Thinking about a trip to South Korea? Ensure travel insurance is at the forefront of your checklist! Keep reading to explore fantastic travel insurance options tailored for budget travelers, backpackers, active adventurers, and beyond. Moreover, we’ll unveil two possible selections for complimentary travel insurance that might have eluded your attention!

Setting off on a memorable adventure to South Korea is undeniably thrilling, yet it’s natural to feel inundated by the array of tasks ahead. Whether it’s arranging flights and lodging, organizing activities, or managing potential jet lag, there’s one vital element that often slips through the cracks – travel insurance.

If you’re in this scenario, there’s no need to worry! Keep reading to uncover all the essentials for obtaining the ideal travel insurance for your South Korea excursion. We’ll provide you with an extensive rundown of the top-notch and budget-conscious options out there!

But before we delve into the details…

Do I really need travel insurance for a trip to the South Korea?

Indeed, without a doubt!

Indeed, without a doubt!

Securing comprehensive travel insurance is absolutely essential, particularly for adventurous travelers like myself, who often partake in activities with elevated risks of injury and potential medical costs.

Throughout my journeys, I’m constantly indulging in thrilling pursuits like mountain hiking, climbing, jumping, diving, and exploring everything that defines a perfect adventure!

Let’s paint a scenario: imagine you’re snowboarding in Switzerland without travel insurance, and unfortunately, you sustain an injury on the mountain, requiring a helicopter evacuation.

The staggering medical bill awaiting you while lying in a hospital bed could easily trigger a panic attack just by glancing at the string of zeros!

However, here’s the undeniable truth: obtaining travel insurance is a prudent choice, regardless of your destination.

Throughout my journeys, I’ve encountered countless backpackers sporting the infamous “Thai Tattoo” – significant scars on their legs resulting from burns caused by scooter exhaust pipes in Thailand!

And let’s face it, do you truly want to find yourself in a public hospital in the heart of Bangkok?!?! With travel insurance, you have the flexibility to opt for a private hospital where you’ll undoubtedly receive superior care. So, why take unnecessary risks? Ensure you’re covered and relish your trip to the fullest!

But do I actually need travel insurance? I don’t usually do any extreme activities or sports!

Listen up: whether you’re gearing up for a shopping spree in Miami or any other excursion, travel insurance is an absolute essential!

While health insurance might not be obligatory in South Korea, as it is in some other nations, there’s always a degree of risk when traveling. From minor mishaps like tripping on the sidewalk to more serious incidents like injuries or illnesses, unforeseen circumstances can arise.

Counting solely on South Korea’s health system (or that of many other countries) without any insurance coverage is akin to courting a personal financial catastrophe.

Moreover, bear in mind that several countries, including South Korea, may mandate some form of health or travel insurance as a prerequisite for entry.

And let’s not overlook, travel insurance isn’t restricted to solely medical emergencies. Depending on your policy, it can also offer reimbursement for lost luggage, flight delays, adverse weather conditions, and even aid in arranging your evacuation from a country in the event of civil unrest.

Thus, before you set off on your journey, ensure you’re safeguarded with the appropriate travel insurance plan! It’s a prudent choice that ensures peace of mind throughout your escapades.

Update regarding travel insurance and the coronavirus (COVID-19)

Although Covid-19 hasn’t been completely eradicated, you might be pondering whether your travel insurance will offer coverage if you fall ill.

Thankfully, at this juncture, almost every travel insurance plan on offer does encompass coverage for illness resulting from Covid-19. Nonetheless, I strongly advise thoroughly scrutinizing the specifics of your policy before committing to the purchase. Being well-versed in the precise coverage will afford you the peace of mind necessary for your travels.

(Or for more details, you can also take a look at our article here: Does International Health and Travel Insurance cover Coronavirus (COVID-19)?)

Observation:These travel insurance choices are geared towards tourists, but if you’re traveling to South Korea for educational reasons, it’s essential to investigate an international health insurance plan crafted specifically for international students. Conversely, if you’re bound for the US for employment or as an immigrant, you’ll require a health insurance policy customized for expatriates. You can explore suitable options for these types of coverage towards the conclusion of the article linked here. Ensure you delve into the available selections that perfectly match your travel and residency requirements.

How does the health system in the South Korea work?

South Korea’s healthcare system is characterized by a mixed system that combines elements of public and private financing. Here are some key points on how it works:

1. National Health Insurance (NHI): NHI is the main health insurance system in South Korea. It is mandatory for all residents of the country, including foreigners who have resided in Korea for more than six months. The NHI is funded by contributions from employees, employers and the government.

