Are you looking for a life change by moving to South Korea? Do you want to know how to make sure you have good health coverage in your new home? Read on to learn all you need to know to make sure you’re protected in medical emergencies!

There are lots of things you need to take care of before you move to another country – have an established place to live, find work, an eSIM valid for korea, understand all the paperwork, buy your plane tickets, dive into learning a new language…

But one of the many to-dos that often gets left to the wayside is sorting out your health insurance.

With a laid-back way of life, bustling urban culture mixed with laid-back scenery and a reasonable cost of living, South Korea is a popular destination for foreigners from all over the world.

But before we get to your option for international health insurance as an expat in South Korea, let’s first talk a bit about how the health system in South Korea is structured, what the difference is between travel insurance and expat insurance, what the level of coverage that you’ll need is, and much more.

(And do be sure to stay until the end of the article for info on the different types of visas you can apply for to start living, studying, or working in South Korea!)

How does the health system in South Korea work?

The public health system in South Korea is called National Health Insurance (NHI), it is a service of great quality. As in most countries, when using the NHI in large cities it is common to find English-speaking doctors and staff, in case Korean is difficult for you. Also, if you are not an advanced speaker of Korean, you may need help registering on the NHI website, which is in Korean.

Expats must apply for the National Health Insurance within the first 6 months of their stay in the country. Previously, expats were not required to register, but after many foreigners fail to pay for services, the government requires registration.

One of the problems you may encounter in the Korean healthcare system is the long wait times, even in emergencies. Obtaining proven insurance will unfortunately not change the scenario in this case. In any case, it is extremely important that your registration is up to date, especially those with asthma or frequent breathing problems, as air pollution in South Korea can greatly impact the lungs.

The health care system in the country is financed by government subsidies, external contributions and even tobacco surcharges. Clinics and hospitals are competent, modernized and offer different treatment options: either Western or Eastern.

Depending on the conditions of each citizen, the NHI covers from 50% to 80% of their health care costs. This includes the costs of medical exams, general procedures, accident coverage and prescription drugs. The Korean healthcare system also pays expenses if an employee is injured on the job or becomes unemployed.

If you live in South Korea but frequently visit other countries, I recommend that you take out a private insurance plan. If you also need frequent medical care or are undergoing treatment for chronic or serious illnesses, I also recommend that you consider opting for a private healthcare system, as it can be more cost-effective in the long run.

Do expats need to have health insurance in South Korea?

To put it simply: yes! Citizens of South Korea have access to free healthcare. But as an expat or immigrant, you will be required by law to have your own private health insurance.

That’s why it’s important to make sure you have health insurance coverage like one of the options I list below 😊

But beyond being a requirement, having an international health insurance policy can give you a lot of peace of mind. Especially when you’re in a new country that’s different from your own, with new laws, systems, and a language that you may not know, plus high healthcare costs.

So, having international health insurance coverage will help keep you safe in any unexpected situations or emergencies. Plus, there are a few other benefits of having an international insurance plan (as I’ll explain in the next section).

As an immigrant in South Korea, should you get an international health plan like the ones recommended on the list below? Or should you get a national plan?

At the end of the day, it’s a personal choice that depends on your exact medical needs, the coverage you require, the length of your stay in South Korea, and the options available for national plans.

An international health insurance plan should be able to meet all of your coverage needs in South Korea. Though if you do choose to get an international plan, make sure to check with your local Korean embassy to make sure it meets the minimum insurance coverage requirement.

I’ve never lived in South Korea, so I don’t know enough about the national plans that might be available and thus can’t say too much about those.

With this in mind, below are some reasons that you may want to choose an international health insurance plan rather than seek out public coverage options:

- Depending on the policy you choose, an international health insurance plan can end up costing less per month

- International insurance policies are great if you have a shorter stay in South Korea since you can choose exactly how long you want your plan to be

- International insurance policies are more flexible since you can cancel or extend at any time

- An international insurance policy will give you coverage in other countries, not just in South Korea (that’s why they are called “international” insurance plans)

Who can an international health insurance plan cover?

