If you’re going to be an international student in France, did you know that most schools will require you to have health insurance to enroll? So, what are your best options if you’re just doing a short course? Or what if you need a policy that’s longer than a year? Take a look at the article below for all the answers!

Health insurance is one detail that students often forget about if they’re going to be studying abroad in France. But it’s very important to guarantee your stay overseas is smooth and safe. Plus, you’ll likely need to show proof of medical coverage to enroll in your course!

Thinking about it, I’ve separated out the best insurance options for students in France, alongside information about student visas, most common courses, and the french health system.

Check it out!

Why do international students in France need health insurance?

The biggest reason to get health insurance is to make sure that you’re covered in case you need any medical care in your new country of residence.

But in the case of France specifically, not all students can use the public health system. And without insurance, even basic healthcare can be really expensive.

However, this is nothing new for anyone, right? In addition to this reason, there are others that I consider relevant that I will explain below.

To be eligible for France’s national health insurance plan, you must meet the following requirements:

- Under 28s as of October 1 of the current college year

- Enrolled in a degree program for a period of at least 4 months or more

- Have a country of origin that is outside the European Union or Switzerland

If you do not meet these provisions, you must purchase private health insurance.

The right international student insurance plan for you is dictated by how long you will be studying in France, whether you will need a visa (and, if so, what insurance requirements you need to meet), whether you will be eligible for the system national health system in France, as well as your personal situation and choices.

And all this brings us to the next point…

What student health insurance is required for a student visa in France?

Health insurance is mandatory to study in France.

Non-European Union nationals (third country nationals)

Students from third countries are those whose nationality is not from the European Union or the European Economic Area.

Students under the age of 28 who study in France for at least 4 months can register for French social security. But for a stay of less than 4 months, private health insurance is required.

Students over the age of 28 studying in France for at least 4 months or more can apply (without the certainty of approval) to register with the French social security system. If your application is not approved, private health insurance will be required.

Medical and private assistance coverage during your stay in France is also highly recommended if you are enrolled in French social security for the following reasons:

1. to obtain a travel visa for France

2. to cover medical costs until you are enrolled in social security in France

3. for being covered under all assistance benefits required during your stay in France

European Union citizens

Students with nationality from EU countries can apply for the European Health Insurance Card (CESD) in their home country. Thanks to this card, EU/EEA citizens can benefit from the same coverage as the French health fund.

However, CESD is not an alternative to travel insurance. It does not cover any travel protection, search and rescue, repatriation to the country of origin, emergency dental treatment, assistance… Private insurance is highly recommended in France also for EU citizens throughout their stay in France.

To learn more about the types of courses you can study in France and the visas required, continue reading the article after the list of the best international health insurance for international students in France.

As always, I recommend you to get a quick online quote with all the companies I suggest here. It might take a bit of time, but you can ended up saving quite a bit of money at the end of the day!

The 5 Best and Cheapest Health Insurance for International Students in France

1. International Student Health Insurance by IMG

IMGlobal offers a variety of insurance plans for students (as well as insurance plans for expats more generally).

They offer three different insurance plans specifically made for students. But since one of them is just for students studying abroad in the United States (The Patriot Exchange Program), we’ll just talk about two of them here.

Plan #1: Student Health Advantage

This program should be enough to meet any requirements your school has for health coverage (though do make sure you check the minimum coverage required by your school first!).

This particular plan covers a lot of things that many others don’t – including mental health disorders, maternity care, and pre-existing conditions. IMG also covers COVID-19 like any other illness and injury that are subject to the terms and conditions of the policy.

Plan #2: Student Health Advantage Platinum

This plan is the same as the one above but offers double the maximum coverage: $1,000,000

What I like about IMG’s International Student Insurance:

- These plans are designed specifically for students

- They cover students of all nationalities

- They have more than 17,000 healthcare providers for you to choose from around the world

- Their have 24/7 customer service

- They cover COVID-19 and telemedicine consultations

What I don’t like about IMG’s International Student Insurance:

- For some of their plans, there is a 1-year waiting period for pre-existing condition coverage

2. International Health Insurance for Cigna Global Students

Cigna Global, one of the largest health insurance companies in the world, offers plans for travelers, expats, and (of course!) international students.

They offer 3 main plans: Silver, Gold and Platinum. These plans will cover you not just in France, but in the entire world! And if you have plans to visit the United States during your stay in France, you can choose to be covered there as well (though this will make your policy a bit more expensive, so it may be better to just get a short travel insurance policy for your visit to the U.S.).

