If you’re planning to relocate or are already living overseas, expatriate or international health insurance becomes an essential requirement. Nonetheless, given the multitude of insurance choices available, determining the most suitable one can prove to be a daunting task. In this article, we will help you identify the optimal options, complete with their advantages and disadvantages, along with tables comparing the key features of each insurance plan.

So, you’re embarking on an international adventure… Congratulations! I’m genuinely excited for you!

Living, working, or studying in a foreign country can be an invigorating experience. You’ll be joining countless individuals who, like you, have the opportunity to explore the world beyond their native lands. However, as you prepare for visa arrangements and arrange for vaccinations, there’s one critical aspect you shouldn’t overlook: expatriate or international health insurance.

The Australian healthcare system is known as Medicare and is a publicly funded and universal healthcare system that provides access to medical services for all Australian citizens and permanent residents. Here’s how the Australian healthcare system works:

- Medicare: Medicare is the cornerstone of Australia’s healthcare system. It is a government-funded scheme that covers a significant portion of the cost of medical services and treatments. Medicare is funded through the general taxation system.

- Bulk Billing: Many medical practitioners in Australia offer “bulk billing,” which means they accept the Medicare benefit as full payment for their services. In this case, patients do not have to pay anything out of pocket. However, not all doctors bulk bill, and some may charge additional fees, which patients are responsible for paying.

- Medicare Card: Every Australian citizen and permanent resident is eligible for a Medicare card. This card allows individuals to access a wide range of medical services, including visits to doctors, specialists, and hospitals, at a reduced cost.

- Primary Care: Most people start their healthcare journey by visiting a general practitioner (GP), who serves as their primary care physician. GPs can diagnose and treat common health issues and can refer patients to specialists or for hospital care if needed.

- Specialists: If a GP determines that a patient needs specialized care, they can refer the patient to specialists. Medicare covers a portion of the costs associated with specialist consultations and treatments.

- Hospitals: Public hospitals in Australia are funded by the government and provide free or heavily subsidized healthcare services to eligible patients. Medicare covers a portion of the hospital costs. In emergencies, patients can go to the nearest public hospital for treatment.

- Pharmaceutical Benefits Scheme (PBS): Australia has a subsidized prescription medication system known as the Pharmaceutical Benefits Scheme. Under this scheme, patients pay a reduced cost for most prescription medications. The government covers the rest of the cost.

- Private Health Insurance: While Medicare covers a substantial portion of healthcare costs, some individuals choose to take out private health insurance. Private health insurance can provide additional benefits, such as access to private hospitals and shorter waiting times for elective surgeries.

- Medicare Levy: Australians are required to pay a Medicare Levy as part of their income tax. This levy helps fund the Medicare system. Some individuals may also have to pay a Medicare Levy Surcharge if they earn above a certain income threshold and do not have private health insurance.

- Medicare Safety Net: The Medicare Safety Net provides additional financial protection for people with high healthcare costs. Once an individual or family reaches a certain threshold of out-of-pocket medical expenses in a calendar year, Medicare increases its benefits for the remainder of the year.

Overall, the Australian healthcare system aims to provide accessible and high-quality healthcare to all citizens and permanent residents. It combines public funding through Medicare with private options to offer a comprehensive healthcare system that caters to various needs and preferences.

What is expat/international health insurance?

International health insurance for expatriates and immigrants offers coverage for your medical expenses while residing in another country for an extended period. Generally, it provides a comprehensive array of healthcare services, encompassing both medical emergencies and preventive care.

It’s essential to clarify that international health insurance differs from travel insurance, and it is strongly discouraged to forgo this coverage.

Why is international medical insurance necessary for expatriates, immigrants, and students?

Just as you require health insurance in your home country, you also need it when planning to live in another country for more than six months. Additionally, many countries stipulate proof of medical insurance as a prerequisite for granting visas or work permits (further details can be found in the “expat/international health insurance for immigration” section below).

Residing abroad as an expatriate, immigrant, or student presents unique healthcare challenges. While you are away from your home country, it is vital to ensure access to quality healthcare services and financial protection in case of unforeseen medical situations.

As an expatriate or immigrant, you will still necessitate regular check-ups, prompt treatment for health issues, and readiness for potential medical emergencies. Possessing international medical insurance that remains effective overseas provides peace of mind, guaranteeing access to the required healthcare.

For students pursuing education abroad, international medical insurance is of paramount importance. In an unfamiliar environment, you may encounter different healthcare systems, potential health risks, and the need for ongoing medical support. Comprehensive coverage ensures access to necessary healthcare services, whether for routine check-ups, illness treatment, or emergency medical care.

