Are you thinking of changing your life and going to live in Spain? Want to know how to make sure you have good health coverage in your new country? Especially since having insurance is often a requirement to get your Spanish visa? Keep reading for all you need to know to protect your health and safety in case of emergencies!

There are a lot of things you need to take care of when moving to a new country – finding a job, looking for a place to live, buying your plane tickets, figuring out how visas and residency permits work, learning a new language…

But one point that is often forgotten about is making sure you have health insurance.

Although Spain has a great public health structure that’s well-funded by the government, as an expat you are required by law to have health insurance in order to get your visa (and that’s exactly what the list of health insurance plans and international health insurance companies below can help you with).

But beyond talking about your options for health insurance as an expat in Spain, we’ll first talk a bit about how the Spanish health system is structured, what the difference is between travel insurance and expat insurance, what types of plan coverage you can choose from, and more.

(And be sure to stay on until the end of the article to get some details on the different types of visas you can apply for to begin living, studying, and working in Spain!)

How does the Spanish health system work?

No matter where you move to, you’re going to want to know how the health system works. Especially if you’re living in a place like Spain, which is considered one of the best and most accessible systems in the world.

The Spanish health system is a mixture of free-to-the-citizens public infrastructure, and private. The health services are financed in part by the social security that Spanish workers pay, and will cover the grand majority of any service you may need.

That said, it’s not totally free all the time. You, as an immigrant without citizenship, are free to use their high-quality public health services. But you’ll have to pay. And if you don’t speak Spanish, it can be a challenge to find people who speak English in public hospitals or health centers.

That’s one reason why many expats or non-citizens who live in Spain choose to get private insurance (where it’s much easier to find English-speaking care).

But if you would prefer to use the public system, even if you don’t meet the criteria for free access to the free public system, you can apply for the “Convenio Especial.” In which case, you’d pay 60 euros per month or 157 euros per month if you’re over 65. To apply, you have to fill out form TA-0040 and submit it to your local Social Security office.

Do I really need to get health insurance if I’m an expat living in Spain?

Well, there’s an easy answer here. If you’re an expat, you’ll be required to show proof of health insurance to get your visa. So yes, you definitely do need to have health insurance if you’re moving to Spain!

So if you want your visa to be approved, then make sure you get coverage like one of those I’ll talk about on the list below 🙂

But beyond that, having a health insurance policy can give you a lot of peace of mind. Staying in a new country with laws, structures, and even a language different from your own can be a challenge. So any steps you take that can ease your transition (such as making sure you have a good health insurance policy) can help.

And, of course, having a health insurance plan will make sure you’re covered if you run into any emergencies or other unexpected situations. And as you’ll see in the next section, there are a few other nice benefits to getting international health insurance.

As an expat in Spain, should I get an international health insurance plan such as the list below? Or should I get a Spanish health insurance plan?

Well, this is ultimately a personal decision that should depend exactly on your specific medical needs, the coverage you require, the length of your stay in Spain, and the options available for national plans.

Either an international health insurance plan or a public plan can meet your requirements for coverage in Spain. But if you do choose to get an international plan, double-check with your local Spanish embassy to see if it meets the minimum coverage requirements.

I’ve never lived in Spain so I can’t speak on the options for national plans, but I can confirm that the companies mentioned below can get you a plan that meets most of your needs.

With this in mind, here are a few additional reasons that you may want to choose an international health insurance plan instead of finding public coverage:

- The monthly cost of an international health insurance plan may be cheaper

- International health insurance is much cheaper to find if you only have a short stay in the country (not to mention it’s also a requirement for travelers to get their visas!)

- International health insurance is more flexible as you can easily renew, extend, or cancel your policy at any time (which is rarely something you can do with a public insurance plan)

- An international health insurance plan will also offer you coverage in other countries, not just in Spain (that’s why they are called “international” plans)

Who can be covered by an international insurance plan?

