Many people who dream of studying in Germany have no idea that, in most schools and institutions, it is necessary to present health insurance to enroll. In this article, we will explain which are the best options for you who are taking a short course or more than one year!

Many people are unaware that they need health insurance as a student, but it is extremely important to make sure you have a headache-free or emergency-free stay abroad. In addition, you will most likely need proof of medical coverage to enroll in the desired course!

That’s why we’ve put together the best insurance options for students in Germany, as well as some important information about student visas, courses, most common institutions and the German healthcare system.

Keep reading!

Why should international students in Germany have health insurance?

Having health insurance is essential for you to stay well in case you need medical or other care in case of other types of emergencies in the destination country.

International students coming to Germany need to be covered by private or public health insurance. Most international students are eligible for universal health coverage in Germany.

However, this depends on some factors such as country of origin, course duration and age.

But this is nothing new, right? Also, I will explain other things that I think are relevant.

The ideal international student insurance plan for your needs depends on how long you will be spending in Germany, whether you will need a visa, whether you will be eligible for the German national healthcare system and your individual choices.

These things take us to another point…

What student health insurance is required for a student visa in Germany?

If you still have doubts, it is important to know that health insurance is mandatory if you are going to study in Germany.

Expats living in Germany can apply for health benefits in two ways: Universal Health Insurance and private health insurance.

If you want to know more about the types of courses you can study in Germany, the best colleges and the visas you need, then continue reading the article after the list of the best international health insurance for international students in Germany.

As I always recommend, it is interesting that you make a quick quote online with all the companies listed here. It will take a little more time, but it saves you a lot of money!

The 5 Best and Cheapest Health Insurance for International Students in Germany

1. Health insurance for international students by IMG

IMG offers a wide range of insurance plans for students (and expats in general).

They have three different insurance plans that are specific to students. One of them is only for students studying in the United States (The Patriot Exchange Program), so we are only going to talk about two of them here.

Plan #1: Student Health Advantage

This program will likely be sufficient to meet your course’s coverage requirements (but it’s always good to certify the minimum coverage required!).

The plan covers many things that some others do not, such as mental health disorders, maternity and pre-existing health conditions such as any illness or injury that are subject to the terms and conditions of the policy. In addition, it also covers COVID-19 costs.

Plan #2: Student Health Advantage Platinum

This plan is exactly like the previous one, but it offers twice the maximum coverage: $1,000,000

What I like about IMG’s International Student Insurance:

- Made specifically for students

- Covers students of all nationalities

- They have over 17,000 healthcare professionals around the world.

- Customer service 24 hours a day, 7 days a week

- Covers COVID-19 and telemedicine consultations

What I don’t like about IMG’s International Student Insurance:

- In some of the plans offered, there is a one-year grace period for coverage of pre-existing conditions.

2. International health insurance for Cigna Global students

Cigna is one of the world’s largest health insurers, offering plans for travelers, expats and international students.

They offer three main plans: Silver, Gold and Platinum, which cover your needs not only in Germany but worldwide! If you have plans to visit the United States during your stay in Germany, you can choose to be covered there as well (although this makes your policy a little more expensive, so it might be better to just get short travel insurance for your visit to the United States).

Here’s a table that compares your plan options:

Cigna’s plans are flexible, allowing you to add whatever you need (which includes things like dental and eye care or international evacuation and crisis assistance).

The company also has a flexible payment policy that offers different options like annual, monthly and quarterly payments.

What I like about international health insurance for Cigna Global Students:

- Quick response to complaints (according to the company, 95% of refund requests are received within 10 days)

- An online help center providing access to a list of over 3,000 hospitals plus information guides

- Cigna has partnerships with more than 1.65 million hospitals, doctors, clinics and specialists around the world, which gives a range of options to the customer who needs medical care.

- 24/7 assistance to answer any of your questions

What I don’t like about Cigna Global’s International Student Health Insurance:

- The most basic plan does not cover prenatal and postnatal care

- They do not include coverage for outpatient consultations with specialists and doctors.

