Top 9 highly cost-effective online platforms for international money transfers are available. These services are designed to be user-friendly, providing instant calculations of transfer fees and the converted amount in the recipient’s currency, giving you the opportunity to review the details before initiating the transfer. With support for over 40 different currencies across more than 70 countries, including the United Kingdom, these platforms offer comprehensive coverage.

To access the complete list of the top nine options, please click here.

While the topic may not seem directly related to travel, it holds great value for travelers and immigrants who often require financial transfers to or from overseas. (I will explain later how this article can prove advantageous for them).

(On a related note, if you or someone you know is planning or interested in living abroad, be sure to visit our page featuring 10 alternative options for residing in other countries).

Here are some scenarios where you can use the services of some of the companies that will be mentioned below to send money to other countries:

- You are making preparations for an upcoming international trip and are seeking ways to save money on currency exchange (more details will be provided later).

- You are currently studying or participating in an exchange program in Great Britain and need to receive funds from your family in your home country. Alternatively, you may be working in the United Kingdom and need to send money to support your family back home.

- Another scenario could be that you reside in the United Kingdom (England, Scotland, Wales and Northern Ireland) but require a transfer of funds from your home country. Additionally, if your spouse is working abroad, they may need to send you money.

- If you have international suppliers or customers, you may need to send or receive payments from them. In case you need to make an international payment, it’s essential to learn how to prevent fraud (more details can be found at the end of this article).

- During your travels, you may run out of money, and your family might need to send you funds to continue your journey. In unfortunate circumstances where you become a victim of theft while traveling, you may require financial assistance from your family. As someone earning a salary in the United Kingdom, you may be interested in investing your earnings in your home country.

- Furthermore, if you have international accounts, you may need to transfer funds to your home country. Lastly, you may prefer the convenience of making online international money transfers without visiting a physical bank branch.

It’s important to note that the website options provided below are applicable to individuals from any country worldwide, including Brazil, Portugal, the United States, Ireland, Canada, Mexico, Spain, Japan, and many others. So, let’s begin!

Important note: Official/spot exchange rate vs. retail/tourist exchange rate

In this article, you will come across the terms “official/commercial exchange rate” and “tourist exchange rate.”

Ideally, it is always more advantageous to exchange your money at the official/commercial exchange rate or the closest rate to it. This ensures that you lose less money during currency conversions. The official/commercial exchange rate is used in the financial market, where large sums of money are traded (think of it as “wholesale” exchange rates).

Most of the recommended companies below use the official/commercial exchange rate or a similar rate (except when mentioned otherwise).

On the other hand, the tourist exchange rate is what you encounter when exchanging money at airports, banks, exchange offices, and similar locations. These establishments use the tourist exchange rate because they have additional expenses and aim to earn more from the transaction. This rate is typically the least favorable.

In simple terms, always strive to exchange currencies using the official/commercial exchange rate and avoid the retail/tourist exchange rate. We have indicated which rate each company uses in the descriptions below.

Now, let’s move on to discussing how you can save money when sending money abroad while traveling

As you may already know (if you’ve read my previous article on handling money and currency exchange while traveling), using your debit, credit, or prepaid card abroad incurs a 6.38% IOF tax on each transaction. This tax can add up to a significant amount!

A cost-effective option is to exchange money in your home country before traveling, purchasing dollars, euros, or other currencies at commercial rates from banks or exchange offices, and using them while abroad. However, it is not advisable to carry large amounts of cash while traveling, and exchange brokers often use the less attractive tourist rate, which could result in monetary losses during the transaction.

For travelers, a more economical alternative is to use one of the options below to send money to family and friends in the countries you will be visiting on your trip. When you arrive in that country, you can retrieve the money in the local currency from the acquaintances who received your money from your home country.

For instance, let’s consider a scenario where I am in Brazil and planning to travel to Australia, where my brother is studying. I can utilize one of the nine companies below to send money to my brother’s checking account. He will withdraw this money in dollars and return it to me upon my arrival in Australia. This way, I do not need to exchange money before leaving Brazil or immediately upon arriving in Australia.

Now, let’s delve into the details of the nine best and most cost-effective companies and websites for sending, receiving, and transferring money abroad. But first…

What’re the 3 ways you should NEVER send and receive money abroad?

#1) BANKS

Many people around the world mistakenly assume that using a bank is a straightforward and cost-effective method for sending or receiving international funds. However, this couldn’t be further from the truth!

Sending global transfers through banks can be EXTREMELY EXPENSIVE! Banks rely on SWIFT codes (or BIC) and IBAN for incoming and outgoing international wire transfers…and they will take advantage of you!

Typically, banks impose a percentage fee on the total transfer amount, along with an additional fee that can sometimes be nearly as high as the transfer itself. To make matters worse, the exchange rate they offer is often abysmal! So, if you choose to transfer money to another country using a bank, you’re likely to lose a significant and unnecessary amount of money.