2. Comprehensive Coverage: NHI offers a wide range of coverage, including doctor visits, hospitalization, laboratory tests, outpatient treatment, surgeries, prescription medications and more.

3. Public and Private Hospitals: South Korea has a mix of public and private hospitals. Public hospitals are run by the government and offer affordable healthcare services. Private hospitals generally provide high-quality healthcare services, but they can be more expensive.

4. Universal Access: South Korea’s healthcare system is based on the principle of universal access, which means that all residents have access to basic healthcare services regardless of their ability to pay.

5. Copayments: Despite the broad coverage offered by NHI, patients often have to pay a portion of the costs of healthcare services, known as copayments. Copayments may vary depending on the type of service and the patient’s income level.

6. Traditional Korean Medicine: In addition to Western medicine, South Korea also values traditional Korean medicine, which includes practices such as acupuncture, herbal medicine, and moxibustion treatments. The South Korean government recognizes and regulates traditional medicine practitioners, and these services are often covered by health insurance.

In summary, South Korea’s healthcare system is known for its comprehensiveness and efficiency, ensuring that all citizens have access to basic healthcare while allowing the private sector to provide high-quality services to those who need it. can pay for them.

What are the best travel insurance options for a trip to South Korea?

As you delve into online research for travel insurance, you’ll encounter a wide range of options.

Nevertheless, I’ve dedicated years to thoroughly researching various travel insurance providers and personally evaluating many of them. The list below comprises the travel insurance options I consistently find myself returning to.

Please keep in mind that the available selections will vary depending on your country of origin and the extent and type of coverage you seek for your trip.

I strongly advise setting aside some time to request quotes from each of these companies for your specific journey. While it may require some effort, the potential savings in the long term make it undeniably worthwhile!

Furthermore, there are travel insurance aggregator websites that enable you to compare and purchase different plans, streamlining the process for efficiency and convenience. Wishing you delightful travels, and may you discover the perfect insurance coverage for your voyage!

1. The well-known, mid-priced travel insurance company:

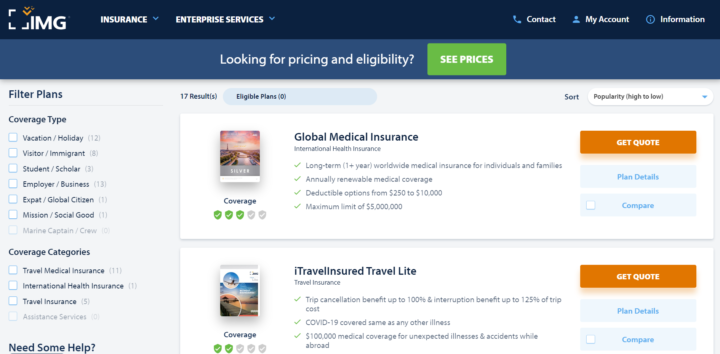

IMG Global (accepts citizens from most countries!)

Absolutely! IMG (International Medical Group) is a reputable American insurance provider offering travel insurance to travelers from more than 190 countries.

This positions IMG as an excellent option to explore when seeking travel insurance for your South Korea trip, regardless of your place of origin!

With their comprehensive coverage and global presence, IMG stands out as a reliable choice for travelers seeking reassurance throughout their travels. Take advantage of the chance to explore their offerings and find the ideal travel insurance plan that fits your requirements, guaranteeing a stress-free adventure in South Korea!

They have one travel insurance plan available for Americans only (Patriot Travel Medical Insurance) and one available for non-American travelers (Patriot America Plus).

You have the flexibility to select your preferred level of coverage, ranging from US$50,000 to US$500,000, with deductible options varying from US$0 to US$2,500.

In terms of pricing, IMG’s rates are generally competitive. However, akin to some other options highlighted here, certain activities may not fall under their policy coverage.

To ensure that you secure all the essential coverage tailored to your specific requirements, I highly recommend meticulously reviewing the policy details before making a final decision. This way, you can embark on your travels with confidence and peace of mind, knowing that your chosen policy provides the comprehensive protection you need. Happy travels!

Travel insurance for seniors (65+): one thing that makes IMG unique is that they offer a travel insurance plan specifically tailored to travelers aged 65 and over, called GlobeHopper Senior.

IMGlobal travel insurance and COVID-19 coverage

In most instances, all IMG plans will include coverage for any medical requirements related to Covid-19, encompassing treatment, hospitalizations, and even medical evacuations.

However, it’s vital to carefully examine your policy before finalizing your purchase to confirm there haven’t been any alterations. By doing so, you can be confident about the extent of Covid-19 coverage provided by your chosen plan. Travel with assurance and peace of mind, knowing you have the essential protection during these unpredictable times!