3. Now Health International

Now Health International has emerged as a frontrunner in the international insurance sector, placing a strong emphasis on providing effective and affordable plans to satisfy its clientele.

A significant advantage of this company lies in its cutting-edge customer service, which delivers information quickly and conveniently.

All Now Health plans are meticulously crafted to address and overcome the unique hurdles faced by expatriates residing in foreign countries, including international and exchange students from around the world.

Moreover, these plans offer complete customization, allowing them to be tailored precisely to meet all of your requirements.

What I like about Now Health International Student Plans:

- Clear information and 24/7 customer service

- Coverage in over 190 countries and territories

- Various international insurance options and customizable plans

- Some plans offer coverage for maternity routines

What I don’t like about Now Health International Student Plans:

- In some procedures, Now Health works with a reimbursement system

- For plans with routine maternity coverage, you must wait a 12-month waiting period to access this benefit

4. StudentSecure Insurance from WorldTrips

WorldTrips is another great insurance company for students. Besides their great travel insurance options, they also have plenty of great international health insurance options for overseas students.

Below, you’ll find more details about the 4 levels of coverage for student health insurance that HCCMIS has on offer.

HCCMIS Plan #1: StudentSecure Elite

- The lowest deductibles and the highest coverage on offer

- 6-month waiting period for pre-existing conditions to be covered

- Includes coverage for club or intercollegiate sports

- Includes personal responsibility coverage

HCCMIS Plan #2: StudentSecure Select

- Lower maximum coverage (and lower monthly cost, too)

- 6-month waiting period for pre-existing conditions to be covered

- Option to add on Crisis Response Rider for rescue coverage

HCCMIS Plan #3: StudentSecure Budget

- 12-month waiting period for pre-existing conditions to be covered

- Medium coverage with a higher deductible

HCCMIS Plan #4: StudentSecure Smart

- The cheapest plan available (with the lowest benefits as well)

- Highest deductibles of all the plans

- Only covers pre-existing conditions at their acute onset

- Does not cover club sports

Take a look at the comparison below of HCC’s 4 StudentSecure plans (click to see the chart in more detail):

Pros of StudentSecure insurance from WorldTrips:

- They have some of the cheapest plans on this entire list

- You have 4 plans to choose from (and they are all made especially for students)

- They offer a discount if you pay the full plan amount upfront

- Their plans include coverage for dental emergencies in case of accidents (up to $250 USD per tooth or $500 USD in total)

Cons of StudentSecure insurance from WorldTrips:

- The Smart plan doesn’t have any pre-existing condition coverage

- In other plans, there is a 6-month waiting period for pre-existing conditions

- With the exception of the Elite plan, their plans don’t cover vaccines

- The Smart plan doesn’t have maternity or nursery coverage

- The low-cost plans have very high deductibles

![]()

Visitor Coverage, established in 2006 in the U.S., aims to simplify the travel insurance selection process by offering customized and affordable solutions for tourists, students, expats, and immigrants.

While the company doesn’t provide its own insurance policies, it acts as a broker, connecting customers with trusted insurers to ensure peace of mind during emergencies. Its easy-to-use platform allows travelers to compare and choose the insurance that best fits their needs by entering just a few trip details.

For international students, for instance, they can input details like their destination, age, and nationality. The platform then suggests the best insurance options, showing costs, coverage, cancellation policies, coverage extensions, and other benefits. It also features ratings and comprehensive information on each insurance provider and their offerings.