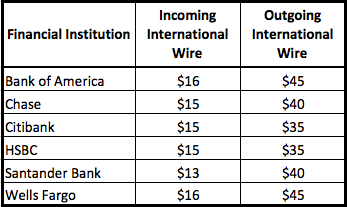

For example, if you use an American bank to transfer money to a European bank, fees can easily accumulate to at least $45 for a single wire transfer (in addition to an unfavorable exchange rate).

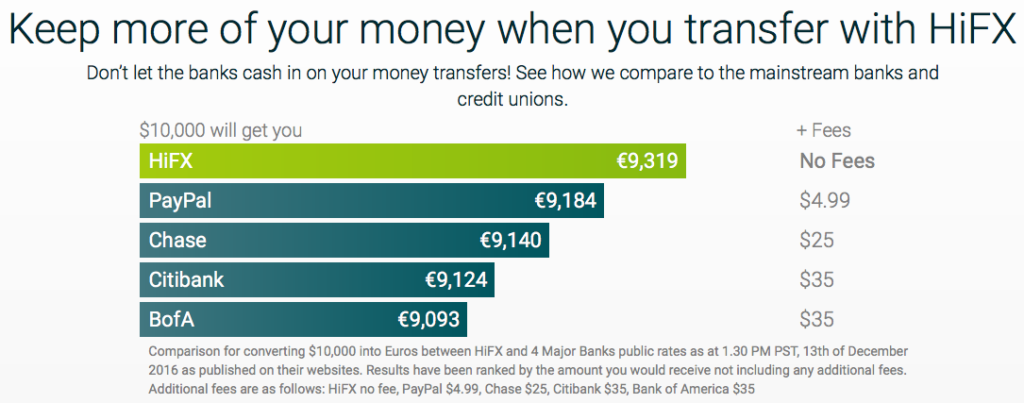

Xe (one of the recommended companies below) provides a comprehensive comparison between their rates and those of major banks for international wire transfers (previously known as HiFX before its acquisition).

And this table gives you an idea of the fees charged by banks for incoming and outgoing international wire transfers…ouch!

#2) and #3) Western Union or MoneyGram

These are two of the most well-known money transfer companies worldwide. Regrettably, this also indicates that numerous individuals utilize them and inadvertently squander their money because they are unaware of superior options.

But if so many other individuals use Western Union and MoneyGram, why should you avoid them?

Because they…

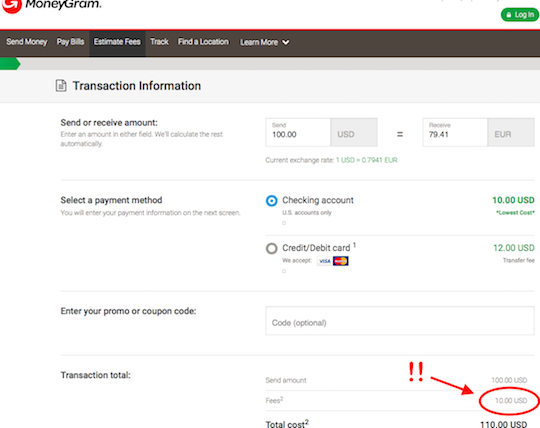

- Are extremely expensive and take a substantial percentage of the funds you are sending (For instance, MoneyGram will charge you almost 25% of the amount you are transferring – which is $22 for a $100 transfer…a complete ripoff!)

- Don’t offer online options for sending or receiving money (you must personally visit their branch and the recipient must do the same) Typically use the retail/tourist exchange rate (also known as the unfavorable rate)

One last time, here are the 3 ways you should NOT do international transfers to United Kingdom:

#1) Banks

#2) Western Union

#3) MoneyGram

Then what are the cheapest and most practical ways to do international money transfers?

Here, I will provide a list of my preferred options based on their affordability and convenience through mobile apps or the web. However, I encourage you to explore all the available choices to find the one that best aligns with your specific financial needs.

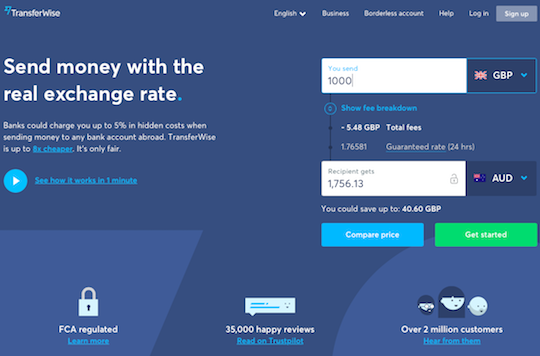

1. Wise (formerly Transferwise)

Wise, previously known as TransferWise, is my preferred option for cost-effective and user-friendly international money transfers. Developed by the same team behind Skype, Wise offers a convenient solution for sending money abroad.

To use Wise, you will need a bank account in the currency of the destination country. It’s worth mentioning that the account doesn’t have to be in your name, making it convenient for sending money to friends and family.

