Moving to Canada (or Quebec) or are you already there as an expat? In need of health insurance coverage? Then read on for this complete list of the best companies to choose from, how to make your decision, how the Canadian health system works, and more!

If you have plans to move to Canada, you probably already know that you need to get a health insurance plan before you arrive. But do you know what the best options are for expats and immigrants in Canada?

If not, don’t worry! I’ll give you all the details (plus some important info to know before your move) below.

Let’s get started!

Why do you need a health insurance plan to immigrate to Canada?

The biggest reason to get a health insurance policy isn’t a secret: it covers you if you have an accident overseas. But why is it so important to do this before you leave your home country? And why should you bother getting a policy at all?

Well, here are the two reasons that I believe make this so important to do:

- You’ll have safety and peace of mind on arrival in Canada

- You’ll be covered in the “waiting period” before you’re covered by the Canadian health system

1. You’ll have safety and peace of mind on arrival in Canada

When you move to a new country, it’s normal for it to take some time to understand how everything works. Because of this, getting a health insurance policy before you leave your home country can help make your move a little easier. And if you run into any problems, you can rely on your insurance.

And another thing to keep in mind is that this health insurance isn’t only to be used in the case of emergencies. Depending on your policy, you can also use it to make appointments with specialists and do exams as you would back in your home country.

2. You’ll be covered in the “waiting period” before you’re covered by the Canadian health system

This is another important point for immigrants in Canada to pay attention to.

In Canada, each province has its own health insurance plan. In other words, if you live in British Columbia, you’ll use the Medical Services Plan. If you live in Ontario, you’ll use the Ontario Health Insurance Plan.

And naturally, the rules for using the system, pricing, and timelines for the arrival of your insurance card will change from province to province.

In some cases, even if you have the right to a provincial plan when you arrive in the country, your insurance card can take several months to be processed and issued. So having health insurance that will cover you (at least for those first few months in Canada) is a good idea.

How to choose the best health insurance as an expat or immigrant in Canada

Below, you’ll learn about the 7 best health insurance companies for anyone moving to Canada. But to help you choose the best one for you, here are the points I’d recommend you consider before making your decision:

- Is the plan for an individual? Or does it also cover a family (if you’re married, have children, are moving with your parents, etc.)?

- Does the plan include all the coverage you need (especially if you have any kind of sickness, disability, are pregnant, or need special treatments)?

- What is the customer support like? Is it 24/7? Is it offered in your language?

How does the Canadian health system work?

As I said above, the Canadian health system varies from province to province. Some offer a free health system, while others charge their inhabitants an amount monthly.

Either way, the health system in Canada is public (though not always free), and all residents have the right to a family doctor regardless of their province. This doctor is a general doctor who will stay with you long-term and refer you to other specialists as needed.

Regardless, even if you do qualify for the Canadian public health system, it’ll probably take some time until you can get into the system…so you’ll still want a separate insurance policy in the meantime. In which case, you’ll find a list as well as a table comparing what I think are the best insurance providers.

Afterwards, make sure you keep reading because I’ll also talk a bit about the various immigration programs Canada has for foreigners!

What are the 7 best health insurance companies for expats and immigrants in Canada?

As usual, I suggest you do a quick online quote on all the options I mention below. Although it takes some time, this will definitely help you save money at the end of the comparisons.

And now’s the time to see the best insurance providers for immigrants and expats in Canada and what I believe to be the pros and cons of each. They are:

- Cigna

- IMG

- Now Health

- Aetna

- SafetyWing

- Global Underwriters

- Foyer Global Health

1. Cigna ![]()

The first insurance provider on our list today is Cigna, an American company that also has a strong presence in many European countries. They are, without a doubt, one of the best options out there for anyone in search of international coverage.

They’ve been in business for more than 60 years and have offered plans to more than 170 million clients around the world. Nikki was even one of them herself when she needed a health insurance plan to get her residence card in Sweden!

Cigna has a wide variety of plans that work for anyone moving overseas, including individuals with plans to reside in Canada.

You can choose from individual or family plans. And their plans are very flexible – you can personalize and add benefits based on exactly what you need covered.

