Are you planning to live in the United States and aren’t sure which international health insurance policy is right for you? Then read on below for the 7 best and cheapest plans and companies that offer international health insurance plans for expats.

Living in another country is an unforgettable experience which can change your entire vision of the world and open the door to many learning opportunities.

The problem is that, in order to get to this point, there’s a lot of things you have to plan for.

Applying for your visa, figuring out how to deal with finances while you’re overseas, booking your flights, finding accommodation…

Not to mention, choosing an international health insurance plan! And given the absurd cost of healthcare in the United States (more than 60% of bankruptcies each year are caused by medical bills…), this is NOT a country where you want to be left without insurance.

So as someone who has lived in the United States as an expat myself, I wanted to create this list to help others with the most popular international health insurance companies for immigrants and expats in the U.S.

This way, you can compare the pros and cons of each plan to choose the one that’s right for you.

But first, I put together some relevant info to help you in your search.

Why bother getting an international health insurance plan in the United States?

If you’re going to become a resident of the United States (or any other foreign country), it’s very important that you and your family are protected if any emergencies happen.

But unfortunately, many people just don’t realize how important it is to buy an insurance policy before you move abroad.

To help you understand why, here’s two of the most important reasons to get a health insurance plan while living in the United States.

How having an international health insurance plan can protect you from bankruptcy in the United States

Even if having an insurance policy isn’t a requirement to enter the United States (like it is to enter the European Union, for example), it’s highly recommended to get one.

(Note: just remember that you need to buy this policy BEFORE you arrive since you often can’t buy a policy after you’ve begun your trip)

If it’s a good idea to have a good insurance plan to visit everywhere else in the world, it’s an urgent need in the United States.

Since the United States has some of the highest healthcare costs in the world, there are many stories of Americans, tourists, and expats that went bankrupt thanks to the enormous hospital costs (I’m not kidding here – as I said above, 60% of all bankruptcies in the United States are caused by medical bills).

Unlike most other countries in the world, the US does not have a public healthcare system. Which means that any service you seek will be private and thus very expensive.

How having international insurance can give you peace of mind

If the financial benefits of having an insurance plan haven’t convinced you, then keep in mind that a plan can also give you peace of mind.

Especially when you’re living in a new country and are unfamiliar with the healthcare system or unsure how to go about seeking out recommendations for doctors/hospitals, your insurance provider can help.

Questions to ask yourself before choosing an international health insurance plan for expats in the United States

Choosing an insurance policy is not an easy task.

With this in mind, here are some questions to ask yourself when it comes to choosing your policy:

- How much coverage does each international health plan offer?

- What is the level of customer service each company offers?

- Does the plan cover any specific health issues that you or your family have?

- How many partner hospitals and doctor’s offices are covered by the plan?

Here’s a bit more info about each of these considerations.

How much coverage does each international health plan offer?

When it comes to health insurance, one of the most important things to look at is the coverage amount.

To determine if the coverage is enough for you or not, here are a few more questions to consider:

- How widespread is the coverage? If you travel withafterwardin the United States, will you be covered? If you visit any neighboring countries, will you be covered? If you plan to travel, is the cost of a more expensive plan worth it to cover your trips as well?

- Does the insurance plan cover all of the particular medical needs of yourself and your family?

- Does the insurance company offer personalized options like adding on dental or eye care coverage?

- Is it possible to extend your plan to cover other members of your family traveling with you? What is the cost per each additional person?

What is the level of customer service each company offers?

Here, I’m not talking about the customer service provided by a doctor’s office or a hospital. I’m talking about the customer service offered by the insurance company itself.

It’s worth taking a look to see how easily you can get a hold of them (only by phone? By email? By live chat?), as well as making sure they have 24/7 support so you can get help with anything you need anytime you need it.

Does the plan cover any specific health issues that you or your family have?

If you or your family have any pre-existing conditions, you’ll need to make sure that the plan you’re looking at covers them.