2. The best, most comprehensive travel insurance company for backpackers and adventurous travelers:

(5% discount coupon comfort5)

I firmly believe that World Nomads stands out as the premier backpacker travel insurance company.

Every time I set out on a journey involving adventurous or “risky” activities such as snowboarding, canyoning, hiking, glacier walking, skydiving, deep-water diving, skiing, climbing, and more, I consistently choose a policy with World Nomads.

Their coverage is exceptionally comprehensive, spanning a wide array of activities. I have yet to come across another insurance company that offers a better deal for ALL the activities covered under World Nomads’ policies. (But if you’ve encountered an alternative, please feel free to share your insights in the comments section below!)

With World Nomads, I have the assurance that I’m fully safeguarded during my daring expeditions and exhilarating adventures.

If you have a particular activity in mind and want to know if it’ll be covered by World Nomads or not, you can take a look at this page here.

In summary, World Nomads offers two types of policies for your consideration. The first is the “Standard” policy, which may suffice even if you have adventurous activities planned. It provides emergency medical coverage for activities like downhill skiing or hiking up to 6,000 meters (nearly 20,000 feet)!

On the flip side, the “Explorer” plan is perfect for more adventurous travelers. It covers a broad range of activities, but it’s crucial to review your plan before purchasing to ensure your specific activities are included.

Additionally, World Nomads offers the option to add coverage for high-value specified items, such as iPhones and digital cameras. This can be a valuable add-on if you’re traveling with expensive electronic gear or visiting regions prone to theft, like Brazil (my home country).

Drawing from my personal experience, I can attest to their attentive and user-friendly customer service team, particularly when I sought reimbursement after falling ill in Thailand.

Lastly, one notable advantage with World Nomads is that you can purchase or extend your travel insurance even after you’ve already commenced your trip. You’re not limited to purchasing it solely from your country of residence. This flexibility makes it convenient for travelers on the move.

You can get a 5% discount code on your World Nomads travel insurance policy by using the coupon code “comfort5″.

(P.S. If you’re anything like me and are also addicted to sports and adventure activities and want to make sure you have good travel insurance that covers them, here are two other articles you might like: 3 Best International Travel Insurance for Extreme Sports and Adventure Activities and 9 Tips to Stay in Shape During Your Travels.)

WorldNomads travel insurance and coronavirus coverage

As of writing this article, World Nomads doesn’t explicitly address whether or not their insurance plans cover Covid-19 treatment. However, you can find their most up-to-date position on the coronavirus on their website here.

3. One of the cheapest travel insurance companies you’ll find anywhere:

WorldTrips (formerly Atlas Travel)

From my experience, travel insurance plans provided by WorldTrips have consistently been among the most budget-friendly options available. However, it’s crucial to note that the lower price may entail some limitations on coverage compared to companies like World Nomads.

For my trips to “safe” destinations, where my main focus is visiting cities, such as the United States or Europe, I typically opt for WorldTrips.

While I’ve previously purchased travel insurance plans from WorldTrips, I’ve been fortunate enough not to require reimbursement, so I cannot personally attest to their reimbursement process. Nonetheless, I’ve come across reviews from other travelers who did need reimbursement, and they reported positive experiences with WorldTrips.

Overall, WorldTrips is an excellent choice for budget-conscious travelers seeking affordable travel insurance. They offer plans of various durations and types, catering to anything from year-long round-the-world backpacking trips to short study abroad programs for university students.

A notable feature of WorldTrips is their flexibility in allowing you to purchase or extend your policy even if you’ve already commenced your trip. So, if you find yourself overseas and in need of coverage, it’s not an issue with WorldTrips.

Moreover, unlike many other insurance companies, WorldTrips imposes no age limit. Although the plan’s price increases with age, they do provide coverage for seniors, rendering them a reliable option for senior travel insurance when few other companies offer this service.

WorldTrips travel insurance and Covid-19 coverage

In many instances, your WorldTrips policy will encompass coverage for any medical expenses arising from Covid-19 illness. Nonetheless, it’s essential to thoroughly review the policy details before making a purchase to confirm you have the most current coverage. This way, you can travel with confidence, knowing you are safeguarded in the event of any Covid-19 related medical requirements.

4. The new international travel insurance company for digital nomads and adventure/extreme sports:

If you’re planning a trip to South Korea, travel insurance is crucial to help you navigate the country’s excellent but often pricey healthcare system.

SafetyWing’s Nomad Insurance Essential plan provides a budget-friendly coverage for medical and travel emergencies, ensuring peace of mind throughout your journey.

