If you want to be an international student in Italy, did you know that most schools require you to have health insurance to apply? So what are your best options if you’re just taking a short course? Or if you need a policy longer than a year? Take a look at the article below to find all the answers!

A Health Insurance is a service that many students do not know they need, but it is very important to ensure a peaceful and safe stay abroad. In addition, you will probably need to provide proof of medical coverage to enroll in the course!

With this in mind, I have separated the best insurance options for students in Italy, along with information on student visas, most common courses and the Italian health system.

Check it out!

Why should international students in Italy have health insurance?

The main reason to take out health insurance is to make sure you are covered if you need any medical care in your new country of residence.

All international students studying in Italy must be covered by a health insurance, public or private. Many international students are eligible to participate in Italy’s universal health care coverage, although this depends on factors such as age, country of origin and duration of their degree program.

However, this is nothing new to anyone, right? Besides this reason, there are others that I consider relevant that I will explain below.

The right international student insurance plan for you depends on the time you will study in Italy, whether you will need a visa (and if so, what insurance requirements you need to meet), whether you will be eligible for the national health system in Italy, as well as your personal situation and choices.

And all this leads us to the next point…

What student health insurance is required for a student visa in Italy?

If you are in doubt, know that health insurance is mandatory to study in Italy.

Expatriates living in Italy can apply for health benefits in two ways: Universal Health Insurance and private health insurance.

To learn more about the types of courses you can study in Italy and the required visas, continue reading the article after the list of the best international health insurance for international students in Italy.

As always, I recommend that you get a quote from all the companies I’ve listed below… it might take a bit more time, but it can help you save a lot of money that you can instead spend making the most of your time in Italy!

The 5 Best and Cheapest Health Insurance for International Students in Italy

1. Health insurance for international students by IMG

IMGlobal offers a variety of insurance plans for students (as well as insurance plans for expatriates in general).

They have three different insurance plans made specifically for students. But since one of them is only for students studying abroad in the United States (The Patriot Exchange Program), we will only talk about two of them here.

Plan #1: Student Health Advantage

This program should have enough to meet all the health coverage requirements of your school (but make sure you check the minimum coverage required first!).

This specific plan covers many things that many others don’t – including mental health disorders, maternity care, and pre-existing conditions. IMG also covers COVID-19 costs like any other disease and injury that are subject to the policy’s terms and conditions.

Plan #2: Student Health Advantage Platinum

This plan is the same as the previous one, but offers double the maximum coverage: $1,000,000

What I like about IMG’s International Student Insurance:

- These plans are designed specifically for students

- They cover students of all nationalities

- They have more than 17,000 healthcare professionals for you to choose from around the world

- They have customer service 24 hours a day, 7 days a week

- They cover COVID-19 and telemedicine consultations

What I don’t like about IMG’s International Student Insurance:

- In some of their plans, there is a 1-year waiting period for coverage of pre-existing diseases

2. International health insurance for Cigna Global students

Cigna Global, one of the world’s largest health insurers, offers plans for travelers, expats and (of course!) international students.

Cigna Global, one of the world’s largest health insurers, offers plans for travelers, expats and (of course!) international students.

They offer 3 main plans: Silver, Gold and Platinum. These plans will cover you not only in Italy but all over the world! And if you have plans to visit the United States during your stay in Italy, you can choose to be covered there as well (although this makes your policy a bit more expensive, so it may be better to get only a short travel insurance for your visit to the US).

Here’s a table comparing your plan options:

Cigna’s plans are really flexible and allow you to add what you need (including things like dental and eye treatments or international evacuation and crisis assistance).

The company also has a flexible payment policy and offers several options such as annual, monthly and quarterly payments.

What I like about international health insurance for Cigna Global Students:

- They answer complaints quickly (according to the company, 95% of refund requests are received in 10 days)

- The online help center provides access to a list of more than 3,000 hospitals, as well as information guides

- They partner with more than 1.65 million hospitals, doctors, clinics and specialists around the world (offering plenty of choice if you need medical care)

- They have assistance 24 hours a day, 7 days a week, to answer any of your questions

What I don’t like about Cigna Global’s International Student Health Insurance:

- The most basic plan does not cover prenatal and postnatal care

- They do not include coverage for outpatient consultations with specialists and doctors

Now Health International is a leader in the international insurance market and its focus is to satisfy its clients with efficient and affordable plans.