Here’s a table comparing your plan options:

Cigna plans are really flexible and let you add on whatever you need (including things like dental and eye treatments or International evacuation and crisis assistance).

The company also has a flexible payment policy and offers several options such as annual, monthly and quarterly payments.

What I like about International Health Insurance for Cigna Global Students:

- They respond to claims quickly (according to the company, 95% of refund requests are received within 10 days)

- Their online help center gives you access to a list of more than 3,000 hospitals plus information guides

- They are partnered with more than 1.65 million hospitals, doctors, clinics, and specialists around the world (giving you plenty of options to choose from if you need medical care)

- They have 24/7 assistance to answer any of your questions

What I don’t like about the International Health Insurance for Cigna Global Students:

- Their most basic plan does not cover prenatal and postnatal care

- They don’t include coverage for outpatient consultations with specialists and doctors

Now Health International is at the forefront of the international insurance market, with a primary focus on providing efficient and affordable plans to satisfy its clients.

As a result, one of the major advantages of this company lies in its advanced customer service, which offers rapid and practical information delivery.

All the insurance plans offered by Now Health are specifically designed to cater to and resolve the challenges faced by expatriates residing in foreign countries, including international and exchange students worldwide.

Additionally, these plans are completely customizable, ensuring a perfect fit for all your individual needs.

What I like about Now Health International Student Plans:

- Clear information and 24/7 customer service

- Coverage in over 190 countries and territories

- Various international insurance options and customizable plans

- Some plans offer coverage for maternity routines

What I don’t like about Now Health International Student Plans:

- In some procedures, Now Health works with a reimbursement system

- For plans with routine maternity coverage, you must wait a 12-month waiting period to access this benefit

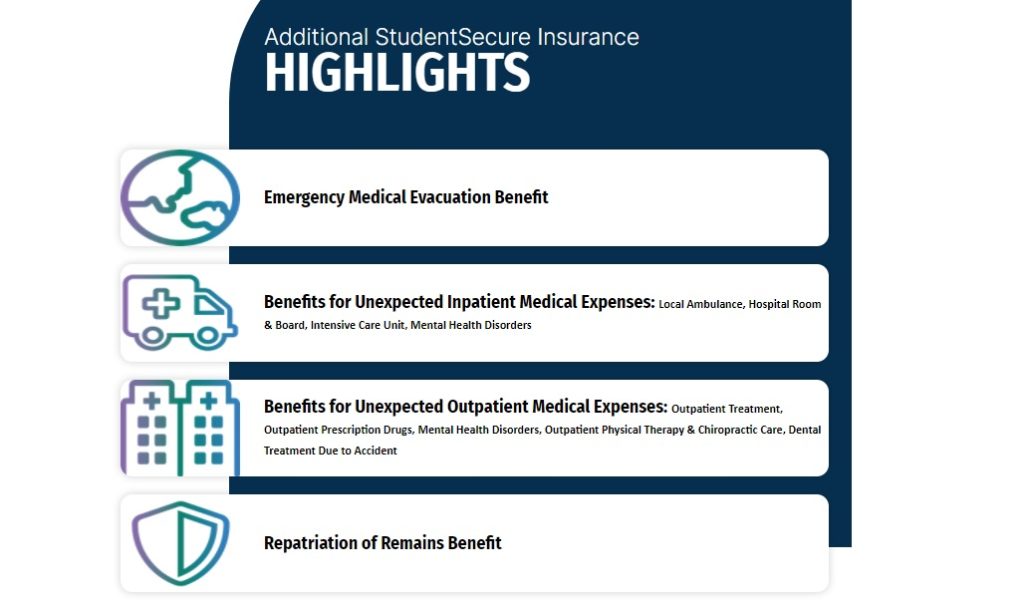

4. WorldTrips

WorldTrips is another provider that offers insurance for full-time students and scholars studying away from home (alongside the usual travel insurance offerings).

These are the 4 levels of student health insurance coverage they offer (all of which work great for France!):

StudentSecure Elite

- Offers the lowest deductibles and the highest maximum coverage

- 6-month waiting period before a pre-existing condition can be covered

- Offers sports coverage for club/intramural/intercollegiate sports

- Covers personal liability

StudentSecure Select

- 6-month waiting period before a pre-existing condition can be covered

- Optional Crisis Response rider for ransom, your personal belongings, and crisis fees

StudentSecure Budget

- Pre-existing condition coverage begins 12 months after purchasing the insurance

- Mid-level benefits & higher deductible (for a lower monthly rate overall)

StudentSecure Smart

- Lowest cost plan (with the lowest benefits to match)