Why SafetyWing’s Nomad Insurance Essential plan is great for South Korea:

- Emergency medical coverage: Includes hospital visits, urgent care, and evacuation – perfect for travelers exploring South Korea.

- Family-friendly options: Dependents can be added to your plan, and children under 10 are covered at no extra cost.

- Asia-wide flexibility: Coverage extends beyond South Korea, ideal for trips to nearby destinations in the region.

- User-friendly platform: Signing up, managing your policy, and filing claims is quick and simple.

- 24/7 support: Access customer assistance anytime during your travels.

What to Consider:

- Premium costs: Plans covering global destinations may be more expensive, reflecting higher healthcare costs in certain regions.

- Final pricing: You’ll need to log in to view the complete cost of your policy, including taxes and fees.

For short-term stays or straightforward travel coverage, I recommend the Nomad Insurance Essential plan that provides reliable protection at an affordable price.

One thing that makes SafetyWing stand out is its focus on insurance plans that cover adventure sports and extreme activities. (Like WorldNomads!)

Plus, their website is fun and allows you to easily and quickly get a quote.

SafetyWing travel insurance and Covid-19 coverage

In many instances, your SafetyWing policy will provide coverage for any medical expenses arising from Covid-19 illness. However, it’s vital to meticulously review the specific details of your policy before making a purchase to ensure you have the most current coverage. Staying well-informed about your insurance coverage will afford you peace of mind as you embark on your travels. Happy journeying!

5. The best place to find & compare cheap travel insurance policies:

Unlike the other choices outlined here, VisitorsCoverage operates as a distinct platform that provides a different service. Rather than serving as an insurance company directly, it offers you access to and comparison of travel insurance plans from a variety of different companies, all in one location. This convenient feature empowers you to efficiently examine multiple options and make informed decisions about the travel insurance plan that aligns best with your specific needs. With VisitorsCoverage, you can seamlessly explore a broad array of choices and choose the optimal coverage for your journey. It’s an excellent method for discovering the perfect travel insurance option tailored to your requirements.

It’s a bit like Momondo, which lets you compare plane tickets from different companies. Or Rentalcar.com, which does the same rental cars.

In other words, it makes it much easier to see all your options for travel insurance plans. And then ultimately compare, choose, and buy the best option for your trip.

VisitorsCoverage presents a wide-ranging assortment of insurance plans, addressing needs ranging from business travel insurance to student insurance options.

With a decade of operation, this website caters to citizens from over 175 countries. Furthermore, according to reviews, VisitorsCoverage boasts a resilient and dependable customer service team accessible online seven days a week. This guarantees that travelers can access timely assistance and support whenever required.

Whether your travels are for business purposes or for studying abroad, VisitorsCoverage stands as a reputable platform for exploring and discovering suitable insurance plans tailored to your specific travel requirements. It’s a trustworthy resource for finding the perfect insurance coverage for your journey.

VisitorsCoverage travel insurance and COVID-19 coverage

On the VisitorsCoverage platform, you can conveniently examine the specifics of each individual plan to grasp its Covid-19 coverage. However, it’s essential to note that, similar to the companies mentioned previously, the majority of travel insurance plans nowadays incorporate some level of Covid-19 coverage.

Travel insurance providers have adjusted to the current circumstances, acknowledging the importance of offering protection for travelers amidst the pandemic. While perusing your options on VisitorsCoverage, you can anticipate encountering plans that cater to Covid-19-related medical needs, providing you with added peace of mind during your journeys. It’s a valuable resource for discovering travel insurance plans that prioritize your safety and well-being amid these challenging times.

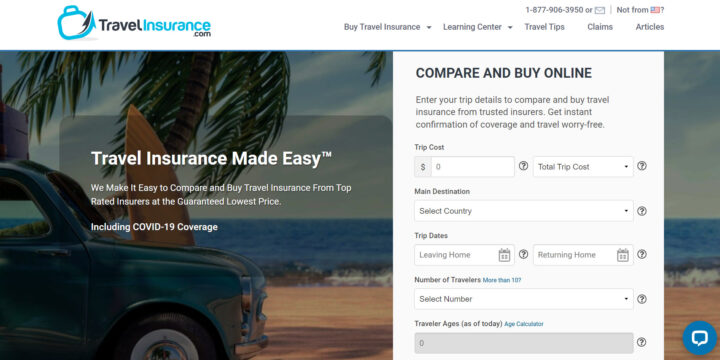

6. Another great website to search for and compare cheap travel insurance policies:

Much like VisitorsCoverage, TravelInsurance.com operates as a travel insurance “portal,” offering the convenience of accessing and comparing various travel insurance plans from multiple companies simultaneously.

