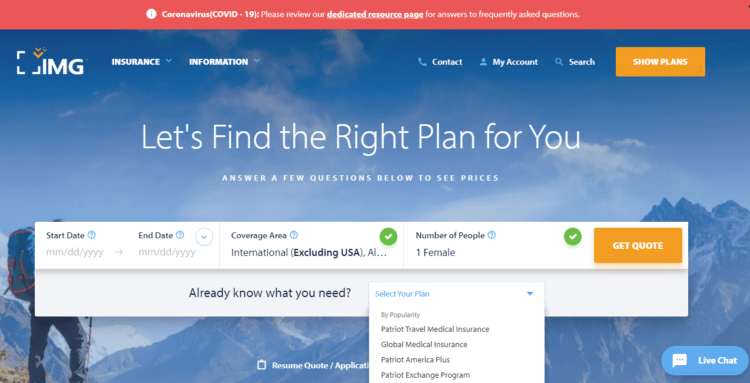

2. IMG ![]()

Another company with great recognition in the area of international insurance is IMG. It has over 25 years of experience and 3 subsidiaries around the world.

IMG has several types of plans for your choice, both for individual profiles or entire families. They also have a variety of plans specific to types of travelers, such as expats. You will see that they have the possibility of plans with long stays of 1 year or more, but also short-term travel plans.

Their website is intuitive and easy to navigate, with filters for dates, plan duration, destination and more that make your search easier. In addition to these filters, you can add your personal details like age and specific needs for the best coverage.

Thus, IMG will provide a detailed quotation that allows a comparison of plan and coverage options for you to have freedom and choose what is best.

Only pay attention to the details of each plan, as some do not have coverage for all age groups and not all of your plans cover the needs of Covid-19.

Advantages of an international health insurance plan with IMG:

- You have the choice of Portuguese on the site

- Customer service 24 hours, 7 days a week

- Flexibility in profiles and plans

- Availability of more than 17,000 clinicians to support

Disadvantages of an international health insurance plan with IMG:

- Not covered by COVID-19 depending on plan

- No coverage for 75+ year olds

Now Health International is aptly named to reflect its core objective of offering a service that is efficient, affordable, and readily accessible. The company places a paramount emphasis on establishing a strong customer relationship. They ensure that plan information is presented in a clear and streamlined manner, and any potential queries are promptly resolved by their dedicated customer support team.

The primary focus of Now Health plans is to cater to the unique demands faced by individuals living abroad. They strive to provide guidance and facilitate access to high-quality healthcare services across the globe.

Pros of an international health insurance plan with Now Health:

- Customized plans according to your needs

- Clear information and excellent customer service team

- Provides coverage in 194 countries and territories

- Plans with high coverage routine maternity coverage

Cons of an international health insurance plan with Now Health:

- You must wait a 12-month grace period to use maternity coverage.

- In some procedures, it is necessary to use the company’s reimbursement system, which means that you would have to pay for your care initially

4. Aetna (acquired by Allianz)

Aetna is a leader and award winner in the area of international insurance. If you’re in search of safety and credibility in your choice of insurance provider before your move to Japão, Aetna is a good company to consider.

Although they don’t have a large variety of plans on offer, the ones they do have give you the flexibility to adjust and add on complementary coverage (like dental care). Depending on the policy, some include coverage of up to 5 million USD.

You can choose from family or individual plans, as well as include coverage for repatriation and medical evacuations.

As an expat, I can recommend the Aetna Pioneer plan. This plan has basic coverage of up to 1.75 million USD. Just fill out the short form on their website to get an exact quote and detailed information about all of the available policies.

Pros of an international health insurance plan with Aetna:

- Maternity care is covered

- Aetna has a mobile app to help you easily find nearby medical services and providers

- Short-, mid-, and long-term plans to choose from

- Customer services available 24 hours a day, 7 days a week

- Pre-trip assistance available to help answer your questions on things like vaccines and accessing regularly-used medications while traveling

Cons of an international health insurance plan with Aetna:

- Few plans to choose from

- Cost of plans above the average of the other companies on this list

5. SafetyWing

SafetyWing is a popular and well-known company particularly for insurance for digital nomads, given that they have insurance plans specifically for remote workers and companies, expats, and digital nomads.

One of the advantages of SafetyWing is that its policies are a little more accessible and easier to understand than the other options on the market. SafetyWing also covers children aged 2-10 for free if their caretakers have a plan with them.

Each plan has a specific price that depends on your age. The cheapest SafetyWing plan doesn’t cover pre-existing conditions, but it does have coverage of up to 250,000 USD. Though you do have the freedom to add additional pre-existing condition coverage separately if you need to.

What I like most about SafetyWing is that they offer 30 days of coverage for free in your home country for every 90 days that you use it overseas, like in Japão or the EAU in general.