- Highest deductibles of all the plans

- Doesn’t cover club sports

- Can only cover a pre-existing condition on its acute onset

Here is a comparison of the 4 HCC StudentSecure plans (click to see full chart):

What I like about HCCMIS’ StudentSecure plans:

- They offer emergency dental care (in case of an accident) up to $250 maximum per tooth and $500 maximum in the certificate period

- They offer a savings plan if you pay your full premium in advance

- They are some of the most budget-friendly plans on this list

What I don’t like about the HCCMIS’ StudentSecure plans:

- There is no coverage for pre-existing conditions in their Smart plan

- There is a 6-month waiting period for pre-existing condition coverage (even in their Elite plan)

- There is no coverage for vaccinations unless you get the Elite plan

- There is no coverage for maternity and nursery care for newborns in the Smart plan

- Their lower-cost plans can have high deductibles

Visitor Coverage, founded in 2006 in the United States, aims to simplify the choice of travel insurance, providing affordable and personalized options for tourists, students, expats and immigrants.

Through a practical and easy-to-navigate platform, travelers can compare different insurance options by providing some basic information about their trip. Although the company does not offer its own insurance, it works as an intermediary, connecting customers with renowned insurers, ensuring security in emergencies.

For international students, for example, simply enter the destination country, age and nationality. Based on this information, the platform suggests the best options, indicating values, items covered, possibility of cancellation, extension of coverage and additional benefits. In addition, it is possible to consult the ratings and complete details about each partner insurer.

What I like about Visitor Coverage student insurance:

- You can view and compare the most popular travel insurance policies on the market

- It provides detailed information from several insurance companies

- Practical and easy-to-use website

- It offers options for each traveler’s profile and at different prices

- Student support 24 hours a day, 7 days a week

- More than 18 years of experience in the market and more than 1 million customers around the world

What I don’t like about Visitor Coverage student insurance:

- There is no Visitor Coverage insurance policy

- Your exchange must last from 30 days to a maximum of 1 year

- It does not cover the following destinations: Belarus, Cuba, Iran, Israel, Lebanon, Mayotte, North Korea, Russia, Syria and Ukraine

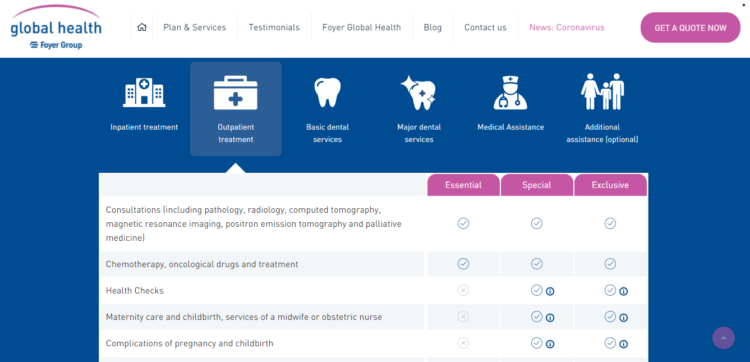

Basic or Premium? Short- or long-term stay in France? Alone or with the family? Regardless of what you need, you can find a plan with Foyer Global Health that works for you.

The company has 3 different plans. Here’s a quick snapshot at what each of these plans includes:

ESSENCIAL

- Consultations, surgery, and anesthetics

- Therapeutic devices (such as cardiac pacemakers) if necessary as a rescue measure

- Congenital diseases (up to a maximum of € 100,000 per life)

- Does not cover maternity and childbirth care

SPECIAL

- Consultations, surgery, and anesthetics

- Therapeutic aids and devices (such as artificial limbs and prosthetics) up to € 2,000

- Congenital diseases up to a maximum of € 150,000 per life

- Maternity and childbirth care (up to € 5,000 with a 10-month waiting period)

EXCLUSIVE

- Consultations, surgery, and anesthetics

- Unlimited therapeutic devices and devices

- Congenital diseases up to a maximum of € 200,000 per life

- Maternity care, childbirth care, and midwife or nurse services at the hospital (up to € 20,000 with a 10-month waiting period)

What I like about Foyer Global Health plans:

- All their plans include consultations, surgeries, and basic dental treatments

- They have 24-hour customer service by phone and email with experienced advisers, doctors, and specialists

- They offer evacuation and repatriation service

- They offer medical support and pre-trip advice (vaccinations, preparation of a first aid kit)

What I don’t like about the Foyer Global Health plans:

- Their most basic plan does not cover prenatal and postnatal care

7. Diplomat Long Term and Diplomat International from Global Underwriters

Global Underwriters offers international health insurance plans for a wide range of travelers, including exchange students and study abroad students.