Getting started with Wise is easy. Simply enter the currency and amount you want to send (e.g., Brazilian real to euros) and the transfer amount (e.g., R$1,000). Wise will provide you with the final amount the recipient will receive in euros, including all fees, taxes, and charges.

One of the advantages of using Wise is that it utilizes the official exchange rate provided by Google for currency conversion. This ensures that you get the most favorable rate regardless of the currencies and transfer direction involved.

Next, enter your information and the recipient’s bank details, even if it’s your own overseas account. Wise will generate a bank slip for you to pay the transfer amount, without any additional fees for issuing the slip. You can pay the slip at a bank, even if you don’t have an account there, or conveniently make the payment online through internet banking from your home.

In some cases, depending on the originating country, you can transfer funds to Wise via domestic transfer, debit card, or credit card (note that using a credit card may incur an additional fee).

Typically, the funds will reach the recipient’s account within 1-3 days. While there are other alternatives available, Wise remains my top choice due to its simplicity and affordability. However, I recommend exploring other options to find the one that best suits your specific needs.

And notice that the currency exchange rate from Wise is pretty much the same as the official one given by Google!

Pros of using Wise for international money transfers:

- It’s the cheapest way to transfer money I’ve found– their fee is only around 0.35% of the total transfer value

- They use the official exchange rate (which is much better than the “tourist” exchange rate)

- It’s super practical – you can do everything online

- It’s cheaper and easier than sending money internationally using banks

- There isn’t a minimum transaction amount

- You can use Wise to transfer money overseas for your Business and pay suppliers or employees

- You can send money to more than 40 countries plus all the countries that use the Euro (19 in total) *

- You can receive payments worldwide

By the way, if you want to send money to Spain, Portugal, Ireland, or other countries that use the Euro, the process is the same. All you need is to select Euro when you begin your transfer and then put the info of the bank account in the country receiving the money.

*Countries that use the Euro:

Germany, Austria, Belgium, Cyprus, Slovakia, Slovenia, Spain, Estonia, Finland, France, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, The Netherlands, Portugal, Andorra, Monaco, San Marino, the Vatican, Kosovo, Montenegro.

Cons of using Wise for international money transfers:

- Until recently, it was not possible to send money if the person did not have a current account in the destination country of the transaction. But now, with Wise’s digital and physical cards, you can make payments directly from your account on the platform, but check availability in your region!

However, if in the country you are in this service is not yet available, an easy way to circumvent this problem is by using the checking account of someone you trust. Here in Sweden, for example, I helped a fellow Brazilian receive money here from his family in Brazil. They transferred the money to my Swedish bank account, I withdrew the money from the ATM and gave it to him.

Personal experience with Wise:

I’ve used Wise to send money from the United States to Brazil (which can be done with a credit card!), from the United States to Sweden, from Australia to Sweden, from Australia to Sweden, and from Sweden to the United States. It’s always worked smoothly for me! So, I’d definitely recommend it.

If you want to see, here’s a video explaining how Wise works:

2. Xe

Xe is a well-known platform that facilitates international money transfers, much like Wise and CurrencyFair. It offers a similar service, making it a viable option for individuals seeking to transfer funds globally.

In addition, Xe is recognized as one of the largest websites globally for checking exchange rates between any two currencies, including their historical values. This feature can be extremely useful for evaluating whether a particular currency is appreciating or depreciating in relation to another.

To determine the transfer fees, it is necessary to create a free account with Xe beforehand.

It is important to note that Xe may not offer money transfer services to certain countries. Nevertheless, it serves as an excellent alternative for individuals from other nationalities who want to send or receive money to and from various countries around the world.

PROS of using Xe for international money transfers:

- Xe does not have a minimum or maximum limit for the transfer value.

- They charge a relatively low fee to send and receive money from abroad (for example: for transfers up to 500 USD a fee of 3 USD is charged)

- They don’t charge any fees to send or exchange abroad

- They use a rate close to the official rate

- It’s super practical – you can do everything online

- You can send money to more than 26 countries plus all the countries that use the Euro

You can see which currencies they work with on their homepage here.

And you can easily sign up on Xe for free to check how much you’d save on a transfer.

Cons of using Xe to transfer money:

- They don’t with all currencies

- You must open an account before getting a quote for the cost of your transfer…..but it’s free to open an account and super fast

- Sometimes it costs more to transfer with Xe than with Wise or CurrencyFair because their rates aren’t always as good (you’ll have to compare for your individual transaction to see what is best)

My personal experience with Xe:

Honestly, I’ve never used Xe. But I have a friend who tried using it to send money from the United States to Sweden and she said everything worked just fine and the cost was pretty good. Plus, I use them all the time to check currency exchange rates when I’m traveling overseas.

3. WorldRemit

WorldRemit is a licensed and authorized company by the National Bank of Belgium, with its headquarters based in Brussels. Their services are available in more than 150 countries, including the United States, the United Kingdom, India, Brazil, and various European countries. WorldRemit supports over 90 different currencies.