Pros of an international health insurance plan with SafetyWing:

- Modern, intuitive website that makes it easy to find policy info

- Customer services available 24 hours a day every day of the week

- 30 days of coverage given for free in your home country for every 90 days of coverage overseas

- They cover Covid-19 and treatments recommended by specialists

Cons of an international health insurance plan with SafetyWing:

- Plans aren’t quite as complete and tend to have lower coverage overall than some of the other options on this list

- The prices shown on the website don’t include taxes and fees

Global Underwriters is another well-known and very popular company when we talk about insurance. They have policies that serve immigrants, students, digital nomads, and expats with will be beginning a new life elsewhere in the world.

For anyone who is moving to Japão, I recommend the Diplomat long Term or the Diplomat International Plan. Both have very complete medical coverage that in general includes all that an expat may need in their new home.

Pros of an international health insurance plan with Global Underwriters:

- Up to 1 million USD in medical coverage is included in the plans cited above, plus 1 million USD in coverage for cases of accidental death or dismemberment

- Client support available 24 hours a day each day of the week

- The plans I mentioned include emergency dental coverage, medical evacuation, and repatriation of mortal remains

Cons of an international health insurance plan with Global Underwriters:

- The Diplomat Long Term plan doesn’t protect travelers in Iran, Afghanistan, or Cuba

- The Diplomat International plan doesn’t have Covid-19 coverage

- Global Underwriters doesn’t work with residents of Australia, Iran, South Dakota, Maryland, or New York

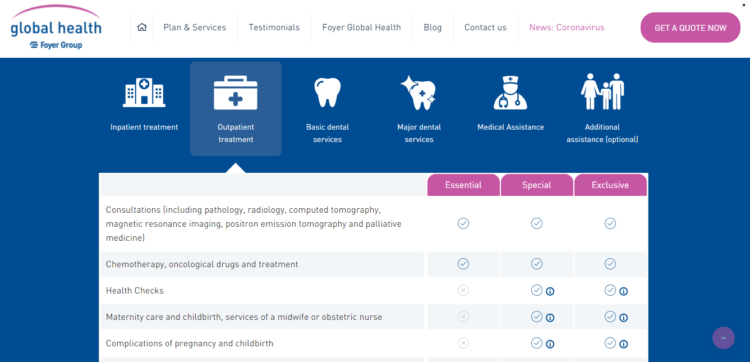

Foyer Global Health is renowned for its international health insurance plans for travelers, expats, digital nomads, and immigrants.

They are a company with many, many plans to choose from (probably more than any other company you’ll find out there), as well as being a trustworthy organization (they are part of the larger European Foyer Group).

Pros of an international health insurance plan with Foyer Global Health:

- All plans include coverage for dental surgeries, appointments, and treatments

- Customer service available online by email or by phone 24/7

- Includes pre-trip preparation support on vaccinations and in preparing a first aid kit

- Coverage available for evacuation and repatriation

Cons of an international health insurance plan with Foyer Global Health:

- The limits of their plans aren’t very clear

Bonus

– GeoBlue

GeoBlue has spent 20 years providing insurance plans with international health coverage.

But GeoBlue only allows their plans to be purchased by citizens and residents of the United States. So if you aren’t an American citizen or green card holder moving to Japão, you can skip this option.

GeoBlue has health plans for all types of travelers, including immigrants. Their Xplorer Essential plan is the one I most often recommend since it’s made for long stays overseas and has unlimited coverage.

But if you’re looking for a shorter plan, take a look at GeoBlue’s Voyager option. Just fill out the form on their website or reach out to an insurance broker to get a quote and more detailed information about their plans.

Pros of an international health insurance plan with GeoBlue:

- They have an app with resources like telehealth

- 24/7 customer services

- All of their plans include unlimited coverage

Cons of an international health insurance plan with GeoBlue:

- Their plans are only available for residents of the United States or American citizens

- Not a lot of flexibility in their plans

- You need to fill out a form or contact an insurance broker to get more information and an exact budget for their plans

Types of Mexican Visas

Below are the types of visas most used by new immigrants when entering Mexico.

The most common visas offered by the Mexican government to expatriates are:

Work in Mexico (paid activities):

Visa form (front and back, on one page) with recent photograph, 3×4 color and white background).

Original and copy of current passport.

Authorization from the National Institute of Migration “NUT” (Single Processing Number).

Copy of the employment contract or proposed letter with the identification of the person signing the letter.

Original and copy of documents proving that the person has the experience, skills or knowledge to carry out the activity for which they are invited (Examples of proof: Diplomas, Course and training certificates, Letters issued by employers, etc.).

Original and copy of proof of address.

For Business Visa:

To obtain this visa, it is necessary to present an invitation letter from the Mexican company with which you will do business, in addition to the documents mentioned in the previous visa.

In short…

Here are the 7 best health insurance companies for expats and immigrants moving to Mexico:

- Cigna

- IMG

- Now Health

- Aetna (Allianz)

- SafetyWing

- Global Underwriters

- Foyer Global Health

Finally…

Starting a life in the land of dreams can be a complicated decision…I hope that with this article you will clear many of your doubts and make this process easier! If you still have any questions about getting health insurance for your move to Mexico (or moving abroad in general), let me know in the comments area below and I’ll get back to you!