The health insurance companies that I’ll list below are for the following citizens who live in South Korea as expats, immigrants, workers, or even students:

- Americans

- Canadians

- Australians

- Brazilians

- Citizens of the European Union (Portuguese, French, German, Dutch, Spanish, Polish, Swedish, Belgian)

- Argentinians

- Brits (English, Scottish, Welsh, Irish)

- Kiwis/New Zealanders

- And for citizens of just about any other country

Beyond expats/immigrants who reside in South Korea, these insurance companies also work for residents who live in:

- The United States

- Canada

- Europe (the European Union or the United Kingdom)

- Japan

- Australia

- And for expats who live in just about any other country in the world

In general, since all these plans and insurance companies are international, they can be used by practically any person in any place since they have worldwide coverage!

Why can’t I just get travel insurance for my move to South Korea? What’s the difference between travel insurance and expat insurance?

Travel insurance is critical for any trip, given that it won’t just cover you in unexpected medical problems or emergencies, but also for issues with your trip like lost luggage or the cancellation of a flight.

That said, it’s important to know that travel insurance is not ideal for immigrants. Although you can find travel insurance policies to cover you for long periods of time, they are made for travelers with temporary stays in a country. Travel insurance coverage isn’t valid for long-term or semi-permanent stays in another country.

Plus, travel insurance won’t meet your health insurance coverage required by law to live in South Korea.

So, you’ll definitely want to choose a travel insurance plan that specifically covers expats. And that’s exactly what I’ll help you with in the list below.

What are the 7 best health insurance options for expats and immigrants in South Korea?

It can be very stressful to find the right insurance plan. With this in mind, take a look at the comparison table of the companies that I recommend below. This way, you can quickly see what the pros and cons are of each company and make the best choice for you!

After the table, I’ll give a longer description of each of the companies, their plans, major benefits, and much more!

That said, the biggest piece of advice I can give is to quickly get a quote with each of the companies on this list before you make your decision. It can take a bit of time, but at the end of the day, you can save a lot of money!

|

|

|

|

|

|||

| BENEFIT | LIMIT | LIMIT | LIMIT | LIMIT | LIMIT | LIMIT | LIMIT |

| Benefit Information | |||||||

| Medical Maximum | Unlimited (for the Platinum plan) | $8,000,000 | The site doesn’t specify | Unlimited | US$1,000,000 per year | The site doesn’t specify | $1,000,000 |

| U.S. In-Network Coinsurance | You choose. From 70%(100% thereafter) to 100% | 100% | No | 60% for maximum coinsurance and then 100% | Yes, for higher fees | Only in emergencies | Yes |

| U.S. Out-of-Network Coinsurance | You choose. From 70%(100% thereafter) to 100% | 90% to $5,000 (100% thereafter) | Yes, for higher fees | 100% | 100% | 100% | 100% |

| Mental Health Availability | No waiting period | 12-month waiting period | Co-payment of $25 per visit, waived deductible | 75% up to 40 visits / 60% after that | No | Waiting period of 10 months | Depends on the plan |

| Mental Health Benefit | Inpatient and Outpatient: $5,000 lifetime maximum to paid in full depending on the plan | Inpatient and Outpatient: $50,000 lifetime maximum | Co-payment of $250 after deductible | 100% up to 60 days | International and ambulance: limit not specified | ||

| Inpatient Prescription Drugs | $500 to paid in full depending on the plan | Up to $8,000,000 | Yes | Complete reimbursement | Yes | Yes | |

| Outpatient Prescription Drugs | None, unless you buy the International Outpatient Option | Up to $8,000,000 | Complete reimbursement | Yes | Yes | ||

| Evacuation and Repatriation of Remains | Paid in full | Up to $8,000,000 | Yes | Up to $25,000 | No | Up to 10,000 euros | Yes |

| Accidental Death & Dismemberment | Depends on the plan | Rider available, limit depends on age. | $50,000 | Depends on the plan | |||

| Emergency Dental | Paid in full | Up to $8,000,000 | Optional | 1,000 per year, $ 200 per tooth | Yes, however you need to pay an extra fee on top of your plan | Depending on the plan, it’s unlimited | It has coverage in the Diplomat Long Term and Diplomat International plans |

| Treatment Necessary as Result of Terrorism | Up to the amount of the coverage | Rider available up to $50,000-lifetime maximum | Clause available up to maximum of $50,000 in lifetime payments | ||||

| Amateur Sports | Unlimited | Rider available up to $10,000 | No | Yes | No | No | No |

| Newborn Care | |||||||

| Routine Nursery Care of a Newborn Child of a Covered Pregnancy | $25,000 to $156,000 depending on the plan | $1,000 additional deductible, $50,000 lifetime maximum, $200 wellness benefit for first 12 months | Yes | Depends on the plan | Can be unlimited depending on the plan | Can be unlimited depending on the plan | |