While WorldRemit does offer transfers to Brazil, it’s important to note that their website is not available in Portuguese. In addition to money transfers, the company also facilitates mobile top-ups in over 110 destinations. They apply minimal service and exchange fees, and the first international money transfer is fee-free, without any additional charges.

Pros of using WorldRemit for international money transfers:

- Low fees and first free transfer

- Services available in several countries

- Cell phone recharge option

Cons of using WorldRemit for international transfers:

- No website in Portuguese

Personal experience with WorldRemit: WorldRemit really does work at low rates, so it’s worth making a quote through this site and comparing it to others on the list. Also, your first download is completely free!

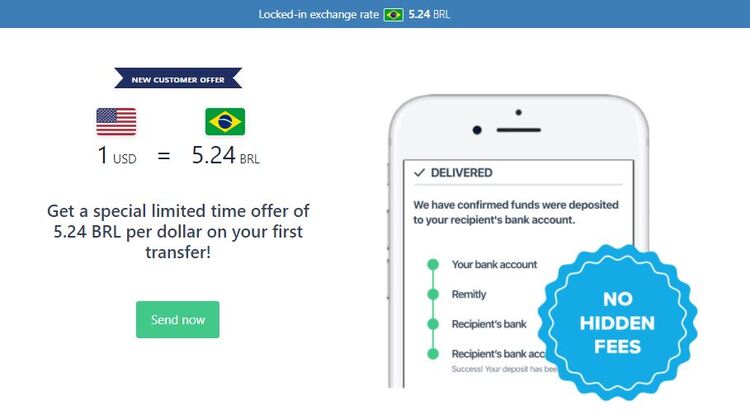

4. Remitly

Remitly has emerged as a prominent contender in the international money transfer industry. While it originally focused on serving customers within the United States, it has since expanded its reach to many countries worldwide.

One standout feature of Remitly is its convenient remote transfer service, which allows users to send money to another country and have it delivered in cash to the recipient’s preferred location through their delivery service.

In addition to their delivery service, Remitly facilitates online transfers to both traditional and digital bank accounts, providing users with a range of options for sending money securely and conveniently.

Pros of using Remitly for international money transfers:

- Remittance option delivered in cash to the desired address;

- Simple and super practical interface;

- Transfer option for digital accounts.

Cons of using Remitly for international transfers:

- The site is not available in Portuguese;

- Compared to other companies on the list, it does not work with a large number of countries.

Personal experience with Remitly:

I’ve never used Remitly, but user feedback is pretty positive. This is really a great option if you need to send money to someone who is not comfortable with technology or if you need cash on hand for a trip, for example.