Unfortunately, few insurance companies offer complete coverage for pre-existing conditions (or even coverage for pregnancy and maternity care).

So if you do have a condition, you’ll want to be careful with your research and be prepared to spend a bit more for a better plan that covers what you need.

How many partner hospitals and doctor’s offices are covered by the plan?

The last question I recommend you ask is about the number of medical offices around the world covered by your plan.

The more options you have, the greater chance you’ll have of getting quick care that’s close to where you live. Not to mention, you’ll also have more choice in where you go.

One other thing to pay attention to is that there are some plans that will pay the hospital/medical provider directly when you go in for your appointment. In other words, you won’t have to pay anything for medical services.

Other plans work with a reimbursement system, which means that you’ll need to pay for the service yourself and then afterwards request the money back from your insurance provider (which honestly can be a bit of a pain).

In sum, the more medical providers covered by your plan, the better. And be sure to check if they pay the medical provider directly or if you have to request a reimbursement.

Who do these international health insurance services cover?

The health insurances on this list serve these citizens who live in the US:

- Canadians

- Australians

- Chinese

- Germans

- French

- Argentineans

- British people

- Swedes

- New Zealanders

And for citizens of almost every other country in the world

In addition to expatriates/immigrants residing in the United States, these insurances also serve those who reside in:

- Canada

- China

- Germany

- Sweden

- Spain

- Portugal

- France (European Union/Schengen area as a whole)

- United Kingdom

- China (and Hong Kong)

- Australia

- Switzerland

And for expats living in almost any other country in the world

Simply put, regardless of your citizenship or which country you plan to move to, most of these international health plans will work for you.

The 7 Best & Cheapest International Health Insurance Plans for Expats in the United States

Below, you’ll find a full breakdown of the best health insurance policies for expats, digital nomads, and immigrants in the U.S., as well as why I believe them to be good options.

Attention: I always recommend that you make a quote with all the companies listed below. Despite the work and time it will take, you can save a staggering amount of money just by doing good research.

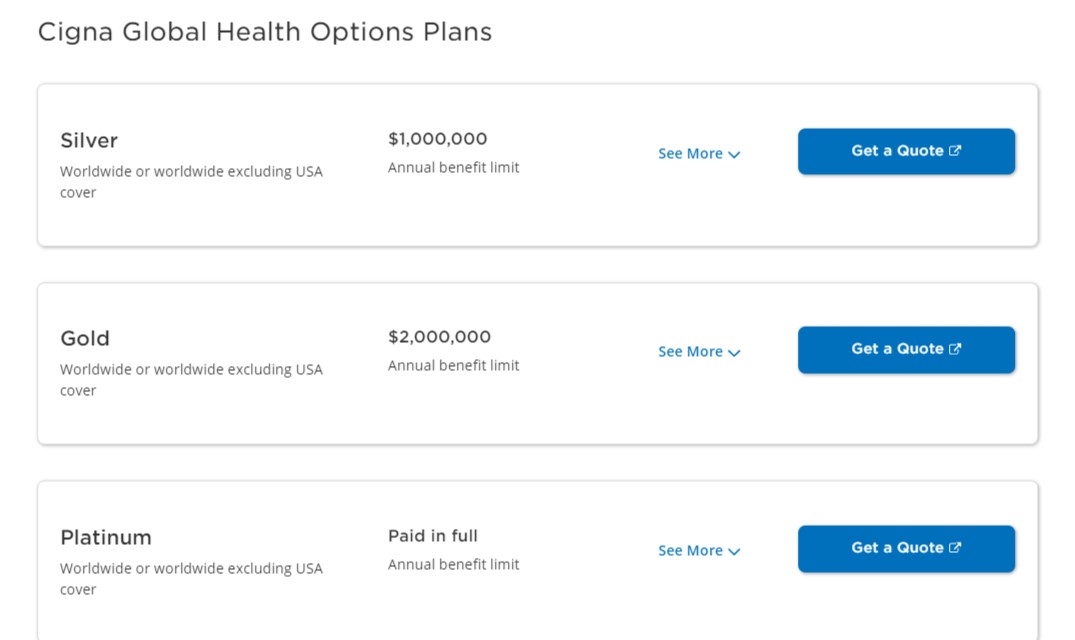

1. Cigna

Cigna is one of the largest international health insurance companies in the world. Originally founded in the United States, today they have expanded globally and have 189 million clients to date.