What I like about Visitor Coverage student insurance:

- It’s a good way to compare the most reliable travel insurance on the market

- It has detailed information from several insurance companies

- It’s an easy-to-use platform

- It shows options that suit each traveler’s profile and with varying prices

- Support for insured students 24 hours a day, 7 days a week

- More than 18 years of experience in the market and more than 1 million customers around the world

What I don’t like about Visitor Coverage student insurance:

- It doesn’t have Visitor Coverage’s own insurance

- The exchange must be at least 30 days and at most 1 year

- It doesn’t cover the following countries: Belarus, Cuba, Iran, Israel, Lebanon, Mayotte, North Korea, Russia, Syria and Ukraine

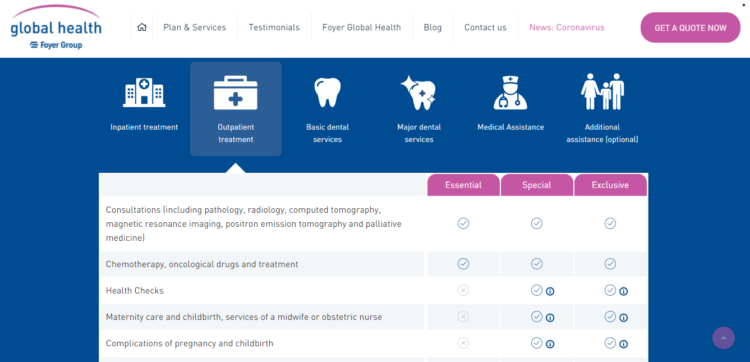

6. Foyer Global Health

Whatever you need, Goyer Global Health is sure to have a plan for you. Their plans range from basic or premium, short-term or long-term, and individual or family.

They have three different plans. Here’s a quick rundown of what each of these plans includes:

ESSENCIAL

- Consultations, surgery and anesthetics

- Therapeutic devices (such as cardiac pacemakers) if needed as a rescue measure

- Congenital diseases (up to a maximum of €100,000 per life)

- Does not cover maternity and childbirth

SPECIAL

- Consultations, surgery and anesthetics

- Auxiliaries and therapeutic devices (such as artificial limbs and prostheses) up to €2,000

- Congenital diseases up to a maximum of €150,000 per life

- Maternity and childbirth care (up to €5,000 with a waiting period of 10 months)

EXCLUSIVE

- Consultations, surgery and anesthetics

- Unlimited therapeutic devices

- Congenital diseases up to a maximum of €200,000 per life

- Maternity care, childbirth care and midwifery or nursing services at the hospital (up to €20,000 with a 10 month waiting period)

What I like about Foyer Global Health plans:

- Plans include consultations, surgeries and basic dental treatments

- 24/7 customer service by phone or email with experienced consultants, doctors and specialists

- They offer evacuation and repatriation service

- They offer medical support and pre-trip advice (vaccinations, preparation of a first aid kit)

What I don’t like about Foyer Global Health plans:

- Your most basic plan does not include prenatal and postnatal care

7. Diplomat Long Term and Diplomat International of Global Underwriters

Global Underwriters offers international health insurance plans for many types of travelers, including exchange students and international students.

When it comes to GU plans, I recommend Diplomat Long Term and Diplomat International for international students in Germany.

What I like about Global Underwriters plans:

- Have coverage for medical evacuations, emergency dentistry and repatriation of mortal remains

- The Diplomat Long Term and Diplomat International plans provide coverage of up to $1,000,000

- In addition to medical coverage, the plans offer assistance in the event of lost luggage and travel interruption.

- 24/7 customer service

What I don’t like about Global Underwriters plans:

- Diplomat International plan does not cover Covid-19

- The Diplomat Long Term plan does not cater for students residing in Australia and Iran, as well as New York, Maryland, South Dakota (but this is not an issue if you are going to Germany!)

- Plans can be a little more expensive than others on this list.

2 International Health Insurance Companies that can also be used by International Students in Germany!

The two companies mentioned below do not offer specific health insurance for those studying abroad. Instead, they offer international health insurance that will (almost certainly) be accepted by your school or university as proof of coverage.

So my advice is that you ask for a quote from these two companies and compare it to the quote you got from the companies listed above. If you find that one of these two companies offers good coverage at a lower price than the other options, check with your German school or university to see if they accept this type of policy.

If they do, this is a great chance to save money before venturing into your new home!

– Geoblue

Geoblue is another great option if you are looking for health insurance to cover you while studying in Germany.