Thus, one of the great advantages of this company is its state-of-the-art customer service, which provides information in a fast and practical way.

All Now Health plans are designed to meet, guide, and solve the challenges experienced by foreigners who reside in another country, including international students and exchange students around the world.

Plus, all plans are customizable so that they perfectly fit all your needs.

What I like about Now Health International Student Plans:

- Clear information and 24/7 customer service

- Coverage in over 190 countries and territories

- Various international insurance options and customizable plans

- Some plans offer coverage for maternity routines

What I don’t like about Now Health International Student Plans:

- In some procedures, Now Health works with a reimbursement system

- For plans with routine maternity coverage, you must wait a 12-month waiting period to access this benefit

4. StudentSecure Insurance from WorldTrips

WorldTrips is another great insurance company for students. Besides their great travel insurance options, they also have plenty of great international health insurance options for overseas students.

Below, you’ll find more details about the 4 levels of coverage for student health insurance that HCCMIS has on offer.

HCCMIS Plan #1: StudentSecure Elite

- The lowest deductibles and the highest coverage on offer

- 6-month waiting period for pre-existing conditions to be covered

- Includes coverage for club or intercollegiate sports

- Includes personal responsibility coverage

HCCMIS Plan #2: StudentSecure Select

- Lower maximum coverage (and lower monthly cost, too)

- 6-month waiting period for pre-existing conditions to be covered

- Option to add on Crisis Response Rider for rescue coverage

HCCMIS Plan #3: StudentSecure Budget

- 12-month waiting period for pre-existing conditions to be covered

- Medium coverage with a higher deductible

HCCMIS Plan #4: StudentSecure Smart

- The cheapest plan available (with the lowest benefits as well)

- Highest deductibles of all the plans

- Only covers pre-existing conditions at their acute onset

- Does not cover club sports

Take a look at the comparison below of HCC’s 4 StudentSecure plans (click to see the chart in more detail):

Pros of StudentSecure insurance from WorldTrips:

- They have some of the cheapest plans on this entire list

- You have 4 plans to choose from (and they are all made especially for students)

- They offer a discount if you pay the full plan amount upfront

- Their plans include coverage for dental emergencies in case of accidents (up to $250 USD per tooth or $500 USD in total)

Cons of StudentSecure insurance from WorldTrips:

- The Smart plan doesn’t have any pre-existing condition coverage

- In other plans, there is a 6-month waiting period for pre-existing conditions

- With the exception of the Elite plan, their plans don’t cover vaccines

- The Smart plan doesn’t have maternity or nursery coverage

- The low-cost plans have very high deductibles

![]()

Visitor Coverage, established in 2006 in the U.S., aims to streamline the process of selecting travel insurance, offering customized and affordable options for tourists, students, expats, and immigrants.

While the company doesn’t provide its own insurance plans, it serves as an intermediary, connecting customers with reputable insurance providers to ensure safety in emergencies. With its intuitive platform, travelers can easily compare and purchase the insurance that best fits their needs by providing a few basic trip details.

For international students, for instance, you can enter information such as your destination, age, and nationality. The platform then displays the best insurance options, detailing prices, coverage, cancellation options, extensions, and other benefits. It also includes ratings and comprehensive information about each insurance provider and their offerings.

What I like about Visitor Coverage student insurance:

- It’s a good way to compare the most reliable travel insurance on the market

- It has detailed information from several insurance companies

- It’s an easy-to-use platform

- It shows options that suit each traveler’s profile and with varying prices

- Support for insured students 24 hours a day, 7 days a week

- More than 18 years of experience in the market and more than 1 million customers around the world

What I don’t like about Visitor Coverage student insurance:

- It doesn’t have Visitor Coverage’s own insurance

- The exchange must be at least 30 days and at most 1 year

- It doesn’t cover the following countries: Belarus, Cuba, Iran, Israel, Lebanon, Mayotte, North Korea, Russia, Syria and Ukraine