While some employers may extend healthcare coverage to employees working abroad, this is not universally applicable. Therefore, it is crucial to ascertain whether your employer offers an international health plan for you and your family. If not, acquiring your immigrant/expatriate insurance plan, mirroring the coverage you had at home, is highly advisable.

The positive news is that customizable international health insurance options are available to cater to your specific needs, whether you are an individual traveler or require coverage for your family.

Investing in international medical insurance as an expatriate, immigrant, or student is a responsible decision that places a premium on your health and well-being while living abroad. It ensures preparedness for any potential healthcare requirements and furnishes you with the necessary support to navigate the healthcare systems of your host country.

Why can’t I simply ensure my well-being before departure?

Scheduling a pre-departure medical examination with your doctor is indeed crucial. Nevertheless, it is equally essential to prioritize your health while abroad. It’s noteworthy that pre-existing conditions or ongoing medication needs may not receive coverage in another country.

Moreover, accidents are an unfortunate reality, even during travel (I once fractured my toe in South Korea, and I’ve encountered fellow travelers who suffered skateboard accidents or experienced food poisoning). Thus, ensuring you possess appropriate coverage remains imperative for unforeseen circumstances.

Can I rely on travel insurance for healthcare while residing abroad?

Typically, travel insurance is insufficient for long-term stays in a single country. It is primarily tailored for trips lasting less than six months, although there are options available for multiple countries if you are a tourist.

To distinguish between travel insurance and expatriate or international health insurance, let’s explore the finer details below.

Difference between travel insurance & expat/international health insurance

Travel insurance:

- It is designed for individuals who are in the midst of tourism or traveling temporarily, as opposed to those establishing long-term residency in a foreign country.

- Usually provides coverage for medical emergencies encountered abroad, though it frequently omits fundamental preventative care.

- Additionally, depending on the particular policy, it might extend coverage to incidents like lost luggage and trip cancellations.

- In specific regions, such as the European Schengen Area, travel insurance might be compulsory for entry.

- To delve deeper into the subject of travel insurance, we suggest perusing our article highlighting the top three cost-effective travel insurance providers.

Expat/international/immigrant/overseas health insurance:

- It is tailored for individuals who are making a long-term move or establishing residency in another country.

- Operates comparably to your standard insurance coverage in your home nation.

- Delivers coverage extending beyond just emergency medical care, encompassing preventive healthcare, dental, and vision services.

- Encompasses a broad spectrum of services, potentially including pregnancy, cancer treatment, or mental health care, contingent upon the available plan options.

- Frequently a mandatory requirement for visa applications or securing resident permits. It can be continuously renewed as long as you remain abroad.

- Possessing international health insurance that provides ongoing coverage is essential for individuals embarking on a permanent relocation overseas.

Expat/international health insurance for immigration and applying for residence permits/visa

In most nations, it is obligatory to provide proof of coverage under an international health insurance plan when applying for a temporary or permanent resident visa. It’s essential to emphasize that travel insurance, by itself, is usually not recognized as sufficient for this purpose.

Considering the intricacies frequently linked to immigration processes, it is of paramount importance to verify that the expatriate or international health insurance policy you are acquiring aligns with the precise demands of the immigration authority in your intended destination country. You may discover this information online; however, if it’s not readily available, it is recommended to directly communicate with the immigration office for clarification.

Personal experience using expat/international health insurance for immigration in Sweden (hint: it’s not always easy): When Nikki relocated from the United States to Sweden, she encountered the necessity of providing evidence of international health insurance to the immigration authorities to secure her temporary residence permit. She decided to purchase a policy from one of the companies listed below, and immigration accepted it.

However, when she proceeded to apply for her tax identification number through the Swedish tax office, she found herself in a situation where the same insurance policy was deemed inadequate. As a result, she had to procure a new policy from a different insurance provider.

If you anticipate facing a similar predicament, it is imperative to conduct a comprehensive examination of the cancellation policies offered by each insurance company. This way, in the event that your current plan is rejected by immigration, you can mitigate financial loss by terminating your existing policy and acquiring a new one.

What should I look for in an overseas healthcare plan for expatriates?