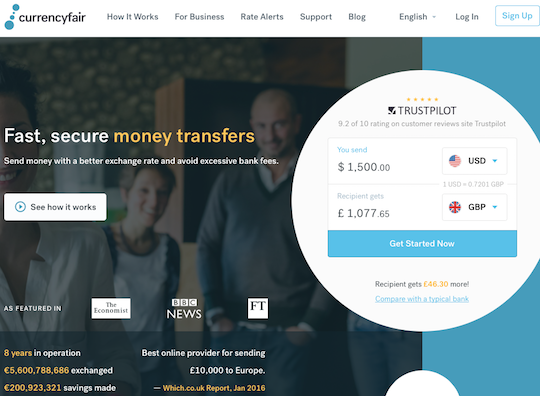

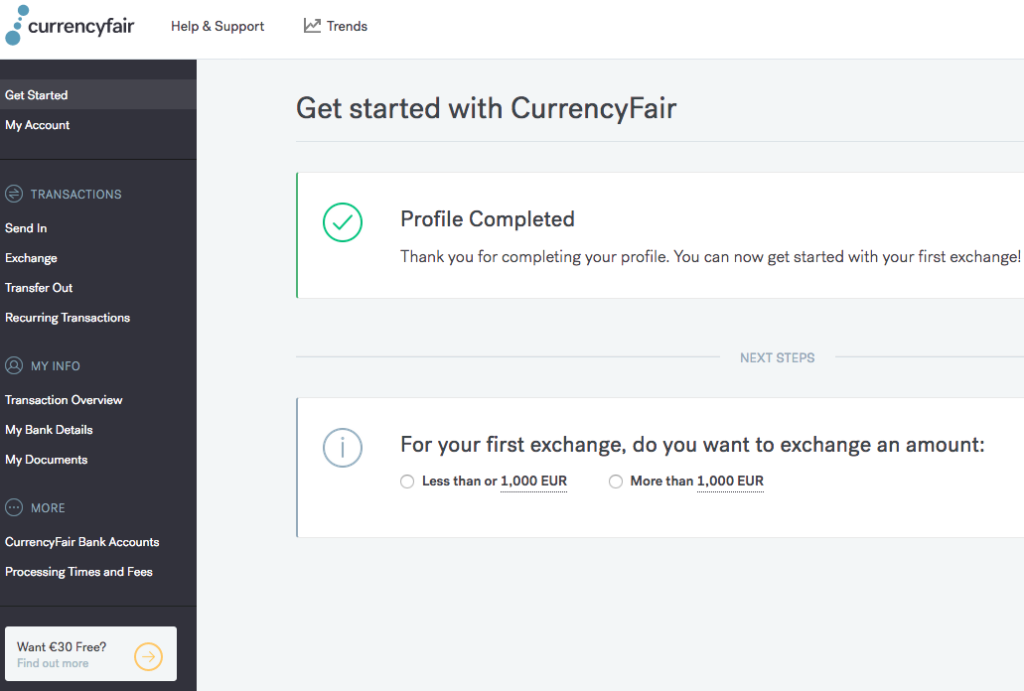

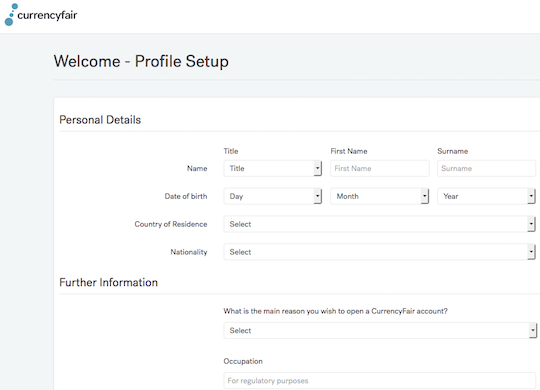

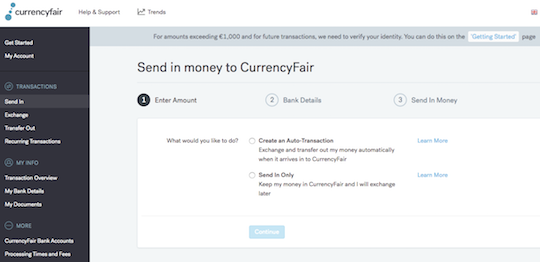

5. CurrencyFair

CurrencyFair functions in a manner similar to Wise, providing a comparable process for money transfers.

However, it is important to note that CurrencyFair has a limitation in terms of supported currencies, as it offers a narrower range and excludes certain currencies like the Brazilian real.

Pros of using CurrencyFair for international money transfers:

- It’s a super cheap way to send and receive money from other countries – they only charge around 0.35% of the total value, like Wise does

- They use the official exchange rate (which is much better than the “tourist” rates banks use)

- It’s super practical – you can do everything online

- You can send funds to more than 18 countries, including those that use the Euro

- As with Wise, you can use CurrencyFair for your Business to pay suppliers or employees

- It’s cheaper and faster than doing international transfers with a bank

- There isn’t a minimum transaction amount

- Now they are also working with Indian Rupee (INR)

Cons of transferring money with CurrencyFair:

- It only works with about half the number of currencies Wise does

Personal experience with CurrencyFair:

I’ve also used CurrencyFair to send money from the United States to Sweden, and it worked just as well as Wise did.

Here’s a quick video on how to sign up for free:

And how to do a transfer with CurrencyFair:

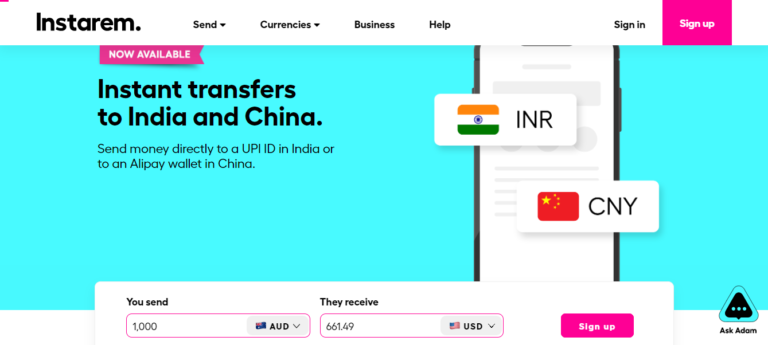

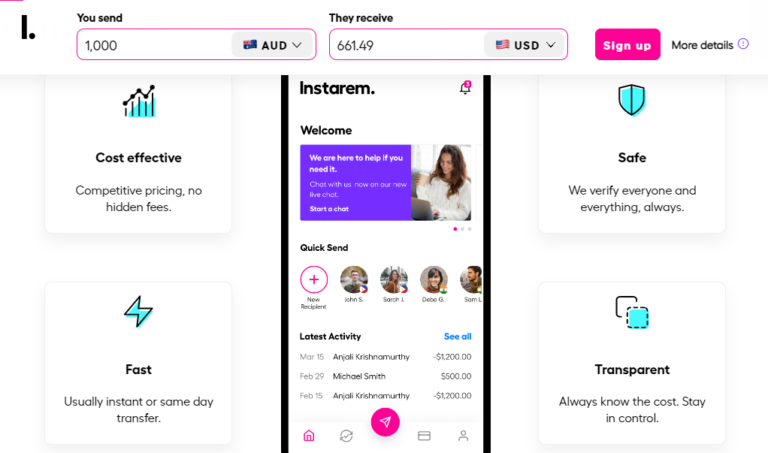

6. Instarem

Instarem is a fintech company that specializes in global currency exchange and money transfer services. Founded in 2014 and based in Singapore, the company operates in more than 25 countries worldwide, leveraging advanced technology to provide efficient, convenient, and cost-effective financial solutions.