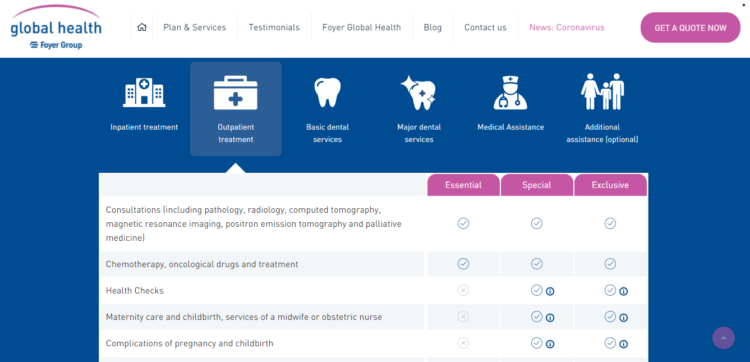

Basic or Premium? Short or long term stay in Italy? Alone or with family? Whatever you need, you can find a plan with Foyer Global Health that works for you.

The company has 3 different plans. Here is a quick overview of what each of these plans includes:

ESSENCIAL

- Consultations, surgery and anesthetics

- Therapeutic devices (such as cardiac pacemakers), if necessary, as a rescue measure

- Congenital diseases (up to a maximum of €100,000 per life)

- Does not cover maternity and childbirth

SPECIAL

- Consultations, surgery and anesthetics

- Auxiliaries and therapeutic devices (such as artificial limbs and prostheses) up to €2,000

- Congenital diseases up to a maximum of €150,000 per life

- Maternity and childbirth care (up to €5,000 with a waiting period of 10 months)

EXCLUSIVE

- Consultations, surgery and anesthetics

- Unlimited therapeutic devices

- Congenital diseases up to a maximum of €200,000 per life

- Maternity care, childbirth care and midwifery or nursing services in the hospital (up to €20,000 with a waiting period of 10 months)

What I like about Foyer Global Health plans:

- All plans include consultations, surgeries and basic dental treatments

- They have 24-hour customer service by phone and email with experienced consultants, doctors and experts

- They offer evacuation and repatriation service

- They offer medical support and pre-trip advice (vaccinations, preparation of a first aid kit)

What I don’t like about Foyer Global Health plans:

- The most basic plan does not cover prenatal and postnatal care

7. Diplomat Long Term and Diplomat International of Global Underwriters

Global Underwriters offers international health insurance plans for a wide range of travelers, including exchange students and international students abroad.

When it comes to GU plans, I recommend Diplomat Long Term and Diplomat International to international students in Italy.

What I like about Global Underwriters plans:

- Your student plans have coverage for medical evacuations, emergency dentistry and repatriation of remains

- Diplomat Long Term and Diplomat International plans cover up to $1,000,000

- They offer coverage and assistance in case of lost baggage and travel disruptions

- They have customer service 24 hours a day, 7 days a week

What I don’t like about Global Underwriters plans:

- The Diplomat International plan does not cover Covid-19

- The Diplomat Long Term plan does not cater to students residing in Australia and Iran, as well as in New York, Maryland, South Dakota (although this is not a problem for you if you have moved to Italy!)

- Your plans may be a bit more expensive than the others on this list

2 International Health Insurance Companies that can also be used by International Students in Italy

The two companies I will mention below do not offer health insurance specifically for students abroad. That said, they offer international health insurance that will (most likely) be accepted by your school or university as proof of coverage.

So my advice to you is to ask for a quote for these two companies below and compare it with the quote you got from the companies listed above. If you find that one of these two companies offers good coverage at a lower price than the other options, check with your Canadian school or university if they accept this type of policy.

If they do, this is a great chance to save money before venturing into your new home!

– Geoblue

Geoblue is another great option if you are looking for a health insurance policy to cover you while you study in Italy.

What I like about Geoblue’s international health insurance:

- Your plans are very adaptable and flexible, based on exactly what you need

- They have customer service 24 hours a day, 7 days a week

- Some of their plans cover extras like evacuation, preventative medical appointments and maternity care

- You can add ophthalmology and dentistry services

- The Xplorer plan does not have maximum medical coverage, covers extreme sports, does not charge franchises for standard services and has no cancellation fees

What I don’t like about Geoblue’s international health insurance:

- They do not cater to residents of New York and Washington (although this may not be a problem if you move your official residence to Italy)

- You have to contact an insurance broker and talk to him personally to get an exact quote (which is very annoying)

– Aetna (acquired by AllianzCare)

Aetna is a recognized company in the area of health insurance.