| Children born as a result of fertility treatment (such as IVF or surrogacy) | Only after the baby is 90 days old | Excluded | Depends on the plan | Excluded | No | ||

| Neonatal Intensive Care Unit | Check website for updated information | $250,000 maximum for first 31 days | No | Up to $250,000 for the first 31 days | No | ||

| Pre-existing Conditions | |||||||

| Pre-existing condition exclusion period | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness |

| Pre-existing condition look back period | Any time prior to effective date | Any time prior to effective date | Any time prior to effective date | Any time prior to effective date | Any time prior to the effective date | Any time prior to the effective date | Any time prior to the effective date |

| Pre-existing annual maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Unlimited depending on the plan | Unlimited depending on the plan | Full reimbursement | Unlimited depending on the plan | Unlimited depending on the plan |

| Pre-existing lifetime maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Unlimited depending on the plan | Unlimited depending on the plan | Full reimbursement | Unlimited depending on the plan | Unlimited depending on the plan |

Attention: This article and table are made for informational purposes as the information contained here is subject to changes and updates.

In my opinion, the best international health insurance companies for expats are:

- Cigna

- IMG

- Now Health

- Aetna (Allianz)

- SafetyWing

- Global Underwriters

- Foyer Global Health

1. Cigna ![]()

First up, we have Cigna, a large American insurance company that’s also widespread in Europe. Cigna is a great choice when we talk about international health insurance.

With more than 60 years of operating on the market, Cigna is well-known for its insurance and has more than 170 million clients around the world. My partner, Nikki, actually purchased a health insurance plan from Cigna in order to qualify for her residence card in Sweden.

Cigna has a wide range of plans for you to choose from, including plans made specifically for expats (and which work great if you’re going to be moving to South Korea!), plus both individual and family plans).

One of the biggest advantages of an insurance plan with Cigna is that you can add benefits to your plan based on the specific medical care you need to have covered. You can choose from Cigna’s Silver, Platinum, or Gold plan, all of which include coverage in more than 200 countries and territories around the world.

If you’re looking for a cheap health insurance plan for South Korea, a great option is Cigna’s Close Care plan. This plan is the most budget-friendly one that Cigna offers since it only includes coverage for your home country and the country you’re a resident of (South Korea, in this case).

Pros of an international health insurance plan with Cigna:

- Customer service available 24 hours 7 days a week

- Flexibility to make changes to and tailor the plan for your specific medical needs

- Includes coverage for Covid-19 and PRC tests

- No registration needed to get a quote

- They have a digital system that lets you easily find hospitals and clinics near you

- Normally, Cigna will pay health providers directly so you won’t need to request reimbursement

Cons of an international health insurance plan with Cigna:

- Some of their plans don’t cover maternity care

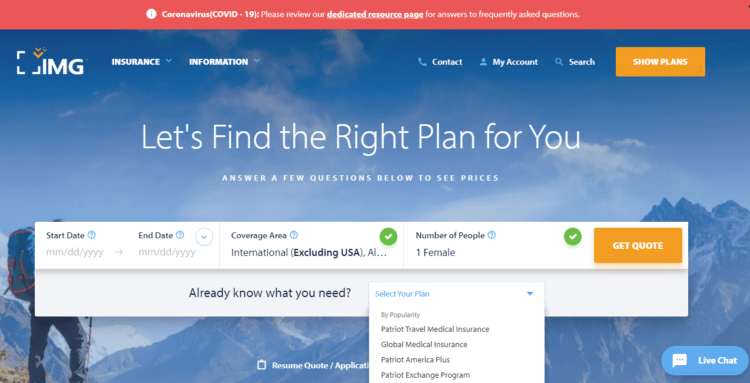

2. IMG ![]()

One more well-known company in the world of international insurance is IMG, which has more than 25 years of experience and 3 subsidiaries worldwide.

IMG has several types of plans for you to choose from, whether as an individual or as an entire family. They also have a variety of plans made specifically for various types of travelers, including expats. You’ll see that you’ll have the option for both long-stay plans of a year or more as well as for much shorter time periods.

IMG’s website is easy to use and search plans on since you can use filters for date, plan length, destination, and much more. Beyond these filters, you can also add in personal details like your age and specific medical needs before seeing your coverage options.