What I like about Geoblue’s international health insurance:

- Very adaptable and flexible plans based on your individual needs

- 24/7 customer service

- Some of their plans cover extras like evacuation, preventative medical appointments, and maternity care.

- It is possible to add ophthalmology and dentistry services

- The Xplorer plan has no maximum medical coverage, covers extreme sports, does not charge deductibles for standard services, and has no cancellation fees

What I don’t like about Geoblue’s international health insurance:

- They do not serve residents of New York and Washington (although this is not a problem if you are going to Germany)

- You need to speak to an insurance broker in person to get an accurate quote (which is very annoying)

– Aetna (acquired by AllianzCare)

Aetna is a recognized company in the field of health insurance.

A good advantage of Aetna is that their plans are quite flexible (you can customize based on all your needs), and they have very good customer service (as far as insurers go).

What I like about Aetna’s international health insurance:

- They’ve been in the health insurance industry for 50 years

- Flexible and customized plans

- Expert service every day, seven days a week

- Coverage for emergency evacuations, cancer treatments, repatriation and hospitalizations

- They have already won awards such as “Health Insurer of the Year” and “Best International Private Health Insurance Provider”

- Application that helps customers maintain healthier habits with a points and rewards incentive system

What I don’t like about Aetna’s international health insurance:

- Their website is not very clear about the exact coverage of some of their plans.

- They don’t offer any kind of travel insurance plan.

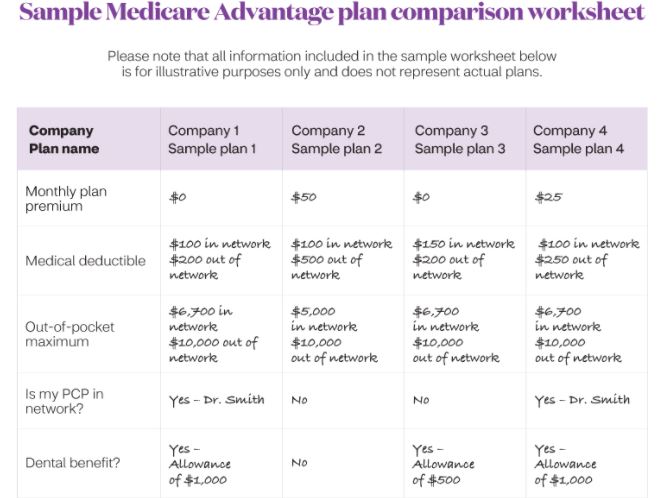

Table comparison of the 7 best health insurance plans for international/exchange students in Germany

Cigna Global Cigna Global |

|

|

|||

| Medical Maximum | Unlimited (for the Platinum plan) | $5,000,000 | There are no limits independent of the plan | US$1,000,000 per year | $1,000,000 |

| Mental Health Benefit | Unspecified | Unlimited for up to 90 days | Included in all plans with a 10-month waiting period | Outpatient: $50 per day max up to $500 in total | Yes |

| Inpatient Prescription Drugs | 80% coverage out-of-network, 100% in the USA and internationally | Unspecified | Coverage available | Name-brand drugs: 50% coinsurance

Generic drugs: 100% coinsurance Special drugs: no coverage |

Yes |

| Outpatient Prescription Drugs | 50% of actual costs, 90 days maximum per dispensation | Unspecified | Unspecified | coinsurance

Generic drugs: 100% coinsurance Special drugs: no coverage |

Yes |

| Mental Health Benefit | Inpatient and Outpatient: $5,000 lifetime maximum to paid in full depending on the plan | Inpatient and Outpatient: $50,000 lifetime maximum | None | Inpatient and Outpatient: limit not specified | Inpatient, outpatient, and therapy: limit not specific |

| Outpatient Prescription Drugs | None, unless you buy the International Outpatient Option | Up to $8,000,000 | Full reimbursement | Yes | Yes |

| Repatriation of Remains | $25,000 maximum or $5,000 for cremation | Optional | Optional | $50,000 maximum or $5,000 for cremation | $13,500 maximum |

| Emergency Evacuation | $50,000 | Optional | Optional | $10,000 | Yes |

| Hospital room coverage | Offered up to the average semi-private room rate | Private room | Private Room | Usual | Usual |

| Terrorism | $50,000 | Unspecified | Unspecified | $100,000 | N/A |

| Accidental Death & Dismemberment (AD & D) | Principal sum of $25,000 that is not subject to deduction | $25,000 for main policy holder, $10,000 for spouse on the plan, $5,000 for child on the plan