The choice of plan you make will depend on the type of coverage you require as an immigrant or expatriate. Below are some fundamental components that your chosen plan should encompass:

- Sufficient yearly benefit maximums

- Plan flexibility with varying price options

- Coverage for wellness care and emergencies

- Inpatient and outpatient hospital visit coverage

- Access to an extensive network of doctors and medical facilities

- Multilingual and 24/7 customer support

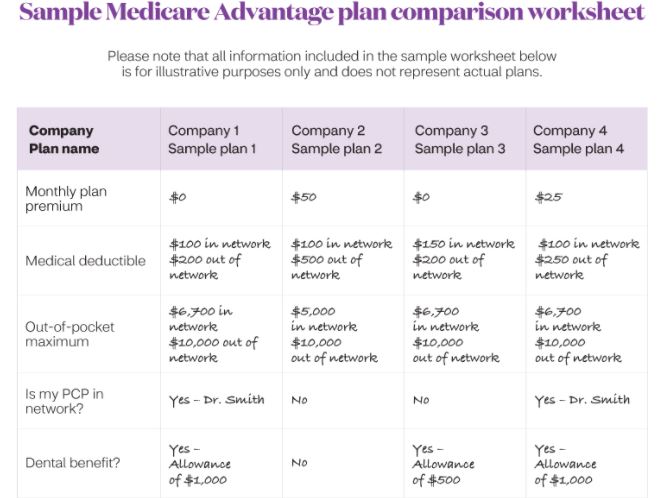

For your convenience, we have compiled a comparative analysis of our top three recommended insurance options for expatriates and immigrants. All these choices offer fundamental coverage for inpatient care, routine doctor visits, emergency evacuations, and round-the-clock customer service.

Please be aware that additional coverage for dental and vision services may result in supplementary expenses. If you are expecting a child or planning to start a family while living abroad, you may need to opt for more comprehensive plans to guarantee adequate coverage.

It’s important to bear in mind that lower-cost insurance plans typically offer reduced coverage. Hence, conducting thorough research is imperative to identify the optimal plan that aligns with your specific requirements.

Who do these international health insurances work for?

For these citizens living abroad as expats or immigrants:

- Canadians

- Australians

- Chinese

- Germans

- French

- Argentinians

- British

- Swedes

- New Zealanders

And for citizens from almost every other country living abroad

For expats/immigrants living in:

- The United States

- Canada

- China

- Germany

- Sweden

- Spain

- Portugal

- France (European Union/Schengen Area as a whole)

- United Kingdom

- China (and Hong Kong)

- Australia

- Switzerland

And for expats living in almost any other country in the world

In other words, no matter your citizenship or which country you are moving to, most of these international health plans will work for you since they are truly global insurances.

Some questions to ask yourself before you buy expat/international medical insurance:

- Do you need a private room if you’re admitted to a hospital?

- Are you planning on starting a family or expanding your family?

- Do you have any pre-existing conditions or are you on any medications you need to continue while living in another country?

- Are you willing to pay a higher deductible for lower premiums?

Note: If you aren’t really an expat/immigrant but an international student at a school or college/university overseas, then I suggest you take a look at my article with the 3 Best and Cheapest Health Insurance for International Students and Exchanges/Study Abroad.

1. Cigna Global

What I like:

- You have a selection of three options: Silver, Gold, and Platinum.

- The Silver plan offers fundamental coverage, including an annual allocation of $100 for eye care and specific cancer screenings.

- Should the need arise, you have the flexibility to tailor your plan by adding outpatient coverage and emergency medical evacuation for treatment abroad.

- The availability of variable deductibles empowers you to manage upfront payments to your advantage.

- You can count on round-the-clock customer support offered in multiple languages.

Payment plans are adaptable, allowing you to choose between monthly, quarterly, or yearly arrangements. The convenience of direct provider billing ensures that Cigna handles the payment for your appointments directly.

Payment plans are adaptable, allowing you to choose between monthly, quarterly, or yearly arrangements. The convenience of direct provider billing ensures that Cigna handles the payment for your appointments directly.- Comprehensive medical coverage in the Middle East is integrated into the plans, encompassing services for organ transplants and kidney dialysis treatments. This international health insurance has garnered favorable reviews.

What I didn’t like:

- It’s worth noting that in order to receive a quote, you will be required to furnish substantial personal information.

- Additionally, it’s important to be aware that the basic plan does not incorporate coverage for maternity care. Consequently, if you are planning to have a child while residing abroad, you will need to invest in a more comprehensive policy.

2. IMGlobal

IMG provides a variety of insurance choices, encompassing travel insurance, student health insurance, coverage for crew members, and, naturally, insurance tailored specifically for expatriates. When navigating their website, make sure to locate their “Health Insurance for Expats/Global Citizens” category.