Cigna’s plans tend to have really ample coverage. So if you want to be prepared for any situation, give Cigna plans a look.

I’ve purchased Cigna plans before and I’ve found the process very easy and straightforward. However, I’ve never had to file a claim with them so I can’t comment on their customer service.

Pros of a Cigna plan as an expat in the United States:

- You can choose between 3 plans: Silver, Gold, and Platinum

- In most cases, Cigna pays the medical provider directly (so you can avoid the annoying and bureaucratic process of requesting a reimbursement)

- They have flexible payment options (monthly, trimesterly, and annually) – you can also pay in advance with flexible deductibles

- They cover up to $100 in eye care each year even with their most basic plans (plus include several exams for cancer prevention)

- They offer 24/7 customer support

- They follow all recommended WHO protocols and offer coverage for COVID-19 treatment

- Several plans cover organ transplants and kidney dialysis

- You can find useful info on the economy, education, and culture of the US on their website

Cons of a Cigna plan as an expat in the United States:

- You need to provide quite a bit of personal info to get a quote

- If you plan to have children during your stay in the US, then you’ll need to choose a more expensive plan since the most basic plan doesn’t include maternity care

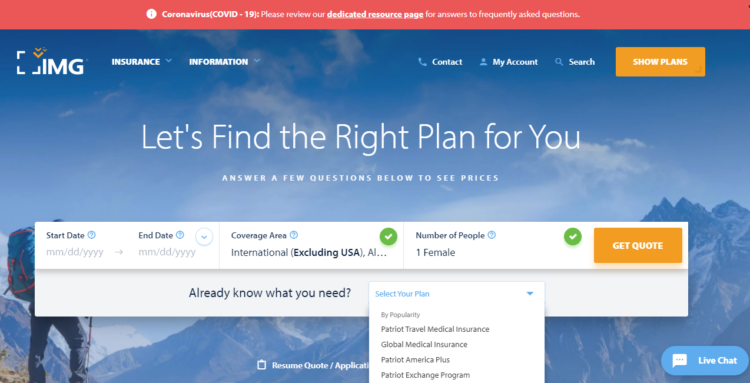

2. IMG

IMG is another great option for expats and digital nomads.

One reason is that they are focused on helping individuals who are proving to another country, the U.S. included. Because of this, they have a variety of plans designed especially for these types of customers.

I’ve personally purchased the “Patriot America Plus” and “Global Medical Insurance” plans a few times, and was happy with the service. But like Cigna, I never had to file a claim so I can’t offer an opinion on their process here.

Pros of an IMG plan as an expat in the United States:

- You have 5 different plans to choose from

- IMG has a network of more than 17,000 medical providers around the world

- They even have plans for missionaries going overseas

- They have an online portal that you can access 24/7 for emergencies and medical support

- They offer coverage for expats and families of all nationalities

- They offer coverage for COVID-19 treatments requested by a doctor

- They have an automatic debit option for payments

Cons of an IMG plan as an expat in the United States:

- You can’t get a plan with IMG if you’re above 75 (however, if you’re under 65, you can get purchase a lifetime plan)

- With the exception of the most expensive plan (which covers births and newborn care if you’d had the plan for at least 10 months), IMG does not cover maternity care

3. GeoBlue

GeoBlue’s plans include extensive coverage, partner institutions and doctors with quality care, and a 24/7 customer service team available to help with any emergency.