Total limit of $250,000 |

Optional | $25,000 for main policy holder, $10,000 for spouse on the plan, $5,000 for child on the plan

Total limit of $250,000 |

There is coverage |

| Emergency Dental | $500 per injury for the coverage period | Optional | Optional | $2,500 | Yes |

| Maternity Care | Only covered in Platinum plan | $14,000/€11,000/£9,000 in the Platinum plan | Only available in the Special and Exclusive plans | Within the US: up to 80% coverage with a $25,000 limit within the PPO network/Outside PPO: up to 50% coverage with a $25,000 limit

Outside the United States: Up to 80% coverage with a $25,000 limit. Benefits reduced by 25% if pregnancy is not reported within the first 90 days. |

Not specified |

| Pre-existing condition exclusion period | Maximum limit of $1,500 with a 12-month waiting period | $14,000/€11,000/£9,000 in the Platinum plan | Coverage available | Limited of $250,000 per plan | Unspecified |

| Intensive Care Unit (ICU) | 100% coverage after the deductible has been met | Full coverage with the Platinum plan | Coverage available | Up to $50,000 | Not specified |

| Vaccines | Unspecified | Optional | Only in the Special and Exclusive plans | $200 | Yes, but must be paid as a separate plan |

| Routine care for newborns | Unspecified | Optional | Only in the Special and Exclusive plans | Up to $750 | Yes, but must be paid as a separate plan |

| Pre-existing annual maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Full reimbursement | Unlimited depending on the plan | Depends on the plan |

| Pre-existing lifetime maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Full reimbursement | Unlimited depending on the plan | Depends on the plan |

Worldwide Medical Insurance / Comparison Chart*

Part of the table courtesy of Tokio Marine HCC

*Note: this table is just for informational purposes and subject to change. It was accurate as of the time we wrote it here, but please check each company’s individual website for updated info.

Why study Germany and how does the Educational System work?

The advantages of studying in a developed country like Germany are numerous. There, tuition fees are almost non-existent, being very low. The cost of living is also very low, despite being a European country with a lot of geopolitical prominence.

Furthermore, even though many Germans can communicate with you in English, learning the language of the country can be a unique experience, as German is a language that can open up many opportunities for you, especially if you want to continue living in the country after your graduation.

Food, art, architecture and German history. All of these are captivating things that will encourage your studies and make your eyes sparkle during your stay in the country.

Now about the education system. In Germany children begin their studies at the age of six, first attending a primary school, and at ten they are separated into three types of school: the Hauptschule, which is completed in the ninth grade. The Realschule, which is completed in the tenth year, gives students the opportunity to enter a technical school and continue their studies. And finally, the Gymnasium, which ends in the twelfth or third year and gives the student the right to enter a university.

The country’s public schools are entirely financed by tax rates and the level of education is high. However, if you do not want to study in a public school, parents can choose to enroll their children in private institutions, which have tuition fees.

Each of Germany’s 16 states has the autonomy to decide the regulations of its education system, its curriculum and conclusions.

In Germany there are 400 public universities and more than 100 private universities. Higher education is divided into three different types of universities: the Technische Universitäten or technical schools, which are geared towards teaching engineering, technology or science. The Fachhochschulen are universities of applied science, focused on social sciences and business. Finally, the Kunst-und Musikhochschulen are universities of arts and communications.

If your focus is not university, but learning the language in your own country, there are also several German courses offered to interested foreigners.