To initiate your search, simply provide your personal details and some information about your trip. The platform will then present you with a comprehensive comparison of the available plans, allowing you to filter the options based on ratings and prices. This user-friendly process streamlines the task of finding the most suitable and competitive travel insurance plan for your specific travel needs, all in one location. With TravelInsurance.com, securing the appropriate coverage for your journey becomes effortless and efficient. It’s an excellent tool for simplifying the process of discovering the perfect travel insurance plan for your upcoming trip.

One nice feature of TravelInsurance.com is that, beyond travel insurance, they also offer insurance plans for immigrants, international students, and expatriates.

TravelInsurance.com and coronavirus coverage

When utilizing TravelInsurance.com, you have the opportunity to examine the specifics of each partner insurer’s Covid-19 coverage. However, it’s crucial to recognize that, similar to the companies mentioned earlier, the majority of travel insurance plans nowadays incorporate some form of Covid-19 coverage.

Travel insurance providers have adjusted to the current circumstances, acknowledging the importance of addressing travelers’ needs during the pandemic. While navigating your options on TravelInsurance.com, you can anticipate encountering plans that provide Covid-19-related protection, affording you the necessary peace of mind for your travels. It’s a reassuring resource for finding travel insurance plans that prioritize your safety and well-being in these uncertain times.

7. A final “travel insurance portal” option to search for and compare policies to find the best deal:

AARDY proves to be an invaluable travel insurance “aggregator,” providing the opportunity to explore multiple travel insurance plan options from various companies simultaneously. Describing themselves as the “Amazon” of travel insurance, AARDY offers a user-friendly platform for effortless plan comparison.

What truly distinguishes AARDY is its exceptional customer service, as evidenced by their high scores on TrustPilot.

In addition to their simple search portal that facilitates swift plan comparison, you can also reach out to them anytime via email, support, or live chat. This feature ensures that all your inquiries and concerns are thoroughly addressed before you finalize your insurance policy purchase.

Moreover, it’s noteworthy that AARDY is committed to giving back to the community. They allocate 10% of their annual income to The Special Operations Warrior Foundation, an organization that provides financial aid to the children of military personnel who lost their lives in combat. By selecting AARDY, you not only acquire reliable travel insurance coverage but also contribute to a meaningful cause that supports those in need. It’s an excellent way to discover the right travel insurance plan while also making a positive impact on the lives of others.

AARDY travel insurance and COVID-19 coverage

Since AARDY itself isn’t a travel insurance provider and is only a portal that lets you compare insurance from many companies, you’ll have to look into the individual insurance company before you buy your plan to see what their position is on Covid-19 coverage.

Bonus option to find and compare many different travel insurance plans at once:

Similar to the other travel insurance “portals” or “aggregators” mentioned previously, InsureMyTrip provides a convenient and efficient means to compare travel insurance plans from multiple companies all in one place.

Their platform simplifies the process, enabling you to easily access and review a wide array of options, thereby facilitating the discovery of the perfect travel insurance coverage for your particular needs. With InsureMyTrip, obtaining the right protection for your journey becomes a smooth and straightforward endeavor. It’s a valuable tool for streamlining the process of finding the ideal travel insurance plan for your upcoming trip.

It’s a lot like Momondo, which is an aggregator for airline tickets, or Rentalcar.com, which is an aggregator for car rentals.

InsureMyTrip distinguishes itself with its steadfast commitment to quality. They strictly adhere to a policy of removing any plan or insurance company from their website if it receives less than 4 stars, ensuring that only top-notch options are showcased to users.

Unlike some other options listed here, InsureMyTrip is solely dedicated to travel insurance. Consequently, you won’t find insurance plans tailored for expats, immigrants, or international students on their platform. This specialization enables them to provide a focused and comprehensive service, specifically catering to travelers’ needs and ensuring they receive the best available travel insurance options. It’s a platform that prioritizes excellence and is dedicated to offering the finest travel insurance choices for travelers.

But if you’re looking for a plan like this to complement your travel insurance, check out my article on the 5 Best & Cheapest Health Insurances for International Students or 5 Best International Health Insurances for Expats & Immigrants.

InsureMyTrip travel insurance and Covid-19 coverage

Since InsureMyTrip itself isn’t a travel insurance provider and is only an aggregator that lets you compare insurance from many companies, you’ll have to look into the individual insurance company before you buy your plan to see what their position is on Covid-19 coverage.

But wait….you might not even need to buy travel insurance!

Here are two sneaky ways you might be able to get “free” travel insurance 🙂

1. Buy your return flight ticket with a credit card to (maybe) get free insurance for your trip.

Depending on the type of credit card you possess, purchasing your roundtrip flight with that card might entitle you to a complimentary basic travel insurance plan included in the purchase.