A good advantage of Aetna is that their plans are really flexible (you can customize based on what is needed for you), and they have very good customer service (as far as insurers are concerned).

What I like about Aetna’s international health insurance:

- They have been in the health insurance industry for 5 decades

- They offer flexible and customized plans

- They have 24-hour specialized service on seven days of the week

- Most of your plans provide coverage for emergency evacuations, cancer treatments, repatriation, and hospitalizations

- They are an insurer who has won awards such as “Health Insurer of the Year” and “Best International Private Health Insurance Provider”

- They have an app that encourages customers to maintain healthier habits with a system of points and rewards

What I don’t like about Aetna’s international health insurance:

- Their website is not very clear about the exact coverage of some of their plans

- They do not offer any type of travel insurance plan

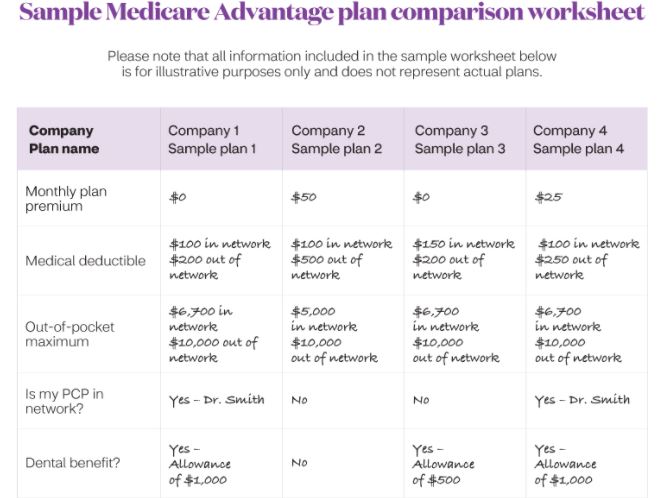

Table comparison of the 7 best health insurance plans for international/exchange students in Italy

Cigna Global Cigna Global |

|

|

|||

| Medical Maximum | Unlimited (for the Platinum plan) | $5,000,000 | There are no limits independent of the plan | US$1,000,000 per year | $1,000,000 |

| Mental Health Benefit | Unspecified | Unlimited for up to 90 days | Included in all plans with a 10-month waiting period | Outpatient: $50 per day max up to $500 in total | Yes |

| Inpatient Prescription Drugs | 80% coverage out-of-network, 100% in the USA and internationally | Unspecified | Coverage available | Name-brand drugs: 50% coinsurance

Generic drugs: 100% coinsurance Special drugs: no coverage |

Yes |

| Outpatient Prescription Drugs | 50% of actual costs, 90 days maximum per dispensation | Unspecified | Unspecified | coinsurance

Generic drugs: 100% coinsurance Special drugs: no coverage |

Yes |

| Mental Health Benefit | Inpatient and Outpatient: $5,000 lifetime maximum to paid in full depending on the plan | Inpatient and Outpatient: $50,000 lifetime maximum | None | Inpatient and Outpatient: limit not specified | Inpatient, outpatient, and therapy: limit not specific |

| Outpatient Prescription Drugs | None, unless you buy the International Outpatient Option | Up to $8,000,000 | Full reimbursement | Yes | Yes |

| Repatriation of Remains | $25,000 maximum or $5,000 for cremation | Optional | Optional | $50,000 maximum or $5,000 for cremation | $13,500 maximum |

| Emergency Evacuation | $50,000 | Optional | Optional | $10,000 | Yes |

| Hospital room coverage | Offered up to the average semi-private room rate | Private room | Private Room | Usual | Usual |

| Terrorism | $50,000 | Unspecified | Unspecified | $100,000 | N/A |

| Accidental Death & Dismemberment (AD & D) | Principal sum of $25,000 that is not subject to deduction | $25,000 for main policy holder, $10,000 for spouse on the plan, $5,000 for child on the plan