What I like:

- They present a choice of 5 plans for your consideration.

- By selecting their services outside the United States, they extend a financial incentive and have the capacity to waive up to half of your deductible.

- With a rich history of over 29 years in delivering health insurance solutions tailored to immigrants and expatriates, they possess a wealth of expertise in this field.

- Their website offers an online portal, granting you uninterrupted access to emergency medical services around the clock.

- Their extensive network encompasses 17,000 healthcare professionals and facilities spanning the globe.

- Direct billing services are at your disposal.

- They provide both annual international health insurance plans and short-term options.

- Coverage is accessible to individuals and families from all nationalities.

- For their Bronze package, a year of global coverage with a $250 deductible may cost you less than $1000 annually.

What I didn’t like:

- Coverage ceases when you reach the age of 75 (however, if you secure a plan before turning 65 and maintain it, you can participate in their lifetime enrollment program).

- The fundamental plan does not encompass maternity care, and even their most comprehensive plan only includes coverage for deliveries and newborn care after a minimum enrollment period of 10 months.

- The company treats COVID-19 in line with their approach to any other illness or injury, adhering to the stipulations outlined in the policy.

As the name implies, Now Health International’s mission is to deliver a streamlined, cost-efficient, and readily accessible service, and there’s no more opportune moment than the present for it.

Hence, the central focus of this company centers around fostering strong customer relationships. Plan particulars are conveyed with precision and effectiveness, and any prospective inquiries or issues are promptly attended to by the company’s dedicated customer support unit.

Now Health plans are thoughtfully designed to address the everyday challenges confronted by individuals living abroad, offering guidance and guaranteeing access to exceptional healthcare on a global scale.

What I like:

Tailored plans to suit your specific requirements Transparent information and an exceptional customer service unit Coverage extended to 194 countries and territories Plans offering comprehensive maternity coverage

What I didn’t like:

A 12-month waiting period is required before utilizing maternity coverage. Certain procedures may necessitate the use of the company’s reimbursement system, which entails initial payment for your care.

Allianz, a renowned insurance powerhouse based in Germany, unquestionably ranks among the foremost giants in the worldwide insurance arena. Consequently, it would be a significant omission to exclude them from our discourse on international health insurance providers.

Here are a few of the things that I appreciate and didn’t like about Allianz.

What I liked:

- Allianz delivers 24/7 international customer support, guaranteeing assistance at your disposal whenever the need arises.

- In numerous instances, you are relieved of the responsibility of direct payments to healthcare providers, as Allianz assumes the role of settling bills on your behalf. This streamlined process eliminates the necessity for reimbursement requests.

- Allianz extends comprehensive coverage across all continents and the vast majority of nations globally, ensuring your protection regardless of your location.

- As part of their offerings, you gain access to a medical application that proves invaluable in preventing and addressing health issues. Upon completing 6 months of your contract, you can take advantage of the app, with expenses of up to €50 covered.

- Allianz’s commitment goes beyond medical care, exemplified in a specialized program exclusively tailored for expatriates and immigrants. This program offers support across a spectrum of dimensions beyond healthcare, encompassing guidance on independent living, addressing family needs, and navigating the distinct challenges associated with residing in a foreign country.

What I didn’t like:

- Allianz don’t have many options for plans.

5. Safety Wing

Safety Wing stands as a prominent figure in the realm of international health insurance, serving a diverse array of individuals, including students, digital nomads, and expatriates. Navigating their website proves to be a seamless experience, as it offers an intuitive interface that enables you to effortlessly generate a quote for their plans. This quote is tailored to your specific circumstances, factoring in details such as your age, intended duration of stay, and the countries in which you seek coverage.

What I like:

- As mentioned earlier, their website boasts exceptional user-friendliness, facilitating the swift generation of insurance quotes. Safety Wing provides expansive coverage tailored to expatriates, inclusive of COVID-19 coverage. The company upholds transparency by distinctly delineating the coverage particulars of each plan.

- Moreover, they extend the option to augment your plan with supplementary services, encompassing dental care, maternity care, deductible expenses, physical therapy, and access to a family physician. Safety Wing’s commitment extends further by offering coverage of up to $10,000 USD for repatriation in the event of a political evacuation.

- In instances where you receive treatment in a public hospital without fees or when the treatment is covered by another insurance, Safety Wing furnishes payment assistance of US $125 per night, capped at 30 nights. They also provide extensive coverage and reimbursement for cancer treatments and reconstructive surgeries.