The health insurance companies that I’ll list below have plans that work for citizens of the following countries that live in Spain as expats, immigrants, workers, or even students:

- Americans

- Canadians

- Australians

- Brazilians

- Citizens of the European Union (Portuguese, French, German, Dutch, Polish, Belgian, Swedish)

- Argentinians

- British (English, Scottish, Welsh, Irish)

- Kiwis/New Zealanders

- And for citizens of almost any other country

Beyond expats/immigrants that reside in Spain, plans from these companies also work for those who reside in:

- The United States

- Canada

- Europe (the European Union or the United Kingdom)

- Japan

- Australia

- And for expats that live in just about any other country in the world

In general, since these are international companies and insurance plans, they can be used by just about any person anywhere in the world since they have global coverage!

Why can’t I just get a travel insurance policy for my move to Spain? What is the difference between travel insurance and expat insurance?

Travel insurance is important for any trip. Not just because it’ll cover you in case of unexpected emergencies or medical problems, but also for travel-related issues like lost baggage or canceled flights.

However, it’s important to know that travel insurance is not the best choice for expats. Although it is possible to get a long-term travel insurance plan, these are made for travelers with temporary stays. They aren’t valid for long-term stays in another country, such as Spain.

So you definitely want to make sure you get an insurance plan specifically for expats. And that’s exactly what the list below will help you with.

What are the 7 best health insurance options for expats and immigrants in Spain?

Finding the right health insurance plan can be very stressful. To make the process a little easier, take a look at the following table with a comparison of the insurance companies that I recommend so you can quickly and easily see the pros and cons of each!

After the table, I’ve written up some more detailed descriptions of each of the companies, their plans, their benefits, and much more.

But we dive in, I want to leave you with one last tip: it’s worth doing some research and get a quote from each of the companies below. It may take a bit of extra time, but you can save a lot of money this way!

|

|

|

|

|

|||

| BENEFIT | LIMIT | LIMIT | LIMIT | LIMIT | LIMIT | LIMIT | LIMIT |

| Benefit Information | |||||||

| Medical Maximum | Unlimited (for the Platinum plan) | $8,000,000 | The site doesn’t specify | Unlimited | US$1,000,000 per year | The site doesn’t specify | $1,000,000 |

| U.S. In-Network Coinsurance | You choose. From 70%(100% thereafter) to 100% | 100% | No | 60% for maximum coinsurance and then 100% | Yes, for higher fees | Only in emergencies | Yes |

| U.S. Out-of-Network Coinsurance | You choose. From 70%(100% thereafter) to 100% | 90% to $5,000 (100% thereafter) | Yes, for higher fees | 100% | 100% | 100% | 100% |

| Mental Health Availability | No waiting period | 12-month waiting period | Co-payment of $25 per visit, waived deductible | 75% up to 40 visits / 60% after that | No | Waiting period of 10 months | Depends on the plan |

| Mental Health Benefit | Inpatient and Outpatient: $5,000 lifetime maximum to paid in full depending on the plan | Inpatient and Outpatient: $50,000 lifetime maximum | Co-payment of $250 after deductible | 100% up to 60 days | International and ambulance: limit not specified | ||

| Inpatient Prescription Drugs | $500 to paid in full depending on the plan | Up to $8,000,000 | Yes | Complete reimbursement | Yes | Yes | |

| Outpatient Prescription Drugs | None, unless you buy the International Outpatient Option | Up to $8,000,000 | Complete reimbursement | Yes | Yes | ||

| Evacuation and Repatriation of Remains | Paid in full | Up to $8,000,000 | Yes | Up to $25,000 | No | Up to 10,000 euros | Yes |

| Accidental Death & Dismemberment | Depends on the plan | Rider available, limit depends on age. | $50,000 | Depends on the plan | |||

| Emergency Dental | Paid in full | Up to $8,000,000 | Optional | 1,000 per year, $ 200 per tooth | Yes, however you need to pay an extra fee on top of your plan | Depending on the plan, it’s unlimited | It has coverage in the Diplomat Long Term and Diplomat International plans |