Total limit of $250,000 |

Optional | $25,000 for main policy holder, $10,000 for spouse on the plan, $5,000 for child on the plan

Total limit of $250,000 |

There is coverage |

| Emergency Dental | $500 per injury for the coverage period | Optional | Optional | $2,500 | Yes |

| Maternity Care | Only covered in Platinum plan | $14,000/€11,000/£9,000 in the Platinum plan | Only available in the Special and Exclusive plans | Within the US: up to 80% coverage with a $25,000 limit within the PPO network/Outside PPO: up to 50% coverage with a $25,000 limit

Outside the United States: Up to 80% coverage with a $25,000 limit. Benefits reduced by 25% if pregnancy is not reported within the first 90 days. |

Not specified |

| Pre-existing condition exclusion period | Maximum limit of $1,500 with a 12-month waiting period | $14,000/€11,000/£9,000 in the Platinum plan | Coverage available | Limited of $250,000 per plan | Unspecified |

| Intensive Care Unit (ICU) | 100% coverage after the deductible has been met | Full coverage with the Platinum plan | Coverage available | Up to $50,000 | Not specified |

| Vaccines | Unspecified | Optional | Only in the Special and Exclusive plans | $200 | Yes, but must be paid as a separate plan |

| Routine care for newborns | Unspecified | Optional | Only in the Special and Exclusive plans | Up to $750 | Yes, but must be paid as a separate plan |

| Pre-existing annual maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Full reimbursement | Unlimited depending on the plan | Depends on the plan |

| Pre-existing lifetime maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Full reimbursement | Unlimited depending on the plan | Depends on the plan |

Worldwide Medical Insurance / Comparison Chart*

Part of the table courtesy of Tokio Marine HCC

*Note: this table is just for informational purposes and subject to change. It was accurate as of the time we wrote it here, but please check each company’s individual website for updated info.

What are the types of visas and courses to study in Italy?

Depending on your nationality, you may need a visa to study in Italy. If you are from an EU or EFTA country (Iceland, Liechtenstein, Norway and Switzerland) you will not need a visa. If you are from any other country, you will need a visa. All students will need to provide accommodation details, proof of financial stability and a comprehensive health insurance policy.

For more information on the visa process, required documents, application costs and where to apply, please visit the MAECI website and provide the relevant information. This site will give you information specific to your situation.

If you are a non-EU or non-EFTA student, you will need to apply for a residence permit once you have a visa. This needs to be done within 8 days of your arrival in the country. You can apply for this at the post office in your new city of residence. If you need any advice or information about this process, your institution can help.

Students who are from an EU or EFTA country do not need to apply for a residence permit. However, if you plan to stay longer than 3 months, you must register with Anagrafe (registration office) in your city of residence. You can register as a temporary resident if you do not intend to move your permanent residence to Italy. If you choose this option, it must be renewed every year. You can also transfer your permanent residency to Italy.

EU students planning to study in Italy for more than 3 months need to register with the Italian National Health Service (SSN) for full health coverage. You can do this at the Local Health Authorities (ASL). You will not have to pay any fees and you will receive a health insurance card (Tessera Sanitaria). This allows you to have access to the same healthcare services as Italian citizens.

Non-EU students must have health insurance to apply for a residence permit. There are three different options for international students.

- Register with the Italian Health Service (SSN) – you can do this with your Local Health Authority (ASL).

- Buy a private health insurance policy in your own country – it is always advisable to have this policy validated by the Italian embassy and translated into Italian or English.

- Buy a private health insurance policy in Italy – you can do this before or after your arrival, but you need it to apply for a residence permit.

NECESSARY DOCUMENTS

- Entry visa application form; http://vistoperitalia.esteri.it/Moduli/it/Formulario Visa Nazionale.pdf

- Recent passport-sized photograph;

- Travel document valid for at least three months after the visa;

- Enrollment or pre-enrollment in a university course

- Proof that you have accommodation in Italy;

- Proof that you have financial support (at least €467.65 per month for the academic year, a total of €6,079.45 per year);

- Adequate insurance coverage for medical treatment and hospitalization;

- Proof of availability of the necessary financial means for repatriation;

- Proof of adequate knowledge of Italian or English according to the language of the program;

- If the student is a minor, he/she must have the expatriation consent signed by each of the parental authorities, or, in their absence, by the legal guardian;

The most common courses for students in Italy are language courses, bachelors, masters and doctorates.