One of the biggest benefits of working with GeoBlue is that they have a wide variety of plans to choose from. Another highlight is that they have personalized plans for teachers, students, boat & yacht crew members, missionaries, and, of course, expats and immigrants.

Pros of a GeoBlue plan as an expat in the United States:

- They have a wide range of plans to choose from

- They have 24/7 customer support

- Some of their plans offer coverage for extreme supports and have unlimited medical limits

- They have plans made especially for immigrants that reside in the United States or for American citizens who live overseas

Cons of a GeoBlue plan as an expat in the United States:

- You need to speak with an insurance broker to get a quote

- Plans aren’t available for residents of New York and Washington

4. SafetyWing

SafetyWing is one of the best options out there when it comes to international insurance for digital nomads, expats, and remote workers living overseas.

Beyond the usual medical coverage, SafetyWing also covers 30 days in your home country for every 90 days that you stay overseas. It’s hard to find this with any other insurance providers!

Another nice benefit of SafetyWing is their portal, which allows you to solve problems quickly and easily (and thus avoid the delays and bureaucracies that many other insurance companies have).

Pros of a SafetyWing plan as an expat in the United States:

- They have fully-customized plans that include exactly what you need

- They have a practical website which lets you easily search for and compare the prices of the plans that interest you

- They offer coverage for children under 10 free of charge

- You have the possibility to add on coverage for eye care, maternity care, and outpatient services (like physical therapy and family medicine)

- They offer coverage up to $100 for repatriation after an evacuation

- If you receive free treatment at a hospital or your treatment is covered by another plan, you’ll receive USD $125/day throughout the duration of your treatment (up to 30 days)

- Their plans cover some treatments for cancer and reconstructive surgeries

- They have 24/7 support no matter where you are

- They cover visits to your home country for 30 days for every 90 days you spent overseas

- They cover all COVID-19 treatments requested by a doctor.

- Their website is much easier and practical to use than most of the other options out there

Cons of a SafetyWing plan as a expat in the United States

- The prices you see directly on the website aren’t exact since they don’t include fees and tax – if you want an exact quote, you’ll have to log in and fill out your personal info

- The fees for coverage in the United States tend to be much higher when compared to those in other countries

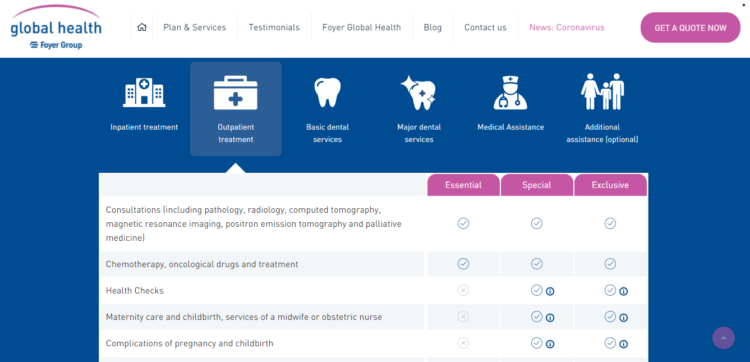

Foyer Global Health is part of the Foyer Group, a well-known European company that has many insurance plans available for clients around the world.

Pros of a Foyer Global Health plan as an expat in the United States:

- They have personalized plans based on your age, country of origin, vaccines, dental/eye care requirements, maternity, and children

- You can choose a different level of coverage for each of these factors, from zero coverage to maximum coverage

- You can get insurance for an individual, insurance for a family, or insurance for a couple

- Their quotes are simple and uncomplicated

- You can choose from long-term or short-term plans

- Their portal allows you to analyze and compare their plans to choose the one that’s right for you

Cons of a Foyer Global Health plan as an expat in the United States:

- Some of their most basic plans don’t include maternity or newborn care

- Although their customer service seems good, it doesn’t appear to be as practical as the others on the list

- Their website doesn’t make the limits of their plans very clear

- Their website includes a lot of useful info about Coronavirus, but it doesn’t make it very clear if their plans cover COVID-19 tests and treatment

- They charge an extra 5 euro fee for emergency support

Global Underwriters is an expert when it comes to medical insurance. They have different plans to meet different traveler profiles, including expatriates living in the United States.