One of Instarem’s key strengths is its commitment to offering highly competitive and transparent exchange rates, which are prominently displayed to customers. Additionally, the company has implemented a loyalty program that rewards users with points for their fast and seamless money transfers from anywhere in the world.

In addition to its financial services, Instarem also offers a comprehensive range of travel insurance products. These insurance solutions cover various contingencies, including medical emergencies, trip cancellations, and lost baggage, among others. Each insurance plan is tailored to the individual needs of clients and can be easily purchased through the mobile app or website. Instarem has partnered with leading insurance providers to ensure that customers receive optimal coverage and peace of mind during their travels.

Pros of using Instarem for international money transfers:

- The company is present in more than 25 countries, which allows it to serve a wide variety of customers around the world. In addition, the company’s geographic expansion has been constant and promising.

- Great Value: Low fees. Great exchange rates. nothing hidden

- Secure and reliable: Industry-leading technology moving $4 billion annually

- Rewards: Send money and earn points to enjoy even greater value

- Save time: skip the lines and send money quickly

- Anytime, Anywhere: Send money anywhere with our app

Cons of transferring money with Instarem:

- Transfer Fees and Limitations: Like any financial services company, Instarem charges money transfer fees and sets limits on transactions. This can make the company’s services less accessible to customers with lower purchasing power or who need to send large amounts of money.

Personal experience with Instarem:

Although I have never used Instarem, user feedback is generally very positive. This can be an excellent choice if you need to send someone money!

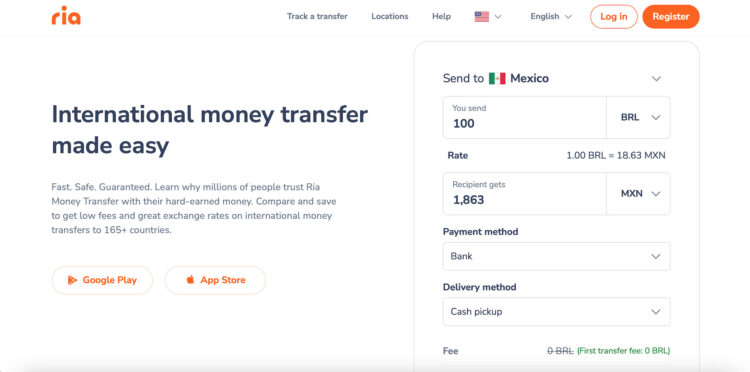

7. Ria

Ria is a well-known global company that specializes in providing convenient and reliable money transfer services to individuals worldwide. Since its establishment in 1987, the company has experienced rapid growth and currently operates from its headquarters in the United States.

Ria offers a comprehensive range of services, including wire transfers, bank deposits, and bill payments, ensuring that customers have diverse options to meet their specific needs. With a vast network of over 436,000 agent locations spanning across more than 160 countries, Ria has established a strong global presence.

The company is committed to delivering secure, user-friendly, and cost-effective solutions for money transfers. Their services are particularly valuable for individuals and families who want to send money to their loved ones living abroad, providing them with a reliable and trustworthy means of financial support.

Pros of using Ria for international money transfers:

- Ria has a global presence with over 436,000 agent locations worldwide, which makes sending and receiving money more convenient for its customers;

- Ria offers a wide range of payment options, including wire transfers, bank deposits and bill payments.

Cons of using Ria for international transfers:

- Ria imposes daily and monthly limits on the amount a customer can transfer, which can be an inconvenience for those who need to send large amounts of money;

- Ria may charge additional fees, depending on the destination country and the payment method selected by the customer;

- Ria may require customers to go through an identity verification process, which can be time consuming and inconvenient.

Personal experience with Ria:

Although I don’t have personal experience with Ria, user feedback is often highly positive. This can be an excellent option if you need to send someone money.

Bonus: Online International Money Transfer Companies

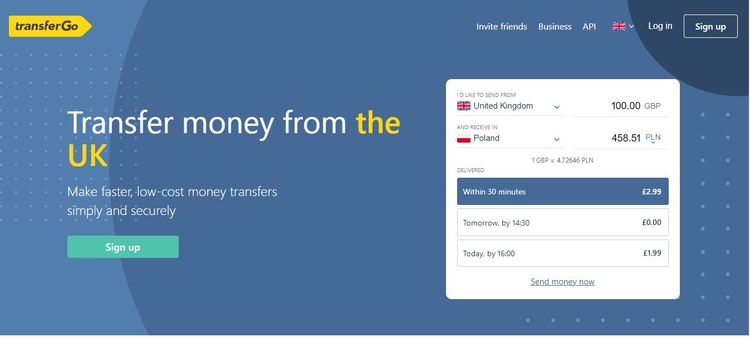

Bonus 1. TransferGo

TransferGo is a reputable provider of international money transfer services, primarily serving individuals in Europe who need to send money abroad.