This way, IMG can get you a personalized and detailed quote that lets you easily compare your options for plans and coverage and figure out which is best for you.

Just keep the specific details of each plan in mind since some of them don’t cover certain age groups and not all of them cover Covid-19.

Pros of an international health insurance plan with IMG:

- Customer service is available 24 hours a day, 7 days a week

- Flexibility to customize your plan and coverage limits

- Ability to choose from more than 17,000 in-network doctors

Cons of an international health insurance plan with IMG:

- They don’t have Covid-19 coverage, depending on the plan

- They don’t offer coverage for individuals above 75

Now Health International is dedicated to delivering an efficient, affordable, and readily available service, as suggested by its name. The company’s primary focus revolves around establishing a strong rapport with its customers. They provide clear and streamlined plan information and address any potential questions or concerns through their responsive customer support team.

Now Health’s plans are carefully crafted to address the everyday obstacles faced by individuals living abroad, offering guidance and ensuring access to top-notch healthcare services across the globe.

Pros of an international health insurance plan with Now Health:

- Customized plans according to your needs

- Clear information and excellent customer service team

- Provides coverage in 194 countries and territories

- Plans with high coverage routine maternity coverage

Cons of an international health insurance plan with Now Health:

- You must wait a 12-month grace period to use maternity coverage.

- In some procedures, it is necessary to use the company’s reimbursement system, which means that you would have to pay for your care initially

4. Aetna (acquired by Allianz)

Aetna is a leader and award winner in the area of international insurance. If you’re in search of safety and credibility in your choice of insurance provider before your move to South Korea, Aetna is a good company to consider.

Although they don’t have a large variety of plans on offer, the ones they do have give you the flexibility to adjust and add on complementary coverage (like dental care). Depending on the policy, some include coverage of up to 5 million USD.

You can choose from family or individual plans, as well as include coverage for repatriation and medical evacuations.

As an expat, I can recommend the Aetna Pioneer plan. This plan has basic coverage of up to 1.75 million USD. Just fill out the short form on their website to get an exact quote and detailed information about all of the available policies.

Pros of an international health insurance plan with Aetna:

- Maternity care is covered

- Aetna has a mobile app to help you easily find nearby medical services and providers

- Short-, mid-, and long-term plans to choose from

- Customer services available 24 hours a day, 7 days a week

- Pre-trip assistance available to help answer your questions on things like vaccines and accessing regularly-used medications while traveling

Cons of an international health insurance plan with Aetna:

- Few plans to choose from

- Cost of plans above the average of the other companies on this list

5. SafetyWing

SafetyWing is a popular and well-known company particularly for insurance for digital nomads, given that they have insurance plans specifically for remote workers and companies, expats, and digital nomads.

One of the advantages of SafetyWing is that its policies are a little more accessible and easier to understand than the other options on the market. SafetyWing also covers children aged 2-10 for free if their caretakers have a plan with them.

Each plan has a specific price that depends on your age. The cheapest SafetyWing plan doesn’t cover pre-existing conditions, but it does have coverage of up to 250,000 USD. Though you do have the freedom to add additional pre-existing condition coverage separately if you need to.

What I like most about SafetyWing is that they offer 30 days of coverage for free in your home country for every 90 days that you use it overseas, like in South Korea or the EAU in general.

Pros of an international health insurance plan with SafetyWing:

- Modern, intuitive website that makes it easy to find policy info

- Customer services available 24 hours a day every day of the week

- 30 days of coverage given for free in your home country for every 90 days of coverage overseas

- They cover Covid-19 and treatments recommended by specialists

Cons of an international health insurance plan with SafetyWing:

- Plans aren’t quite as complete and tend to have lower coverage overall than some of the other options on this list

- The prices shown on the website don’t include taxes and fees

Global Underwriters is another well-known and very popular company when we talk about insurance. They have policies that serve immigrants, students, digital nomads, and expats with will be beginning a new life elsewhere in the world.

For anyone who is moving to South Korea, I recommend the Diplomat long Term or the Diplomat International Plan. Both have very complete medical coverage that in general includes all that an expat may need in their new home.