Cards from Visa, Mastercard, American Express, and Diners often provide this benefit. However, it’s crucial to contact your card provider or visit their website to determine whether your card includes this feature and how it operates.

If you’re traveling to Europe, this free basic insurance plan might suffice to meet the mandatory Schengen insurance requirements.

Nevertheless, it’s important to understand that the plan offered by your credit card is more of an international health insurance plan, rather than a comprehensive travel insurance plan.

This entails two key points. Firstly, the coverage will likely be limited to emergency medical care only, and it may not extend to treatments necessitated by sports or “risky” activities.

Secondly, unlike standard travel insurance, you won’t be covered for travel delays, lost baggage, canceled flights, or any other trip-related issues, nor will you be eligible to receive compensation for such incidents. It’s vital to be aware of these limitations and consider supplemental travel insurance if you require broader coverage for your journey. Before making any assumptions, carefully review the terms and coverage of your credit card’s travel insurance offer to know exactly what is included.

Also keep in mind that this won’t work if you’re using miles to buy your plane ticket.* And that the maximum time limit on insurance from these types of credit cards is only 31 days. So if you’re still traveling, you’ll have to buy a regular travel insurance policy to keep yourself covered.

*CORRECTION: As per the valuable comment from blog reader Alex on the Portuguese version of this article, if you possess a Visa Platinum credit card and use the accumulated miles to pay for ticket taxes and fees, you may be eligible for their worldwide travel insurance.

However, I recommend personally verifying this information with your credit card provider since the benefits offered by the same credit cards can vary based on the countries they are issued in. Thank you, Alex, for sharing this insightful tip!

Additionally, thanks to a comment from reader Ana Luisa, I’ve learned that the Visa Platinum insurance typically provides coverage for 60 days, which is longer than the usual 30-day coverage offered by most other credit cards.

Nonetheless, if your trip exceeds this duration, it is advisable to supplement the remaining portion of your journey with a regular travel insurance policy. With the Visa Platinum insurance, you can save some money during the first two months of your trip. Always ensure you have the appropriate coverage for the entire duration of your travels to ensure a worry-free journey. It’s essential to be well-prepared and adequately covered throughout your entire trip.

2. Use your health insurance policy from your home country or country of residence.

Before we conclude, here’s one more potential option for you to consider. It involves checking with your health insurance plan provider in your home country to see if they offer any international travel insurance options.

Since you are already insured with them, you may have the opportunity to obtain cost-effective or even complimentary coverage for your travels abroad. However, it is essential to verify that their insurance will cover the specific destinations you’ll be visiting and all the activities you plan to engage in during your trip.

By exploring this option, you might find a convenient and budget-friendly way to secure the necessary travel insurance for your journey. Remember to review the terms and coverage thoroughly to ensure you have the appropriate protection for your travel needs. Safe and enjoyable travels! It’s always wise to check with your existing health insurance provider as they might have suitable travel insurance options that align with your needs and can save you money on additional coverage.

A quick note about travel insurance for cruising:

Someone recently reached out asking if any of these travel insurance plans could be used for cruise trips, so I did some research.

Based on what I could find, both WorldNomads and WorldTrips will cover you on a cruise.

WorldTrips has confirmed via email that their Atlas plan provides coverage for medical evacuation from a cruise ship if required, depending on the circumstances.

It appears that all travel insurance plans offered by WorldNomads also extend coverage to cruisers. However, please bear in mind that there is an age limit of 66 for their plans. On the other hand, WorldTrips has the advantage of not having any age limit for their coverage, making it an appealing option for older travelers.

As for the other companies mentioned, I am still awaiting confirmation from them regarding their coverage for cruisers. It’s always prudent to obtain clear and detailed information about your travel insurance options before making a decision. Safe travels, and I hope you find the perfect plan for your journey! It’s crucial to have a comprehensive understanding of your travel insurance coverage, especially when embarking on a cruise trip. Always verify the specifics with the insurance providers to ensure you have the appropriate protection throughout your cruise journey.

Fraud Warning! As mentioned earlier, both WorldNomads and WorldTrips offer the flexibility of purchasing travel insurance even after you’ve begun your trip. However, it’s crucial to be cautious about potential fraudulent practices.

It’s important to understand that buying travel insurance after you’ve fallen ill or experienced an accident, in the hope of obtaining coverage for that specific incident, is not permissible. Insurance companies are aware of this possibility, and most policies contain an “anti-fraud” clause to prevent such actions. According to this clause, you can only utilize your insurance policy 48 hours after its purchase.