While their services are available in over 60 countries worldwide, please note that transfers to Brazil are currently limited to customers with European bank accounts. However, TransferGo offers a variety of transfer options and competitive rates to cater to their clients’ needs.

Customers can conveniently send money using their bank account, debit card, or credit card, providing flexibility and ease of use. TransferGo offers two transfer speed options: fast transfers, which can be completed within 30 minutes, or low-fee economic transfers, which may take up to three days to finalize.

The transfer process with TransferGo is designed to be user-friendly and straightforward, ensuring a convenient and hassle-free experience for international money transfers.

When making transfers with TransferGo, you can use this code or coupon: HMSESq

Pros of using TransferGo for international money transfers:

- There are no daily limits for transfers on TransferGo

- They work with fast transfer options (for a fee of £2.99)

- They allow transfers directly from your bank account, debit card or credit card to foreign accounts

- They have a simple and practical interface to receive money from abroad

Cons of using TransferGo for international transfers:

- Each transfer may not exceed the $30,000.00 limit

- It is not possible to transfer money from the USA, Canada, among other countries to Brazil

Personal experience with TransferGo:

If you are looking for a company to transfer money from Europe to the rest of the world, this is a great option. In my experience, the whole process is done very simply and cheaply.

Bonus 2. OFX

OFX is a prominent global financial institution that specializes in providing money transfer services to individuals and businesses worldwide. Established in Australia in 1988, it has expanded its operations to other countries, including the United States, Canada, the United Kingdom, and New Zealand. With a focus on competitive exchange rates and low transfer fees, OFX aims to offer personalized services tailored to the specific needs of its clients.

The company is dedicated to providing secure, efficient, and cost-effective solutions for international money transfers, backed by 24/7 customer support. Whether it’s wire transfers, bill payments, or recurring transfers, OFX offers a variety of transfer options to accommodate the diverse requirements of its customers.

OFX is particularly beneficial for individuals and businesses that need to transfer significant amounts of money overseas, such as expatriates, international students, and global trade enterprises. With a proven track record of delivering exceptional customer service and satisfaction, OFX has earned a reputation as a reliable and highly respected participant in the international money transfer industry.

Bonus 3. PayPal

PayPal is a popular online payment platform widely used for transactions with different parties. It is commonly employed for making payments on platforms like eBay and other e-commerce websites.

While PayPal does offer international money transfer services, one limitation is that you can only withdraw funds to a US bank account.

However, you have the flexibility to use the funds in your PayPal account for purchases at online retailers that accept PayPal payments or transfer your balance to another PayPal user.

Pros of using Paypal for international transfers:

- It’s a very easy and practical way to send/receive money between almost any two people in the world

- It’s very popular

- You can use it to send/receive payments from overseas from any person that also has Paypal (since you only need an email to open an account)

- It’s super practical – you can do everything online.

- Works for people from all over the world (although you can only withdraw the money if you have a U.S. bank account)

- There’s no minimum transaction

Cons of using Paypal for international transfers:

- You can’t take money out of your Paypal wallet (if someone sends it to you) unless you have a bank account in the United States (otherwise, you’ll have to leave it in your Paypal account and can only use the money to buy things on websites that accept Paypal, like eBay)

- They charge a 3% fee on some transfers

- They don’t use the official exchange rate (they use the retail/tourist rate instead), so you’ll lose some money when you exchange from one currency to the other

Personal experience with Paypal:

I use Paypal directly to buy things on eBay and to receive payments from a few companies that only pay with Paypal. But I don’t use it for international transfers because I think the exchange rate is bad and the options above are better, so it’s up to you.

BONUS CRIPTO:

How to do international transfers using digital currency

Cryptocurrencies, like Bitcoin, have emerged as a modern alternative in the global financial market. Although still relatively new, their popularity is steadily growing.

A major advantage of digital currencies is their cost-effectiveness for international money transfers when compared to traditional channels. Additionally, transactions can be processed quickly within minutes, regardless of the recipient’s location.

- Coinbase (for getting digital currencies like Bitcoin, Ethereum, and Litecoin)

Consider utilizing Coinbase as a reliable platform for international money transfers using cryptocurrencies like Bitcoin. As the largest cryptocurrency exchange in the world, Coinbase has earned a strong reputation within the industry.

To begin, sign up for a free account on Coinbase and complete the identity verification process. Afterward, transfer funds from your bank account to your digital wallet and purchase the cryptocurrency of your preference. Coinbase supports various popular cryptocurrencies, including Bitcoin, Ethereum, and Litecoin.

Once you have acquired your desired cryptocurrency, you can easily send it to anyone worldwide who possesses a digital wallet. Simply enter the recipient’s digital wallet address and initiate the transfer from your own digital wallet.