- Families with children under the age of 10 can benefit from all-inclusive insurance coverage at no additional cost. Furthermore, Safety Wing ensures round-the-clock customer support, accessible worldwide.

- To augment their comprehensive coverage, Safety Wing permits visits to your home country for up to 30 days within every 90-day period.

What I didn’t like:

- The fees for coverage in the United States, Hong Kong, and Singapore are relatively high.

- The quote process necessitates the creation of a login and the completion of extensive information before displaying all fees.

It’s important to note that Safety Wing also encompasses COVID-19 coverage in their expatriate insurance plans. This inclusion has been available for their nomad plans since August 1st, 2020.

Nonetheless, it’s essential to be aware that COVID-19 tests are only covered when they are deemed medically necessary by a physician. Antibody tests, conversely, are not covered as they do not fall under the category of medical necessity.

Global Health, a subsidiary under the esteemed Foyer Group umbrella, emerges as a prominent European entity renowned for its diverse array of insurance solutions. They excel in an array of coverage categories, encompassing travel insurance, expatriate insurance, and student insurance. Backed by a sterling reputation and a wealth of experience, Global Health has firmly established itself as a dependable and highly-regarded player within the insurance sphere. Furthermore, they are celebrated for their wide-ranging assortment of tailored plans, affording individuals the opportunity to discover coverage that precisely aligns with their unique requirements.

What I like:

- You retain the flexibility to tailor your insurance coverage according to variables such as your age, country of origin, dental and vision care preferences, maternity and child care needs, and more. Global Health empowers you with the autonomy to select your desired level of coverage for each of these facets, ranging from minimal to comprehensive.

- Whether you are an individual, a childless family, or a family with children, Global Health extends insurance options meticulously tailored to meet your specific requirements.

- Even in the absence of health insurance in the United States, you are assured coverage for emergencies while on American soil.

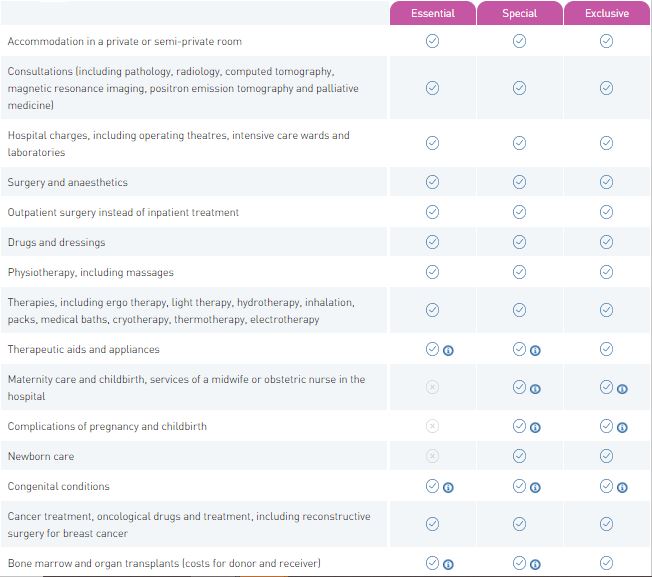

- In addition to the aforementioned customization, you have the option to choose from three distinct plan categories: ESSENTIAL, SPECIAL, and EXCLUSIVE, each delivering varying degrees of coverage.

- The process of acquiring a quote is both swift and straightforward, necessitating only minimal personal information.

- Moreover, deductible alternatives are at your disposal, enabling you to align your plan with your financial preferences.

- For those contemplating a brief stay in another country, Global Health offers short-term plans designed to accommodate your needs.

- To facilitate an informed decision-making process, Global Health permits plan comparisons, enabling you to assess and select the option that best aligns with your specific requirements.

- With comprehensive health insurance coverage available for expatriates across Europe, Global Health ensures that individuals residing throughout the continent have access to comprehensive healthcare protection.

What I didn’t like:

- The fundamental plans offered by Global Health feature limited coverage and may omit crucial services such as maternity care and newborn care.

- While the customer service provided by Global Health is functional, it may not be as user-friendly or straightforward compared to other companies on this list.

- The clarity of coverage details and limits on the Global Health website could benefit from enhancement, making it more accessible to understand what is encompassed and what is not.

- Although the Global Health website contains information pertaining to coronavirus, it remains unclear whether their plans specifically cover COVID-19 tests or complications.

- It is important to note that Global Health imposes a 5 euro fee for emergency support, constituting an additional cost to factor into your considerations.