| Treatment Necessary as Result of Terrorism | Up to the amount of the coverage | Rider available up to $50,000-lifetime maximum | Clause available up to maximum of $50,000 in lifetime payments | ||||

| Amateur Sports | Unlimited | Rider available up to $10,000 | No | Yes | No | No | No |

| Newborn Care | |||||||

| Routine Nursery Care of a Newborn Child of a Covered Pregnancy | $25,000 to $156,000 depending on the plan | $1,000 additional deductible, $50,000 lifetime maximum, $200 wellness benefit for first 12 months | Yes | Depends on the plan | Can be unlimited depending on the plan | Can be unlimited depending on the plan | |

| Children born as a result of fertility treatment (such as IVF or surrogacy) | Only after the baby is 90 days old | Excluded | Depends on the plan | Excluded | No | ||

| Neonatal Intensive Care Unit | Check website for updated information | $250,000 maximum for first 31 days | No | Up to $250,000 for the first 31 days | No | ||

| Pre-existing Conditions | |||||||

| Pre-existing condition exclusion period | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness |

| Pre-existing condition look back period | Any time prior to effective date | Any time prior to effective date | Any time prior to effective date | Any time prior to effective date | Any time prior to the effective date | Any time prior to the effective date | Any time prior to the effective date |

| Pre-existing annual maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Unlimited depending on the plan | Unlimited depending on the plan | Full reimbursement | Unlimited depending on the plan | Unlimited depending on the plan |

| Pre-existing lifetime maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Unlimited depending on the plan | Unlimited depending on the plan | Full reimbursement | Unlimited depending on the plan | Unlimited depending on the plan |

Worldwide Medical Insurance / Comparison Chart*

Part of the table courtesy of Tokio Marine HCC

Note: This article and table were created with information that was accurate at the time of its publishing. This information is subject to changes and updates.

In my opinion, the best companies for international health insurance for expats are:

- Cigna

- IMG

- Now Health

- Aetna

- Global Underwriters

- SafetyWing

- Foyer Global Health

1. Cigna ![]()

In first place we have Cigna, an American company that’s well-known across Europe as well. Cigna is a great choice to consider if you’re looking for international health insurance.

Cigna has been around for more than 60 years, and has more than 170 million clients worldwide. My partner, Nikki, actually got a Cigna health plan herself in order to qualify for her residence card in Sweden.

With a wide variety of plans to choose from, you’ll even find plans specifically for expats going to work in any country overseas (Spain included!). You’ll find both individual and family plans, as well be able to choose between the Silver, Platinum, or Gold plan (all of which offer coverage in more than 200 countries and territories around the world).

Another benefit of Cigna’s plans is that you can add benefits to your plan based exactly on what specific medical care you need.

If you’re looking for a cheap health insurance plan for Spain, Cigna’s Close Care plan is a great option. This plan is the cheapest one that Cigna has on offer since it only offers coverage in your country of origin and the country you mean to reside in.

Pros of an international health insurance plan with Cigna:

- 24-hour customer service, 7 days a week

- Flexibility to change your plan to cover your specific medical needs

- Coverage for Covid-19 and PCR tests included

- You don’t need to sign up to get a quote

- They have a digital system that lets you quickly and easily find hospitals and clinics near your location

- Generally, Cigna pays health providers directly so you won’t have to seek out reimbursement

Cons of an international health insurance plan with Cigna:

- Not all of their plans cover maternity care

2. IMG ![]()

Another well-known company in the field of international health insurance is IMG, who has more than 25 years of experience and has 3 subsidiaries worldwide.

IMG has many plans for you to choose from, including individual and family plans. They also have a variety of plans made specifically for travelers, like expats.

On their website, you’ll see that you can find plans for long stays of up to a year or more, as well as plans for shorter trips.