When it comes to GU’s plans, I recommend Diplomat Long Term and Diplomat International for international students in France.

What I like about Global Underwriters plans:

- Their student plans have coverage for medical evacuations, emergency dentistry, and repatriation of remains

- The Diplomat Long Term and Diplomat International plans offer coverage up to $1,000,000

- They offer coverage and assistance in case of lost luggage and travel interruptions

- They have 24/7 customer service

What I don’t like about the Global Underwriters plans:

- Their Diplomat International plan does not cover Covid-19

- The Diplomat Long Term plan does not serve students residing in Australia and Iran, as well as New York, Maryland, South Dakota (though this won’t be a problem for you if you’ve changed your residency to France!)

- Their plans can be a bit more pricey than the others on this list

2 International Health Insurance Companies That Can Also Be Used by International Students in France

The two final companies I’ll list below don’t offer health insurance specifically for students abroad. That said, they do offer international health insurance that will (most likely) be accepted by your school or university as proof of coverage.

So here’s my advice to you: get a quote for these two companies below and compare it to the quote you get from the companies listed above. If you find that either of these two companies offers good coverage at a lower price than the other options, check in with your Canadian school or university if they accept this type of policy.

If so, this is a great chance to save money before venturing to your new home!

– Geoblue

Geoblue is another great option if you’re looking for a health insurance policy to cover you while you study overseas in France.

What I like about Geoblue’s international health insurance:

- Their plans are very adaptable and flexible based on exactly what you need

- They have 24/7 customer service

- Some of their plans cover extras like evacuation, preventative medical appointments, and maternity care

- You can add on ophthalmology and dentistry care

- Their Xplorer plan has no maximum for medical coverage, covers extreme sports, doesn’t charge deductibles for standard services, and doesn’t have cancellation fees

What I don’t like about Geoblue’s international health insurance:

- They don’t serve residents of New York and Washington (though this may not be a problem if you change your official residence to France!)

- You have to contact an insurance broker and speak to them personally to get an exact quote (which is pretty annoying)

– Aetna (acquired by Allianz)

Aetna is a well-known company in the field of health insurance.

One nice advantage of Aetna is that their plans are really flexible (you can customize based on whatever you need covered), and they have quite good customer service (as far as insurance companies goes, that is).

What I like about Aetna’s international health insurance:

- They’ve been in the health insurance industry for 5 decades

- They offer flexible and tailored plans

- They have 24/7 specialized service

- Most of their plans offer coverage for emergency evacuations, cancer treatments, repatriation, and hospitalizations

- They are an insurance company who has won awards such as as “Health Insurer of the Year” and “Best International Private Health Insurance Provider”

- They have an app that encourages clients to maintain healthier habits with a points and awards system

What I don’t like about Aetna’s international health insurance:

- Their website is not very clear about the exact coverage for some of their plans

- They don’t offer any kind of travel insurance plans

Table comparison of the 7 best health insurance plans for international/exchange students in France

Cigna Global Cigna Global |

|

|

|

||

| Medical Maximum | Unlimited (for the Platinum plan) | $5,000,000 | There are no limits independent of the plan | US$1,000,000 per year | $1,000,000 |

| Mental Health Benefit | Unspecified | Unlimited for up to 90 days | Included in all plans with a 10-month waiting period | Outpatient: $50 per day max up to $500 in total | Yes |

| Inpatient Prescription Drugs | 80% coverage out-of-network, 100% in the USA and internationally | Unspecified | Coverage available | Name-brand drugs: 50% coinsurance

Generic drugs: 100% coinsurance Special drugs: no coverage |

Yes |

| Outpatient Prescription Drugs | 50% of actual costs, 90 days maximum per dispensation | Unspecified | Unspecified | coinsurance

Generic drugs: 100% coinsurance Special drugs: no coverage |

Yes |

| Mental Health Benefit | Inpatient and Outpatient: $5,000 lifetime maximum to paid in full depending on the plan | Inpatient and Outpatient: $50,000 lifetime maximum | None | Inpatient and Outpatient: limit not specified | Inpatient, outpatient, and therapy: limit not specific |

| Outpatient Prescription Drugs | None, unless you buy the International Outpatient Option | Up to $8,000,000 | Full reimbursement | Yes | Yes |

| Repatriation of Remains | $25,000 maximum or $5,000 for cremation | Optional | Optional | $50,000 maximum or $5,000 for cremation | $13,500 maximum |

| Emergency Evacuation | $50,000 | Optional | Optional | $10,000 | Yes |

| Hospital room coverage | Offered up to the average semi-private room rate | Private room | Private Room | Usual | Usual |

| Terrorism | $50,000 | Unspecified | Unspecified | $100,000 | N/A |

| Accidental Death & Dismemberment (AD & D) | Principal sum of $25,000 that is not subject to deduction | $25,000 for main policy holder, $10,000 for spouse on the plan, $5,000 for child on the plan