Global Underwriters stands as a renowned insurance provider, distinguished for its superb offerings tailored to expatriates and immigrants. Drawing upon years of expertise in the field, they excel in crafting customized insurance plans to cater to travelers across the globe.

Catering to expatriates, Global Underwriters presents two exceptional options: Diplomat Long Term and Diplomat International. These all-encompassing plans are meticulously engineered to cater to the unique requirements of individuals dwelling in foreign lands, affording them comprehensive coverage and a profound sense of security.

What I like:

- Global Underwriters’ plans encompass vital features, including provisions for medical evacuations, repatriation of remains, and emergency dental coverage. With substantial benefits, you can access coverage of up to $1,000,000 for medical expenses, as well as accidental death or dismemberment protection.

- Furthermore, Global Underwriters extends support in cases of trip interruptions stemming from health-related issues and extends assistance for lost luggage, ensuring a smooth and worry-free travel experience.

What I didn’t like:

The Diplomat Long Term plan is not available for residents of New York, Maryland, South Dakota, as well as citizens residing in Australia and Iran.

- The Diplomat Long Term plan does not encompass travel to Cuba, Iran, and Afghanistan.

- The Diplomat International plan does not provide coverage for Covid-19-related care.

3 Bonus options for Expat International Insurance plans:

– GeoBlue

GeoBlue emerges as a top-tier insurance solution for expatriates, rendering it a well-suited selection for individuals, whether they are permanent residents or temporary visitors in the United States. Renowned for its outstanding quality benchmarks and a dominant presence in the insurance landscape, GeoBlue firmly holds its position as a preeminent leader within its domain.

What I like:

- GeoBlue delivers an exemplary service that not only meets but exceeds the most stringent quality benchmarks.

- Their adaptable Xplorer plan is meticulously designed to cater to the unique needs of expatriates, foreign nationals residing in the US, and US citizens living in foreign countries. It boasts remarkable flexibility to accommodate these distinct requirements.

- Under the Xplorer plan, you will not be burdened with any deductibles for standard services, and there exists an unlimited medical cap, guaranteeing comprehensive and unbounded coverage.

- Furthermore, the Xplorer plan extends its coverage umbrella to encompass even extreme sports activities, and it comes without any associated cancellation fees.

- For added convenience, you have the option to enhance your plan with supplementary dental and vision coverage choices.

- GeoBlue offers a spectrum of plans to choose from, affording you the liberty to select the one that aligns perfectly with your individual requirements.

- Their customer service operates seamlessly around the clock, ensuring assistance is accessible 24 hours a day, 7 days a week.

- GeoBlue’s plans offer comprehensive coverage, encompassing indispensable services such as evacuation, health consultations, and maternity care.

What I didn’t like:

- GeoBlue’s insurance plans are not available to residents residing in the states of New York and Washington.

- For pricing details, it is essential to reach out to a licensed broker.

GeoBlue offers a valuable advantage of providing unlimited telemedicine consultations at no charge for plan members with Covid-19-related inquiries. Moreover, if prescribed by a healthcare provider, the company shoulders the expenses associated with clinical testing and Covid-19 treatment.

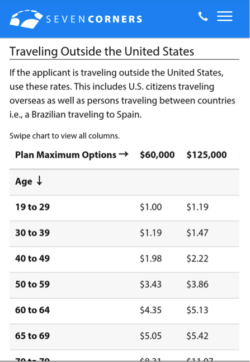

– Seven Corners Liaison Majestic

As with IMG, Seven Corners also has medical insurance for travelers, students, faculty, and others.

What I like:

- Boasting a robust 20-year legacy in the industry, Global Underwriters emerges as a reliable purveyor of international health insurance solutions. Their all-encompassing plans encompass coverage for pre-existing conditions, instilling peace of mind in individuals with ongoing healthcare needs.

- Furthermore, Global Underwriters distinguishes itself by offering assistance in locating embassies and furnishing travel advisories, prioritizing your safety and well-being during your international sojourn. Their round-the-clock multilingual travel assistance ensures swift support whenever the need arises.

- Global Underwriters’ plans provide extensive coverage, spanning both inpatient and outpatient care, dental services, emergency evacuation, and emergency reunion, enabling your loved ones to stand by your side during hospitalization. For adventure enthusiasts, they even offer a hazardous sports rider that covers activities like hang gliding, zip-lining, water skiing, and bungee jumping.

- For those in pursuit of budget-friendly coverage, Global Underwriters’ foundational plans come at an enticing price point. For example, a single male relocating to Fiji can secure a basic plan with a $250 deductible for approximately $1 per day.