Pros of an international health insurance plan with Global Underwriters:

- Up to 1 million USD in medical coverage is included in the plans cited above, plus 1 million USD in coverage for cases of accidental death or dismemberment

- Client support available 24 hours a day each day of the week

- The plans I mentioned include emergency dental coverage, medical evacuation, and repatriation of mortal remains

Cons of an international health insurance plan with Global Underwriters:

- The Diplomat Long Term plan doesn’t protect travelers in Iran, Afghanistan, or Cuba

- The Diplomat International plan doesn’t have Covid-19 coverage

- Global Underwriters doesn’t work with residents of Australia, Iran, South Dakota, Maryland, or New York

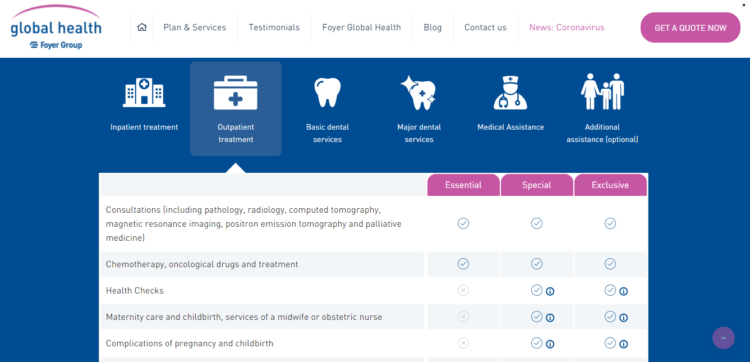

Foyer Global Health is renowned for its international health insurance plans for travelers, expats, digital nomads, and immigrants.

They are a company with many, many plans to choose from (probably more than any other company you’ll find out there), as well as being a trustworthy organization (they are part of the larger European Foyer Group).

Pros of an international health insurance plan with Foyer Global Health:

- All plans include coverage for dental surgeries, appointments, and treatments

- Customer service available online by email or by phone 24/7

- Includes pre-trip preparation support on vaccinations and in preparing a first aid kit

- Coverage available for evacuation and repatriation

Cons of an international health insurance plan with Foyer Global Health:

- The limits of their plans aren’t very clear

Bonus

– GeoBlue

GeoBlue has spent 20 years providing insurance plans with international health coverage.

But GeoBlue only allows their plans to be purchased by citizens and residents of the United States. So if you aren’t an American citizen or green card holder moving to South Korea, you can skip this option.

GeoBlue has health plans for all types of travelers, including immigrants. Their Xplorer Essential plan is the one I most often recommend since it’s made for long stays overseas and has unlimited coverage.

But if you’re looking for a shorter plan, take a look at GeoBlue’s Voyager option. Just fill out the form on their website or reach out to an insurance broker to get a quote and more detailed information about their plans.

Pros of an international health insurance plan with GeoBlue:

- They have an app with resources like telehealth

- 24/7 customer services

- All of their plans include unlimited coverage

Cons of an international health insurance plan with GeoBlue:

- Their plans are only available for residents of the United States or American citizens

- Not a lot of flexibility in their plans

- You need to fill out a form or contact an insurance broker to get more information and an exact budget for their plans

Types of visas you can apply for to live, work, and study in South Korea

On the South Korea Visa Portal, you can find all types of visas to enter and/or stay in the country, whether as a tourist, student, spouse of a citizen, as an investor and others.

Before applying for a South Korean visa, know that the process is not simple. The application and the process as a whole can be confusing and the requirements quite high. There are many ways to apply for each visa, it will depend on which visa you want and what you need. The simplest part of the process is the cost, which is standardized and paid in dollars.

In total, South Korea makes use of 15 different types of visas in different categories of business, tourism, studies and humanitarian issues. Therefore, we will only talk about the most requested ones here: employment-based visas, job seeker visas, family visas and residence permits.

Employment-based visas:

The type of work visa you can apply for in South Korea will basically depend on what you do. Three of your work visa options that allow you to stay in the country for more than 90 days are:

E-1 Teacher Visa

This visa is for foreign nationals looking to give lectures or do research in their field at educational facilities above university level. This visa entitles you to multiple entry, is valid for 1 year and can be renewed at intervals of one year. In specific cases, you can stay as long as you need, with renewals available every five years.

E-2 Foreign Language Instructor

With this visa you can teach a foreign language in a company or educational facility above elementary school level or similar institutions. The visa is multiple entry, lasts for two years and can be renewed at intervals of two years.