Total limit of $250,000 |

Optional | $25,000 for main policy holder, $10,000 for spouse on the plan, $5,000 for child on the plan

Total limit of $250,000 |

There is coverage |

| Emergency Dental | $500 per injury for the coverage period | Optional | Optional | $2,500 | Yes |

| Maternity Care | Only covered in Platinum plan | $14,000/€11,000/£9,000 in the Platinum plan | Only available in the Special and Exclusive plans | Within the US: up to 80% coverage with a $25,000 limit within the PPO network/Outside PPO: up to 50% coverage with a $25,000 limit

Outside the United States: Up to 80% coverage with a $25,000 limit. Benefits reduced by 25% if pregnancy is not reported within the first 90 days. |

Not specified |

| Pre-existing condition exclusion period | Maximum limit of $1,500 with a 12-month waiting period | $14,000/€11,000/£9,000 in the Platinum plan | Coverage available | Limited of $250,000 per plan | Unspecified |

| Intensive Care Unit (ICU) | 100% coverage after the deductible has been met | Full coverage with the Platinum plan | Coverage available | Up to $50,000 | Not specified |

| Vaccines | Unspecified | Optional | Only in the Special and Exclusive plans | $200 | Yes, but must be paid as a separate plan |

| Routine care for newborns | Unspecified | Optional | Only in the Special and Exclusive plans | Up to $750 | Yes, but must be paid as a separate plan |

| Pre-existing annual maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Full reimbursement | Unlimited depending on the plan | Depends on the plan |

| Pre-existing lifetime maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Full reimbursement | Unlimited depending on the plan | Depends on the plan |

Worldwide Medical Insurance / Comparison Chart*

Part of the table courtesy of Tokio Marine HCC

*Note: this table is just for informational purposes and subject to change. It was accurate as of the time we wrote it here, but please check each company’s individual website for updated info.

Types of courses that foreign students can take in France

Now that you know all about the best health insurance companies for students in France, you probably also have an idea in mind of what type of course you plan to do in the country.

But if not, here’s a list of the 3 most common courses that international students do in France.

- Language courses

As with the United States, Ireland, and Australia, France is also a popular destination for anyone looking to do a language course.

The length of a language course in France can range anywhere from 1 month to 1 year.

- College courses

For anyone who’d like to do a college degree overseas, France is a great option. Your time studying can vary anywhere from 1 to 5 years. And in some cases, it’s even possible to work at the same time.

If you are interested in this option, you can find university courses in just about anything – Gastronomy, Engineering, History, etc.

- PhDs, specialized degrees, or MBAs

If you’re looking for professional development, these 3 types of programs are good options.

Naturally, the duration of these programs can vary. In some cases, it’s possible to work while you’re studying.

What are the types of visas to study in France?

For non-EU students studying in France, the main visa categories are:

1. Schengen visa

Covering stays of less than 90 days, Schengen visas require insurance coverage valid in France of at least €37,500. If you would like more information about this Schengen Visa and its insurance requirements, please visit our Schengen Visa Insurance page for more information and advice.

2. Long-Term Student Visa over 28 years old

For students over 28 years of age and planning to stay longer than 90 days. You will be required to present proof of valid private health insurance in France as part of the visa application.

3. Long-Term Student Visa under the age of 28

For students under the age of 28 who plan to stay in France for more than 90 days, you may be eligible for the social health system in France depending on which school they attend and, if eligible, 70% of most healthcare costs will be covered. In this case, it is recommended that you purchase a supplemental insurance plan that can cover any remaining costs that are not covered by the healthcare system when you are residing in France.

In sum…

Once again, here are the 5 best and cheapest health insurance policies for international students in France:

- Student Health Advantage from IMG

- International student health insurance from Cigna Global

- Now Health International

- StudentSecure from HCCMIS

- Foyer Global Health

In conclusion…

Altogether…as you prepare for your time as an international student in France, make sure health insurance isn’t one detail you forget about.

After all, you may not be able to enroll in school without it…and you don’t want to get stuck paying out-of-pocket for medical expenses!

If you still have any doubts about these travel insurance options for students in France (or about moving abroad in general), let me know in the comments area below and I’ll be happy to help!