Their website is easy to use with filters for travel dates, length of time overseas, destination, and much more to help you find the right plan. Beyond these filters, you can also add in personal details like your age and medical needs to see the best coverage available.

Just be sure to pay attention to the details for each plan since they don’t cover all age groups and not all their plans cover Covid-19.

Pros of an international health insurance plan with IMG:

- 24-hour customer service, 7 days a week

- Flexible plan offerings

- Network of more than 17,000 doctors worldwide

Cons of an international health insurance plan with IMG:

- They don’t cover individuals above 75 years of age

- There isn’t included Covid-19 coverage in all of their plans

As the name implies, Now Health International has a clear mission: to offer a service that is efficient, affordable, and easily accessible. The company places great importance on establishing a strong customer relationship. They provide comprehensive and user-friendly plan information, and any queries or concerns are promptly addressed by their dedicated customer support team.

Now Health plans are designed with the specific needs of expatriates in mind, addressing the everyday challenges of living abroad. They aim to provide guidance and ensure access to high-quality healthcare services across the globe.

Pros of an international health insurance plan with Now Health:

- Customized plans according to your needs

- Clear information and excellent customer service team

- Provides coverage in 194 countries and territories

- Plans with high coverage routine maternity coverage

Cons of an international health insurance plan with Now Health:

- You must wait a 12-month grace period to use maternity coverage.

- In some procedures, it is necessary to use the company’s reimbursement system, which means that you would have to pay for your care initially

4. Aetna

Aetna is a leader and award-winner in the field of international insurance. If you’re looking for a safe and credible insurance plan before your move to Spain, then Aetna is a good company to consider.

Although they don’t have a lot of diversity in their plans, the plans they do have are flexible and allow you to add complimentary coverage (like dental care). Depending on the plan you choose, the coverage limit can be as high as 5 million USD.

You can choose from family or individual plans, and you can also add in coverage for repatriation and medical evacuation if you like.

As an expat, I usually recommend the Aetna Pioneer plan, which has coverage of up to 1.75 million USD. Just fill out the form on their website to get an exact quote and see all the details.

Pros of an international health insurance plan with Aetna:

- They have maternity care coverage

- They have an pplication that lets you easy locate health services and providers in your area

- Short-, mid-, and long-term plans to choose from

- 24-hour customer service, 7 days a week

- Pre-trip assistance available to answer questions on topics like vaccines and regularly-used medications

Cons of an international health insurance plan with Aetna:

- Few plans to choose from

- Prices are higher compared to the others on this list

Global Underwriters is yet another well-known and popular company when it comes to insurance. Their policies attend immigrants, students, digital nomads, and expats with plans to begin life in another place in the world.

For someone moving to Spain, I recommend their Diplomat Long Term or Diplomat International Plan. Both of these plans offer complete coverage and generally include all that an immigrant may need in their new home.

Pros of an international health insurance plan with Global Underwriters:

- Up to 1 million USD in medical coverage for the plans listed above with an additional 1 million USD in coverage in case of accidental death or dismemberment

- 24-hour customer support, 7 days a week

- The plans listed above include emergency dental, medical evacuations, and the repatriation of mortal remains

Cons of an international health insurance plan with Global Underwriters:

- The Diplomat Long Term plan doesn’t protect travelers in Iran, Afghanistan, or Cuba

- The Diplomat International Plan doesn’t have Covid-19 coverage

- Global Underwriters doesn’t serve residents of Australia, Iran, South Dakota, Maryland, and New York

6. SafetyWing

Safety Wing is a well-known and popular choice when it comes to health insurance for digital nomads, given that they have plans especially made for remote workers and companies, immigrants, and digital nomads.

The cost of SafetyWing’s plans depends on your age. The cheapest plan doesn’t cover pre-existing conditions, though does have a maximum coverage of 250,000 USD. But you are able to add coverage for pre-existing conditions separately if you need it.