For instance, if you become seriously ill during your trip and decide to buy travel insurance then to cover your medical treatment, you’ll have to wait for 48 hours before your policy becomes valid for reimbursement. Furthermore, you’ll need to provide evidence to your insurance provider that the illness occurred after you purchased the policy.

However, in the case of an accident, you can use your insurance within the 48-hour window. Nevertheless, you must be able to demonstrate that the accident took place after you acquired your travel insurance plan.

To reiterate, attempting to deceive insurance companies by purchasing a policy and then swiftly seeking reimbursement for a pre-existing condition or recent incident is not a viable strategy. Insurance companies employ measures to investigate such situations and ensure they are not being deceived. So, it’s imperative to adhere to the guidelines and use travel insurance responsibly and honestly to guarantee appropriate coverage for your travels. Travel insurance is designed to protect against unforeseen incidents, not to provide coverage for pre-existing conditions or incidents that occurred before obtaining the policy.

Can I use traveling insurance while living abroad as an expat or an immigrant?

If you’re living overseas or traveling in a country for a short period, you might be okay with just travel insurance.

But you’re looking for more complete coverage (travel insurance usually just covers medical emergencies), if you’re going to be living abroad long-term, or if you need proof of health insurance for immigration purposes, then what you actually need is an international health insurance plan for expats or immigrants.

If you’d like to learn more about the differences between travel insurance and international health insurance, then you can take a look at our article about the 3 Best International Health Insurance for Expats & Immigrants.

Or, you can quote directly with some of these expat insurance companies here:

Can I use travel insurance during my international exchange or while studying abroad?

In summary, whether you need a separate insurance plan for your study abroad depends on your specific circumstances. My advice is to first verify with your school or university. Generally, if your course or program lasts for less than 3 months, and you’ll be studying on a tourist visa, a travel insurance policy should be sufficient for your needs.

However, it’s essential to confirm this information with your educational institution to ensure you have the appropriate insurance coverage during your study period. Always check with your school or university to understand their insurance requirements for study abroad programs, as they may have specific guidelines and recommendations to ensure you have the necessary coverage while studying abroad.

However, if you’ll be needing a student visa, then you’re going to need a health insurance plan that’s designed just for international students or exchanges.

This is particularly crucial if you’re traveling to the United States with a J1, J2, or F1 visa, or to Europe with a Schengen student visa. In such cases, having the appropriate insurance coverage is vital to meet the specific requirements of these visas and ensure a smooth and hassle-free study abroad experience. It’s essential to be well-prepared and have the right insurance in place to comply with the visa regulations of your study destination, as this can impact your eligibility and experience while studying abroad.

If you’re an international student and think you might need one of these special medical insurance plans, then take a look at my page with The 3 Best and Cheapest Health Insurances for International Students & Exchanges to learn more.

Again, you can check out directly some of these international student insurance companies here:

Cigna for International Students

International travel insurance coverage for terrorism

I’ve had a few comments in both the English and the Portuguese article asking if travel insurance covers acts of terrorism.

I did a bit of research, and here’s what I found out:

Although WorldTrip’s basic travel insurance plan doesn’t cover terrorism, their Atlas Premium plan DOES cover “treatment of injuries and illnesses relating from an act of terrorism, up to the limit set forth in the schedule of benefits and limits.” So yes, they do appear to have terrorism coverage.

If you ever find yourself in the unfortunate situation of being injured in a terrorist event while traveling, having WorldTrip’s Atlas Premium plan can provide essential coverage. This plan is designed to offer protection during unforeseen circumstances, providing you with a crucial safety net during challenging times.

Additionally, many of WorldTrip’s plans include a valuable “Crisis Response Cover,” which extends protection in the event of civil or political unrest, natural disasters, or other crises that travelers may encounter abroad. This comprehensive coverage even includes scenarios of “express kidnapping,” covering response expenses, ransom, and personal belongings surrendered.

It’s worth noting that while the “Crisis Response” feature is highly beneficial, it may not be available in certain countries. These countries include Iraq, Afghanistan, Pakistan, Nigeria, Somalia, Venezuela, Iran, Cuba, Sudan, and North Korea. However, in most of these countries, your regular travel insurance coverage will still remain valid, minus the specific “crisis” aspect of the coverage.

As always, carefully review the terms and conditions of your insurance policy to fully comprehend the extent of coverage and any limitations concerning your travel destination. Travel insurance serves as a vital safeguard, offering peace of mind and security throughout your journeys. WorldTrip’s Atlas Premium plan provides valuable protection during unforeseen events, and their Crisis Response Cover adds an extra layer of security for travelers facing challenging situations while abroad. Be sure to check the availability of the Crisis Response feature in your intended travel destination and have a comprehensive understanding of your coverage to travel with confidence and peace of mind.