What I didn’t like:

Coverage cannot be obtained if your U.S. address falls within the states of Maryland, Washington, New York, South Dakota, or Colorado.

- Coverage is not available for individuals above 60 years of age.

- They do not provide coverage for destinations such as Iran, Syria, U.S. Virgin Islands, Gambia, Ghana, Nigeria, or Sierra Leone.

- Precertification is necessary for specific services, including inpatient stays, rehabilitation, outpatient surgeries, and home healthcare.

– Aetna (acquired by Allianz)

Aetna stands as a customer-focused enterprise, unwavering in its commitment to delivering services finely tuned to cater to individual needs. With an unwavering dedication to addressing the distinct requirements of expatriates and residents in various countries across the globe, Aetna presents an array of tailored plans.

By delving into the distinctive situations of their clientele, Aetna guarantees that their plans are meticulously crafted to furnish comprehensive coverage and cater to the precise healthcare requirements of individuals dwelling overseas.

What I like:

- Aetna stands as a reputable institution with a storied history spanning more than half a century. Their area of expertise lies in crafting personalized insurance solutions tailored explicitly for expatriates and digital nomads, thus ensuring that their unique requirements find fulfillment.

- Evidencing a steadfast commitment to customer service, Aetna extends round-the-clock support, accessible 24/7. Their comprehensive plans typically encompass extensive provisions for hospitalization, emergency evacuation, repatriation, and cancer treatment, thus bestowing upon individuals a profound sense of tranquility.

- Celebrated for their excellence, Aetna has garnered prestigious accolades, including the titles of “Best International Private Health Insurance Provider” and “Health Insurer of the Year.” Additionally, they have developed a user-friendly mobile application that empowers individuals to monitor their health while earning reward points for embracing healthy habits. These accrued points can subsequently be redeemed for gift cards at popular retail establishments.

- Aetna extends its coverage umbrella to encompass expatriates and foreign residents in over 15 countries and territories worldwide, thereby ensuring an expansive reach and accessibility for individuals in search of dependable international health insurance.

What I didn’t like:

- They do not offer travel insurance plans tailored to solo travelers or families.

- The website could benefit from improved clarity and intuitiveness when presenting available plans.

- Aetna International fully covers the cost of Covid-19 treatment and testing for members of certain plans, such as Medicare. To ascertain which plans are covered, you will need to reach out to the company directly.

Do you consider yourself a “global citizen,” or are you a digital nomad and need medical insurance that will follow you worldwide?

If that resonates with your situation, the highlighted insurance choices are also well-suited to your requirements. The seven international health insurance plans presented are expressly crafted for digital nomads or individuals who inhabit different countries without a permanent abode. These plans are tailored to the requirements of “global citizens” seeking all-encompassing global health protection.

To provide a quick summary and facilitate comparison, here are the key features of the seven international health insurance plans:

| CIGNA | IMGLOBAL | AETNA | GEOBLUE | SAFETY WING | GLOBAL HEALTH FOYER | GLOBAL UNDERWRITERS |

| Silver – $1 million | BRONZE – $1 million | The values of the limits increase depending on the length of the insurance contract | The coverage amounts may change according to your choices | Annual benefit maximum of US $1,000,000 | Personalized plans for you or your family | Maximum annual benefit of $1,000,000.00 |

| Gold – $2 million | SILVER – $5 million | Aetna’s plans may cover cancer treatments when the patient is part of a clinical trial. | Full reimbursement for hospital & cancers treatments, ambulance, and reconstructive surgeries | Value of total coverage is something you can customize per item | Up to $1,000,000 coverage in cases of accidental death or dismemberment | |

| Platinum – Unlimited | GOLD – FOR COVERAGE UP TO 36 MONTHS – $5 million | Value of total coverage is something you can customize per item | ||||

| GOLD – FOR COVERAGE AFTER 36 MONTHS – $5 million | ||||||

| GOLD PLUS – $5 million | ||||||

| PLATINUM – $8 million |

A complete table comparing these 7 health insurances for expats…

|

|

|

|

|

|||

| BENEFIT | LIMIT | LIMIT | LIMIT | LIMIT | LIMIT | LIMIT | LIMIT |

| Benefit Information | |||||||

| Medical Maximum | Unlimited (for the Platinum plan) | $8,000,000 | The site doesn’t specify | Unlimited | US$1,000,000 per year | The site doesn’t specify | $1,000,000 |