One nice benefit is that children aged 2-10 are covered for free if their caretaker has a plan. But my favorite SafetyWing benefit is that they offer 30 days of free coverage in your home country for every 90 days that you use your plan in another country, like Spain.

Pros of an international health insurance plan with SafetyWing:

- Their website is modern and easy to navigate

- 24-hour customer service, 7 days a week

- You get 30 days of free coverage in your home country for every 90 days of coverage you have overseas

- Their plans include Covid-19 coverage and treatments recommended by medical specialists

Cons of an international health insurance plan with SafetyWing:

- Their plans aren’t quiet as complete as those from the other companies on this list

- The prices you see on their website don’t include taxes and fees

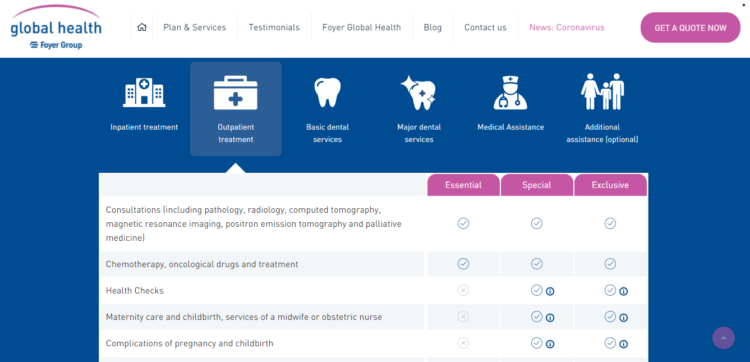

Foyer Global Health is a big player in the world of international insurance plans for travelers, expats, digital nomads, and immigrants.

The company has a huge variety of plans (perhaps more than you’ll see anywhere else), and is a trustworthy name since they are part of the larger European Foyer Group.

Pros of an international health insurance plan with Foyer Global Health:

- All of their policies cover dental surgeries, appointments, and treatments

- 24-hour customer service, 7 days a week by email and phone

- They offer pre-trip support with things like vaccines and preparing a first aid kit

- Coverage for evacuations and repatriation available

Cons of an international health insurance plan with Foyer Global Health:

- Their coverage limits aren’t super clear

Bonus

– GeoBlue

GeoBlue has spent nearly two decades offering health insurance plans with worldwide coverage.

But GeoBlue only offers insurance to citizens and residents of the United States. So if you’re not an American citizen or resident moving to Spain, feel free to skip this option.

GeoBlue has health plans for all different types of travelers, including immigrants. Normally I recommend their Xplorer Essential plan as it’s made for long stays overseas and has unlimited coverage.

If you’re looking for a shorter plan, try out their Voyager one.

One annoying feature: you have to fill out a contact form or speak with an insurance broker to get a quote and more detailed info about their plans.

Pros of an international health insurance plan with GeoBlue:

- App with telemedicine support available

- 24-hour customer service, 7 days a week

- Some of their plans include coverage for pre-existing conditions

- All of their plans have unlimited coverage

Cons of an international health insurance plan with GeoBlue:

- Their plans are only available for U.S. citizens or residents

- Plans aren’t very flexible

- You have to fill out a form or speak with a broker to get more info and pricing on their plans

Types of visas you can apply for work, live, or study in Spain

If you’re planning to live in Spain, one of your top priorities will be to apply for your visa.

As an immigrant moving to a new country for work, your company will probably offer some support with your move, including assistance with your visa application and perhaps even with finding a place to live.

That said, it’s still important to pay attention to the different types of visas you can apply for, what documents you need to prepare to apply, and the turnaround time for your visa to be ready.

If other members of your family will be moving with you, then you’ll also have to look into the types of visas they need.

Spain categorizes visas based on the length of your stay, in addition to requiring a Work Permit (if you’re moving to work) and a residence permit. If you don’t yet have a job offer, you can request a Highly Skilled Professional Visa (European Blue Card) if your specific profession is on the list of in-demand jobs.