E-3 Research

This visa is suitable for foreigners who are invited by a public or private institution to carry out research in natural sciences or advanced technology. The visa is multiple entry, valid for 1 year and can be renewed at intervals of one year. In specific cases, you can stay as long as you need, with renewals available every five years.

*Among other employment-based visas.

Job Seeker Visa:

If you don’t already have a job, you can move to South Korea as a job seeker by applying for a D-10 visa. However, please note that the eligibility standards are quite high. You will need to meet one of the following requirements:

- Your previous employer has recently (no later than the last three years) been featured on the Fortune 500 list.

- You are a graduate of a university listed in the Times Higher World University Rankings.

- You are a recent graduate (graduated within the last three years) from a Korean community college or higher education institution.

- You have a bachelor’s degree or higher and have completed a research program at a Korean research institution within the last three years.

- You are recognized by the head of a diplomatic mission.

*You can also get this visa if you are planning to do an internship in Korea.

Family visa:

Spouses and minor, unmarried children of holders of all of the aforementioned visas need to obtain an F-3 visa to legally remain in South Korea. In addition to paying the issuance fee, applicants must submit the following documents:

- completed application form

- Passport

- a passport-style color photograph (3.5mm by 4.5mm)

- family relationship certificate (birth, marriage, etc.)

- proof of financial stability (proof of employment, tax payment certificates, etc.

Residence permits:

Please note that the following visas are for applications for a long-term, but still temporary, residence permit. However, having these types of visas can eventually lead to permanent residency in South Korea.

F-2-7 visa

Holders of E-1, E-2, E-3, E-4, E-5, E-6, E-7, D-2, D-5, D-6, D-7, D- 8, D-9 and D-10 can apply for the F-2-7 visa after working in the country for one year. Candidates are evaluated on a points-based system that requires them to score 80 points out of a possible 120. The things you are evaluated on are:

- Age: The age that allows you to get the most points is 30-35 (25 points). The lowest score is given to people aged 51 and over (15 points).

- Income: Earning over 100 million KRW (85,000 USD) per year will earn you ten points. Earning less than 20 million KRW (17,000 USD) is worth just one point.

- Education: The higher the qualification – the better the score. A high school diploma will give you 15 points, while a doctorate is worth 35 to 33 points, depending on the subject.

- Korean Proficiency: Proficiency is categorized into six levels which are determined by taking the Korean Proficiency Test (TOPIK).The highest level earns a candidate 20 points, while the lowest is worth 10 points.

- The Social Integration Program: The Korean Immigration and Integration Program (KIIP) is a free education program that helps expats learn the language and adapt to the Korean way of life. Points are awarded depending on how many levels of the program you have completed. The maximum you can get is 28 points.

- Bonus Points: Volunteering and study experiences in Korea, as well as work experiences abroad, can earn an additional 1 to 5 points. Although it seems little, with just one point below the minimum you can be rejected.

*The visa is valid for up to three years.

F-2-99 visa

If you don’t meet the requirements for an F-2-7 visa, check to see if you qualify for the F-2-99. This visa is not that demanding when it comes to criteria, as there is no points-based assessment system and the main requirement is the length of your stay in the country.

- D-1, D-5, D-6, D-7, D-8, D-9, E-6-1, E-6-3, F-1 and F-3 visa holders are required to remain continuously in Korea for seven or more years.

- Holders of E-1, E-2, E-3, E-4, E-5 and E-7 visas need to remain continuously in Korea for five or more years.

For your stay to qualify as continuous, you cannot leave the country for more than one month. Other requirements you need to meet are:

- You need to be of good character (no criminal record, complying with local laws, having sufficient income, etc.).

- Be an adult (over 18 years of age).

- Your family wealth (either property or cash) must be worth more than KRW 30 million (USD 25,500).

- Your previous year’s income must be higher than the country’s per capita Gross National Income.

- You must have completed KIIP Level 2.

*This visa is valid for 1 to 3 years.

These are just 2 of the visa types applying for residency.

In sum…

Here are the 7 best health insurance companies for expats and immigrants moving to South Korea:

- Cigna

- IMG

- GeoBlue

- Aetna (Allianz)

- SafetyWing

- Global Underwriters

- Foyer Global Health

In conclusion…

Deciding to begin life in a new country can be complicated…I hope that this article can help you simplify a lot of your doubts about this process!

But if you still have any questions about getting health insurance before your move to South Korea (or about moving overseas in general), let me know in the comments area below and I’ll get back to you!