| U.S. In-Network Coinsurance | You choose. From 70%(100% thereafter) to 100% | 100% | No | 60% for maximum coinsurance and then 100% | Yes, for higher fees | Only in emergencies | Yes |

| U.S. Out-of-Network Coinsurance | You choose. From 70%(100% thereafter) to 100% | 90% to $5,000 (100% thereafter) | Yes, for higher fees | 100% | 100% | 100% | 100% |

| Mental Health Availability | No waiting period | 12-month waiting period | Co-payment of $25 per visit, waived deductible | 75% up to 40 visits / 60% after that | No | Waiting period of 10 months | Depends on the plan |

| Mental Health Benefit | Inpatient and Outpatient: $5,000 lifetime maximum to paid in full depending on the plan | Inpatient and Outpatient: $50,000 lifetime maximum | Co-payment of $250 after deductible | 100% up to 60 days | International and ambulance: limit not specified | ||

| Inpatient Prescription Drugs | $500 to paid in full depending on the plan | Up to $8,000,000 | Yes | Complete reimbursement | Yes | Yes | |

| Outpatient Prescription Drugs | None, unless you buy the International Outpatient Option | Up to $8,000,000 | Complete reimbursement | Yes | Yes | ||

| Evacuation and Repatriation of Remains | Paid in full | Up to $8,000,000 | Yes | Up to $25,000 | No | Up to 10,000 euros | Yes |

| Accidental Death & Dismemberment | Depends on the plan | Rider available, limit depends on age. | $50,000 | Depends on the plan | |||

| Emergency Dental | Paid in full | Up to $8,000,000 | Optional | 1,000 per year, $ 200 per tooth | Yes, however you need to pay an extra fee on top of your plan | Depending on the plan, it’s unlimited | It has coverage in the Diplomat Long Term and Diplomat International plans |

| Treatment Necessary as Result of Terrorism | Up to the amount of the coverage | Rider available up to $50,000-lifetime maximum | Clause available up to maximum of $50,000 in lifetime payments | ||||

| Amateur Sports | Unlimited | Rider available up to $10,000 | No | Yes | No | No | No |

| Newborn Care | |||||||

| Routine Nursery Care of a Newborn Child of a Covered Pregnancy | $25,000 to $156,000 depending on the plan | $1,000 additional deductible, $50,000 lifetime maximum, $200 wellness benefit for first 12 months | Yes | Depends on the plan | Can be unlimited depending on the plan | Can be unlimited depending on the plan | |

| Children born as a result of fertility treatment (such as IVF or surrogacy) | Only after the baby is 90 days old | Excluded | Depends on the plan | Excluded | No | ||

| Neonatal Intensive Care Unit | Check website for updated information | $250,000 maximum for first 31 days | No | Up to $250,000 for the first 31 days | No | ||

| Pre-existing Conditions | |||||||

| Pre-existing condition exclusion period | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness |

| Pre-existing condition look back period | Any time prior to effective date | Any time prior to effective date | Any time prior to effective date | Any time prior to effective date | Any time prior to the effective date | Any time prior to the effective date | Any time prior to the effective date |

| Pre-existing annual maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Unlimited depending on the plan | Unlimited depending on the plan | Full reimbursement | Unlimited depending on the plan | Unlimited depending on the plan |

| Pre-existing lifetime maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Unlimited depending on the plan | Unlimited depending on the plan | Full reimbursement | Unlimited depending on the plan | Unlimited depending on the plan |

Worldwide Medical Insurance / Comparison Chart*

Part of the table courtesy of Tokio Marine HCC

*Note: this table is just for informational purposes and subject to change. It was accurate as of the time we wrote it here, but please check each company’s individual website for updated info.

To sum up…

These are the 7 best international health insurance for expats and immigrants:

- Cigna

- IMG

- Geo Blue

- Allianz

- Safety Wing

- Foyer Global Health

- Global Underwriters

In conclusion…

Fundamentally, obtaining an immigrant/expat health insurance plan becomes imperative when you’re preparing to establish residence in a foreign land, be it for a temporary or permanent duration.

We grasp the challenges of choosing the right plan, having navigated this journey ourselves. We empathize with any uncertainties or questions you may encounter. Please don’t hesitate to leave a comment below if you seek assistance or if you believe there are any facets we might have missed. We stand ready to offer our support!

Do you live abroad and need to receive or send money back home cheaply?

I have a specific article to help you make international transfers as cheaply as possible: The 5 Best Websites for International Money Transfers (send and receive money from abroad).