If your desire is to take a course at an Italian university, you can check out some scholarships to fulfill your dream of studying at one of the best universities in the world, such as Scuola Normale Superiore, Bocconi University, University of Bologna, Gran Sasso Science Institute (GSSI ), among others!

Scuola Normale Superiore: 75 PhD scholarships are offered by the Scuola Normale Superiore to students from outside Italy and Italian citizens for a period of four years. This scholarship covers tuition fees and a scholarship for board and accommodation. All students will be entitled to additional funding for their research activity, even abroad.

- Institution: Scuola Normale Superiore

- Study Level: PhD

- Click here for Deadlines and step-by-step application process

Arturo Falaschi Postdoctoral Fellowships: This is a fully funded scholarship for international students. The scholarship period is 2 years with the possibility of a 1-year extension. The Scholarships comprise a very competitive package, including scholarship, health insurance and additional benefits.

- Institution: ARES

- Level of Study: Postdoctoral

- Click here for Deadlines and step-by-step application process

Bocconi University: Bocconi University Scholarships are fully funded scholarships for international students. These scholarships are available to study undergraduate and masters. These scholarships provide full tuition waivers worth up to approximately €12,000 per year (for Undergraduate) and €13,000 per year (for Graduate) and accommodation.

- Institution: Bocconi University

- Level of Study: Undergraduate / Master’s

- Click here for Deadlines and step-by-step application process

University of Bologna: University of Bologna Scholarship is a fully funded scholarship for international students. This scholarship is offered for undergraduate and masters studies. This scholarship provides the recipient with scholarships of €11,000 gross for Unibo Action 2) and tuition fee waivers for Unibo Action 1.

- Institution: University of Bologna

- Study in: Italy

- Level of Study: Undergraduate/Master’s

- Click here for Deadlines and step-by-step application process

Italian Government Scholarship: It is a fully-funded scholarship for international students to pursue Masters or Doctoral degrees at leading Italian universities. This scholarship covers monthly payments of 900 euros, tuition and medical insurance.

- Institution: Italian Institutes of Higher Education

- Study in: Italy

- Level of Study: PhD/Master’s

- Click here for Deadlines and step-by-step application process

NATO Defense College Fellowship: is a fully funded research fellowship for international students. This scholarship will provide a stipend to cover the costs of your stay in Rome and your travel expenses.

Institution: NATO Defense College (NDC)

Study in: Italy

Level of Study: Research

Click here for Deadlines and step-by-step application process.

Gran Sasso Science Institute (GSSI): The Gran Sasso Science Institute (GSSI) Doctoral Program offers 31 PhD scholarships to international students in Astropoparticle Physics, Mathematics in Natural, Social and Life Sciences, Computer Science, Urban Studies and Regional Sciences. This scholarship will provide tuition waivers, accommodation and free meal vouchers.

- Institution: Gran Sasso Science Institute (GSSI)

- Study in: Italy

- Study Level: PhD

Click here for Deadlines and step-by-step application process

In addition to all these options, Italian is a great choice of study, and if you decide to study Italian in Italy you will be able to experience this rich and beautiful language first hand – along with the culture, landscape and gastronomy that make Italy famous throughout the world. world! In this link you will be able to find the best Italian courses in Italy in 2022.

In Sum…

Once again, these are the 5 best and cheapest travel insurance policies for international students in Italy:

- Student Health Advantage from IMG

- International health insurance for Cigna Global students

- Now Health International

- Foyer Global Health

- Insurance StudentSecure da HCCMIS

In Conclusion…

All in all… as you prepare for your time as an international student in Italy, make sure that health insurance is not a detail you forget.

After all, you may not be able to enroll in school without it… and you don’t want to get stuck paying out of your own pocket for medical expenses!

If you still have any questions about these travel insurance options for students in Italy (or about moving abroad in general), let me know in the comments area below and I will be happy to help!