Depending on where you’re from, if you don’t yet have a job, you may need to apply for a Schengen visa which will allow you to stay for 90 days. You can then use that time to search for a job or just for tourism.

For citizens of the European Union, the situation is easiest as you obviously don’t need any kind of visa to begin your work in Spain as it’s a fellow European Union country.

Any type of visa you apply for will be valid for at least 90 days. But anyone who wants to spend more than 180 days in the country should go to their local office to request a TIE (Tarjeta de Identificación de Extranjero – “Foreigner Identification Card”) during their first month in the country.

Don’t forget to reach out to your country’s Spanish embassy at any time if you have any questions about the process.

Below, you can find some more info on the types of visas most commonly requested by new immigrants in Spain.

Spanish work visas

Spain has lots of professional opportunities for expats in the country, so we’ll start with this type of visa.

Spanish policies give priority to their own citizens for job openings, so it can sometimes be difficult for foreigners to find work.

That said, there are 5 types of work permits in total, though none of them are visas in themselves.

Beyond the European Blue Card I mentioned above, there are several types of work employment visas (if you have an employment contract) or self-employed work visas.

Most work visas will require you to have an employment contract from a Spanish company (which the company will have to seek our authorization for).

There is also a particular intra-company visa specifically for workers who were transferred to Spain by the company they were already working for. In this case, prior authorization from the Spanish authorities is still required.

There is also a residence and work visa without prior authorization. This is designed exclusively for civil or military employees, religious ministers, teachers, scientists, artists, and media correspondents.

Finally, the self-employed work visas for entrepreneurs will require you to submit a business plan that defines your company, including a study of the market and a financial forecast. Depending on the purpose of the company, enrollment in the Professional Council may also be required.

Spanish student visas

Students who are going to Spain need to have a clear idea in mind of how long they’ll stay in the country as this will affect the type of visa they can apply for.

But no matter which student visa you apply for, you’ll need:

- A completed and signed application form

- Valid passport

- A recent 3×4 photograph

- Proof of residency

- Admission document (acceptance letter from a public or private educational institution)

- Diploma or academic history for previous studies

- Proof of income sufficient to cover living expenses (or documentation proving you’ve been granted a scholarship)

- Official letter from the educational institutional listing out the start and end date of the course and the workload (which must be greater than 15 hours per week)

- If your parents will be supporting you, their income tax return and a notarized commitment to pay the student’s expenses

- Health insurance that covers medical expenses for your entire stay in Spain (just like those recommended in the list above!)

If your stay in the country will be above 180 days, you’ll also need to present a medical certificate and a criminal background check done by the federal police (in accordance with the Hague apostille and translated into Spanish).

With a student visa, you are legally allowed to work up to 20 hours per week. You’ll also need to request a TIE (Foreigner Identity Card) to stay in Spain for more than 6 months.

Visas for retirees and non-earners in Spain

If you’re retired and don’t plan to work in Spain, you can also apply for a Spanish Non-Lucrative Temporary Residence Visa.

To qualify, you have to not be a citizen or family member of someone from the European Union, not have a criminal background, and not be in Spain irregularly.

Though you aren’t legally allowed to work in Spain with this visa, you do have to prove you have income of at least 2,259.60 euros per month (with an additional 564.90 euros needed for each dependent family member) coming from other sources to support yourself.

After you’re granted the visa, which can take 3 months to be approved, you’ll have 1 month to withdraw and 90 days to travel permanently.

In sum…

Here are the 7 best health insurance companies for expats and immigrants moving to Spain:

- Cigna

- IMG

- Now Health

- Aetna

- Global Underwriters

- SafetyWing

- Foyer Global Health

In conclusion…

Going through the process of moving overseas can be very difficult…so I hope this article has helped make that process a little easier and smoother for you!

If you still have any other questions about getting health insurance before you move to Spain (or about moving abroad in general), let me know in the comments area below and I’ll get back to you!