GU’s Diplomat America plan is designed specifically for foreign residents of the US. Perfect for exchange students, digital nomads, business travelers, missionaries or those who want to take a long trip across the US.

Pros of a Global Underwriters plan as an expat in the United States:

- Global Underwriters is a stable company successful in meeting market demands

- Up to one million in Diplomat America coverage

- Specialized plans for expatriates and international residents

- Coverage available for individual travelers and families

- Flexible coverage from at least 15 days to one year

Cons of a Global Underwriters plan as an expat in the United States:

- Does not cover US residents and citizens

- They do not provide coverage for pre-existing illnesses

- Limits for emergency dental care lower than other plans mentioned above

- The website does not make clear the details of the plans offered

7. Aetna

Aetna is a solid company and has been a worldwide leader in insurance for more than 50 years.

One of Aetna’s standout factors is their prioritization of customer service. Because of this, they have a well-trained team available to answer questions and help you with emergencies 24/7.

Pros of an Aetna plan as an expat in the United States:

- Aetna has plans designed especially for digital nomads and expats

- They have 24/7 customer support

- They’ve won awards like “Health Insurance of the Year” and “Best International Provider for Private Health Insurance”

- Most of their plans offer coverage for cancer, evacuation, and repatriation in emergencies and hospitalizations

- Aetna has a full-service app that promotes and monitors the health of its users

Cons of an Aetna plan as an expat in the United States:

- The most basic plans don’t cover maternal or pregnancy care

Bonus:

Allianz Care is a German company that we can’t leave off our list. Although it’s a more traditional insurance company than some of the others here, they have quite a few advantages that are worth mentioning.

Here are some of what I did and didn’t like about Allianz’s plans.

Pros of an Allianz Care plan as an expat in the United States

- They have 24/7 customer support for clients around the world

- In most cases, Allianz will pay the medical provider directly for any services you request (in other words, you can avoid the long delays and beauracracies of requesting a reimbursement)

- They have plans specifically for expats

- Their portal has tips for expats on adapting to a new country, living alone, and dealing with potential problems that can happen when you’re living overseas

- They have a medical app to help with the treatment and prevention of health problems and illness

Cons of an Allianz Care plan as an expat in the United States

- They don’t have many plan options

- Their website isn’t very intuitive to use and compare plans

Now Health is another excellent international health insurance option for expatriates, this company’s main mission is to provide quality service with efficiency and clarity to its customers.

Now Health’s differential is, of course, its customer service. It is possible to contact the company through several channels and resolve all your doubts and pending issues in a simple way.

All Now Health plans are customizable and designed especially for new international residents, helping its users to experience the challenges of life in a new country.

Pros of an Now Health plan as an expat in the United States

- Customized and Flexible Plan Options

- 24/7 customer service

- Some plans cover maternity services

Cons of an Now Health plan as an expat in the United States

- To use maternity services coverage, you must have completed the 12-month period of the plan.

- Some services are done with a reimbursement system, which can be bureaucratic and impractical

Comparison table of the best international health insurance for expats in the United States

If you still have any doubts about where to begin your search, take a look at the table below for some help comparing all the options I listed above.