How to study in Germany

As some countries have fewer years of primary education than Germany, it is necessary, in these cases, to take a preparatory course lasting one to two semesters, with a final exam, called the Studienkolleg before applying to a German university. The subjects offered in this preparatory course will already be focused on the desired degree course and the fees vary between 30 and 300 euros per semester.

In order not to have to go through this preparatory course, it is necessary that you have already taken an undergraduate course for at least one year in your home country. In this way, it is only necessary to apply directly to the desired German university.

In most universities in the country, applications are made between November and January or May and July. This will all depend on the university, so keep an eye on your desired university. Below I will comment a little about some German universities.

It is important that you have at least C1 level in German, as few undergraduate courses there are offered in English and this can compromise your entire learning process.

Types of visa for foreign students in Germany

A student visa is essential for most people who want to study in a foreign country. This does not change in the case of Germany.

Citizens of EU countries, Norway, Iceland, Liechtenstein and Switzerland do not need a visa or residence permit. For citizens of countries such as New Zealand, USA, Australia, Brazil, United Kingdom, Canada, Israel, Japan, Republic of Korea, Andorra, El Salvador, Honduras, Monaco and San Marino, a residence permit is required, which can be requested after entering Germany, but not applying for a visa before going to the country.

If you are not from one of these countries, you must apply for a visa at the German embassy, which upon arrival in Germany can be replaced by a residence permit after your installation in the country. There are two types of student visas:

- Student Visa: ideal if you are going to a German university. Commonly valid for three months prior to applying for a residence permit;

- Study Candidate Visa: valid in case you need to do the aforementioned preparations (language course or preparatory course) before entering a German university or your admission letter has not yet been sent. It is also valid for three months and can be extended if the student needs more time to fulfill the requirements of the student visa or residency application.

The documents for applying for a visa are: passport, two recent biometric photos, proof of having taken out insurance covering at least the initial three months of stay, proof of language or proof that you wish to study German in the country, admission letter from university (in case of student visa), proof of enrollment (in case of student visa), proof of financial resources and payment of the fee.

It is worth remembering that it is always good to check the necessary documents directly at the German embassy in your country. That way, you avoid being outdated and any headaches.

Whether you need a student visa or not, the next step is to apply for a residence permit. To do this, you need to register your German address at the Resident Registration Office in your new city.

The process is very simple. First you need to register at the office. Just make an appointment at the office (some cities give you the option to book online), present a passport and proof of residence signed by the owner of the property and wait for confirmation.

After this initial registration, it is possible to apply for the residency application by presenting proof of registration at the office, proof of health insurance, university enrollment letter, proof of financial resources, passport and one or two biometric photos. If you are a citizen of the European Union, you do not need to apply.

The best German Universities

When looking for a university to study, it is normal to get lost among so many options, especially when it comes to a foreign country that we know very little about.

The most renowned universities in Germany are: Ludwig Maximilians Universität München, Universität Heidelberg, Humboldt-Universität zu Berlin and Rheinische Friedrich-Wilhelms-Universität Bonn.

For students who do not speak German and do not intend to specialize in the language, just to get to know the country and its culture, some universities offer courses and programs in English, such as Jacobs University Bremen, Hertie School of Governance, CODE University of Applied Sciences and others.

It is important to research a lot about the college’s education system, courses, how the day-to-day works on campus, university extension projects and answer any questions you have so you don’t regret your choice!

In Sum…

Once again, these are the 5 best and cheapest travel insurance policies for international students in Germany:

- Student Health Advantage from IMG

- International health insurance for Cigna Global students

- Now Health International

- Foyer Global Health

- Insurance StudentSecure da HCCMIS

In Conclusion…

Finally… As you prepare for your time as an international student in Germany, make sure that health insurance isn’t something you forget about.

After all, you might not be able to apply to college without it… and you don’t want to be stuck paying out-of-pocket medical expenses!

If you still have any questions about these travel insurance options for students in Germany (or moving abroad in general), let me know in the comments area below and I’ll be happy to help!