Once the recipient receives the cryptocurrency, they can sell it for their local currency, such as Reais, Euros, or Dollars, and transfer the funds to their bank account through Coinbase.

The Coinbase platform is user-friendly, ensuring a seamless navigation experience throughout the entire process. Additionally, if you are interested in investing in cryptocurrencies, Coinbase is a reputable option due to its size and established track record.

How to invest in Bitcoins or other digital currencies

If you choose to hold onto digital currencies after purchasing them, you have the option to wait for their value to potentially increase and sell them in the future. However, it’s important to note that there is no guarantee that the currency will appreciate in value, and in fact, it can even decrease in value.

So be careful with investing in digital currencies! Don’t use money that you’ll need in short or midterm!

Pros of using cryptocurrency for international transfers through Coinbase:

- It’s a cheap way to send money between almost any two countries in the world

- It’s getting more and more popular

- You can use your bank account, debit card, or credit card to do the deposit into your digital wallet in Coinbase

- You can use it to receive payments from overseas from any person that has their own digital wallet (your digital wallet can be through Coinbase or any other platform that works with cryptocurrency)

- It’s very easy – you can do everything online

- There’s no minimum transaction

Cons of using cryptocurrency for international transfers through Coinbase:

- The value of the digital currencies still varies a lot (AKA: it’s highly volatile), so it’s possible that the amount you send may already be worth more or less by the time it arrives at the destination

- You have a pay a fee of a small percentage of the total value you deposit in Coinbase. If you use a credit card, this fee can be up to 3%

- It can take a few days for the purchase of Bitcoin to be finalized. With Ethereum and Litecoin, the buy and sell confirmation is faster

- It’s a new market and many people still don’t know how it works

Personal experience with Coinbase:

On a previous occasion, I opted to use digital currencies to pay for an online purchase, as it was more cost-effective compared to using credit cards. I chose to utilize Coinbase to purchase a small amount of Bitcoins and transferred them to the online store. The process was straightforward and the transaction went smoothly.

Summing up…

The 7 cheapest ways to receive, send, and transfer money abroad:

- Wise

- Xe

- World Remit

- Remitly

- Currency Fair

- Instarem

- Ria

- TransferGo

- OFX

- Paypal

- Coinbase

In Brief….

Similar to any significant financial undertaking, it is crucial to conduct comprehensive research and compare different options when it comes to international money transfers. By dedicating time to compare exchange rates, transfer fees, and other relevant factors, you can significantly reduce the expenses associated with sending or receiving funds.

To simplify the process, you can choose a specific amount, such as $500 USD, and assess each of the aforementioned options to determine which one offers the highest value in terms of the amount received. While this may require additional effort, it can ultimately lead to cost savings and ensure you secure the most favorable deal available.

Protect yourself against fraud and common scams with international money transfers!!

Use only the companies listed above to transfer money to trusted individuals or reputable companies with positive feedback. Do not transfer money to anyone you don’t know personally. Additionally, be cautious if a family member or friend sends you an urgent message requesting money but you are unable to contact them through phone, Skype, WhatsApp, or other reliable means.

By paying attention to strange signs like the ones below, you can tell if you’re being the victim of a scam or not….and then avoid it if you are. Think very carefully before making a transfer. If you’re not sure, don’t take the risk!

Don’t send/transfer money to people or companies:

- If you or your family/close friends don’t know them personally

- For a deposit to buy a property or a rent payment. Take note of this one because it is one of the most common scams for people that live abroad! ONLY send them if you are personally in the city where you are renting and you have personally visited the property & met with the agent/landlord of the place that’s to be rented or purchased. Seriously, this scam is a lot more common than you think….and a lot of people who move abroad get screwed by it!

- To buy something online. You shouldn’t have to use an international transfer for this, better to use a credit card or Paypal (which have payment protections)

- From a place claiming to protect you from a virus that doesn’t accept credit cards (since all trusted antivirus companies should)

- For an emergency situation that hasn’t been confirmed by a friend or family member

- To “redeem” lottery winnings or prizes….another super common scam!

- To make charitable donations. Ask for another way to contribute…be wary of any charity asking for international money transfers

- To start working as a mystery shopper. You should never have to pay for this, it’s free!

- To get a job….this is always a scam! Don’t pay a company to start working with them!

- For a credit card fee or loan. These fees are ALWAYS paid via your credit card and not through international money transfers

Use only the companies listed above to transfer money to trusted individuals or reputable companies with positive feedback. Do not transfer money to anyone you don’t know personally. Additionally, be cautious if a family member or friend sends you an urgent message requesting money but you are unable to contact them through phone, Skype, WhatsApp, or other reliable means.

Conclusion…

We have come to the end of this guide, focusing on making international money transfers with convenience, affordability, and security as top priorities. If you have any questions or concerns, please don’t hesitate to leave a comment in the section below. I’ll be more than happy to provide prompt assistance and address any inquiries you may have.