|

|

|

SafetyWing SafetyWing |

|

|

|||

| BENEFIT | LIMIT | LIMIT | LIMIT | LIMIT | LIMIT | LIMIT | LIMIT |

| Medical Maximum | Unlimited (for the Platinum plan) | $8,000,000 | The site doesn’t specify | Unlimited | US$1,000,000 per year | The site doesn’t specify | Depending on the plan, can be up to $1 million |

| U.S. In-Network Coinsurance | You choose. From 70%(100% thereafter) to 100% | 100% | No | 60% for maximum coinsurance and then 100% | Yes, for higher fees | Only in emergencies | Yes |

| U.S. Out-of-Network Coinsurance | You choose. From 70%(100% thereafter) to 100% | 90% to $5,000 (100% thereafter) | Yes, for higher fees | 100% | 100% | 100% | 100% |

| Mental Health Availability | No waiting period | 12-month waiting period | Co-payment of $25 per visit, waived deductible | 75% up to 40 visits / 60% after that | No | Waiting period of 10 months | Yes |

| Mental Health Benefit | Inpatient and Outpatient: $5,000 lifetime maximum to paid in full depending on the plan | Inpatient and Outpatient: $50,000 lifetime maximum | Co-payment of $250 after deductible | 100% up to 60 days | International and ambulance: limit not specified | Inpatient, outpatient, and therapy: limit not specific | |

| Inpatient Prescription Drugs | $500 to paid in full depending on the plan | Up to $8,000,000 | Yes | Complete reimbursement | Yes | ||

| Outpatient Prescription Drugs | None, unless you buy the International Outpatient Option | Up to $8,000,000 | Complete reimbursement | Yes | Yes | ||

| Evacuation and Repatriation of Remains | Paid in full | Up to $8,000,000 | Yes | Up to $25,000 | No | Up to 10,000 euros | Yes |

| Accidental Death & Dismemberment | Depends on the plan | Rider available, limit depends on age. | $50,000 | It depends on the plan | |||

| Emergency Dental | Paid in full | Up to $8,000,000 | Optional | 1,000 per year, $ 200 per tooth | Yes, however you need to pay an extra fee on top of your plan | Depending on the plan, it’s unlimited | It has limitations depending on the plan |

| Treatment Necessary as Result of Terrorism | Up to the amount of the coverage | Rider available up to $50,000-lifetime maximum | Clause available up to maximum of $50,000 in lifetime payments | N/A | |||

| Amateur Sports | Unlimited | Rider available up to $10,000 | No | Yes | No | No | N/A |

| Routine Nursery Care of a Newborn Child of a Covered Pregnancy | $25,000 to $156,000 depending on the plan | $1,000 additional deductible, $50,000 lifetime maximum, $200 wellness benefit for first 12 months | Yes | Depends on the plan | Can be unlimited depending on the plan | Depends on the plan | |

| Children born as a result of fertility treatment (such as IVF or surrogacy) | Only after the baby is 90 days old | Excluded | Depends on the plan | Excluded | No | No | |

| Neonatal Intensive Care Unit | Check website for updated information | $250,000 maximum for first 31 days | No | Up to $250,000 for the first 31 days | No | Depends on the plan | |

| Pre-existing condition exclusion period | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness |

| Pre-existing condition look back period | Any time prior to effective date | Any time prior to plan effective date | Any time prior to plan effective date | Any time prior to plan effective date | Any time prior to plan effective date | Any time prior to plan effective date | Any time prior to plan effective date |

| Pre-existing annual maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Unlimited depending on the plan | Unlimited depending on the plan | Full reimbursement | Unlimited depending on the plan | Unlimited depending on the plan |

| Pre-existing lifetime maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Unlimited depending on the plan | Unlimited depending on the plan | Full reimbursement | Unlimited depending on the plan | Unlimited depending on the plan |

Note: this table is subject to change. At the moment of writing this article, all info was correct and up-to-date. Check with the insurance provider for the most up-to-date information.

In conclusion…

Beginning a new life in a foreign country may not be the easiest task, but it’s certainly one of the most enriching and unforgettable!

That said, I hope that this comparison above has helped you in your search for the best policy, or at least given you a better idea of what your options are.

I’ve spent a lot of time living in the United States as an expat…so if you have any other questions about expat insurance for the United States or have any other questions about living overseas in general, let me know in the comments area below and I’ll get back to you!