General tips to help you get back your travel insurance reimbursement

All the travel insurance companies I recommended above have extensive networks of hospitals, clinics, and doctors. The best approach is to seek treatment at one of these in-network facilities.

By doing so, you won’t be required to pay anything out of pocket, as the treatment bill will be directly submitted to the insurer for payment (unless the treatment surpasses the maximum coverage amount).

For this reason, in the event of any unexpected circumstances such as illness or an accident, it is crucial to promptly contact your travel insurance provider. They will guide you on which in-network doctor or hospital to visit for seeking treatment.

In situations where accessing an in-network medical provider is not possible, you’ll have to pay for the treatment upfront and then apply for reimbursement from the insurance company later on.

As you may know, dealing with insurance companies, whether for cars, homes, health, or travel, can be a bit challenging, and they often require precise documentation before releasing payments.

To assist you in the process, here’s a list of the documents that travel insurance companies typically request when you file a claim to seek reimbursement for medical expenses incurred during your trip: [List of required documents]. Providing the necessary documentation in a well-organized manner can expedite the reimbursement process and ensure a smoother experience with the insurance company.

But first, a few insurance terms to cover:

*make a claim: ask an insurance company for reimbursement for medical expenses

*insurer: the travel insurance company

*beneficiary = claimant = the insured: the person (you) who is asking the insurance company for money/reimbursement

List of documents usually requested by travel insurance policies when you seek reimbursement for medical expenses (if you were treated by an out-of-network provider):

- Copy of the claimant’s national ID (driver’s license or other state-issued ID)

- Copy of Proof of Residency (any current proof – from the last 3 months – with the name of the claimant). If you don’t have this, send a declaration of residence that is completed, signed, and notarized by the insurer.

- For minors, a declaration of residence must be completed, signed, and notarized by the respective legal guardian (form provided by the insurer)

- Copy of the claimant’s voucher

- Original registration information form, signed by the beneficiary (form provided by the insurer)

- Copy of passport (ID page + page with entrance and exit stamps from the country where the accident happened) or other documentation that shows beneficiary was outside of habitual domicile when an accident happened (aka your home country) – for example: airplane tickets (by the way, you should always keep your boarding pass until the end of your trip, not only for filing a possible claim but also request your miles!)

- Presentation of the original medical report with descriptions of the procedures, provided by the health professional or medical center with a clear indication of the diagnosis, clinical history, and admission form, in the case of hospitalization

- Original prescription (if the pharmacy still has the prescription, send your x-ray or a document showing you picked up your medicine in exchange for the prescription)

- Invoice of the medical procedures or the pharmacy receipt with medications prescribed, which should match the quality and quantity of the provided prescription

- Report of medical care (explaining the reason, what happened and how the treatment went – both from the travel insurance staff as well the health providers), written by the beneficiary

- A completed list of expenses (form provided by the insurer)

- Your contact phone number, address, and e-mail

- Proof of bank info (copy of bank statement header, check, or debit card)

And here’s the worst part – you’ll likely have to send all of these documents physically by mail!

I understand; it’s an enormous hassle. That’s why it’s so much simpler if you can receive treatment from a medical provider within your insurance company’s network. This way, you can avoid the wasted time and headaches of preparing all the paperwork.

However, if you find yourself with no other option, going through the reimbursement process isn’t the end of the world. With a bit of organization and ensuring that you have all the required documents in order, your chances of successfully filing your claim and receiving a prompt reimbursement are quite promising!

If you’ve had to make a claim before, please share your experience and any helpful tips in the comments section below to assist other readers. Your insights can be valuable in navigating the claims process and ensuring a smoother experience for others.

To summarize, these as the best travel insurance companies for the South Korea:

- IMGlobal

- World Nomads Travel Insurance

- WorldTrips

- SafetyWing

- VisitorsCoverage

- TravelInsurance.com

- AARDY

- InsureMyTrip

My final advice: Seriously, don’t forget to purchase travel insurance before your trip! If you’re already traveling and haven’t bought insurance, do it as soon as possible. And if you’ve already bought a policy but need to extend it (which WorldNomads and WorldTrips allow), make sure to do so before it expires.

This way, you’ll have the peace of mind of knowing you’re covered for the entirety of your trip to South Korea.

Now, it’s your turn. Have you had any experiences with travel insurance? Have you ever needed to use your policy? If so, which company did you use, and how was the claims process? Or do you still have any questions about travel insurance in general?

Share your thoughts in the comments section below, and I’ll be sure to respond!

Wishing you safe and happy travels! (And let’s hope you never have to use that travel insurance plan you just purchased!)