When you get your quote, you can choose from the Silver, Gold, or Platinum plan. Each plan will give you coverage in more than 200 countries and territories around the world.

You can also choose “Close Care” if you’re looking for a cheaper plan. In which case, this plan is only valid in your origin country and the country you’re going to be moving to.

Pros of an international health insurance plan with Cigna:

- They have 24/7 customer service

- They offer Covid-19 coverage including PCR tests

- Clients have access to an online portal where they can see the nearest hospitals that they have coverage at

- In most cases, you don’t pay the healthcare provider directly (Cigna pays them directly for your consultation so you don’t have to request reimbursement)

- They have tailored and flexible plans

- It’s easy to get a personalized quote (no need to input a ton of personal info)

Cons of an international health insurance plan with Cigna:

- Not all of their plans cover maternity care

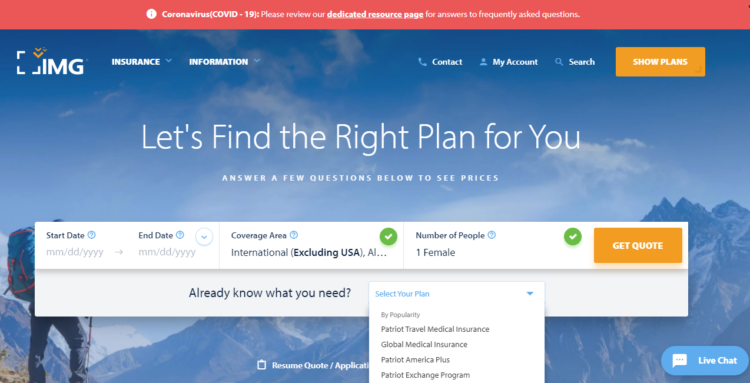

2. IMG ![]()

IMG is another large international health insurance provider. With more

than 25 years of experience, they currently operate with 3 subsidiaries around the world. In fact, this is one point that IMG highlights on their website: they offer 24/7 customer support in 18 languages!

When it comes to their plans, you have several options available…whether you’re moving alone or with a family. They have several plans created around specific reasons for travel, such as for immigrants and expats.

These particular plans are long-term with a 1-year minimum and can be renewed. However, you can also select shorter plans that still cover all you need.

You can easily see your options on their website by filtering according to the dates and plan length you’re looking for, your age, your reason for travel, your country of origin, and your destination country.

You can also add in info about your family so you can see plan prices for everyone.

But be sure to carefully read the specifications of each plan, since IMG doesn’t have plans for all ages.

Pros of an international health insurance plan with IMG:

- Multilingual 24/7 customer service

- Their network includes more than 17,000 doctors around the world

- Ability to adjust your plan benefits based on what you need for coverage (with 5 plans in total for you to choose from)

- The company considers COVID-19 like any other illness and injury

Cons of an international health insurance plan with IMG:

- They don’t offer plans for travelers above 75

Now Health International is driven by its name, aiming to deliver a service that is efficient, affordable, and readily available. The company places significant emphasis on cultivating a strong rapport with its customers. They prioritize providing clear and concise plan information and promptly resolving any inquiries or issues through their dedicated customer support team.

Now Health plans are specifically tailored to meet the diverse challenges experienced by individuals living abroad. They are designed to offer guidance and ensure seamless access to top-notch healthcare services worldwide.

Pros of an international health insurance plan with Now Health:

- Customized plans according to your needs

- Clear information and excellent customer service team

- Provides coverage in 194 countries and territories

- Plans with high coverage routine maternity coverage

Cons of an international health insurance plan with Now Health:

- You must wait a 12-month grace period to use maternity coverage.

- In some procedures, it is necessary to use the company’s reimbursement system, which means that you would have to pay for your care initially

4. Aetna (acquired by Allianz)

With more than 50 years spent helping clients around the world, Aetna is another trustworthy insurance option to consider before your move to Canada.

All of Aetna’s plans are very flexible, which is good news because they don’t have a ton of plans to choose from. But you do have the option to add complementary coverage, such as dental care.

Beyond this, the plans they do offer are high-quality and include coverage up to 5 million U.S. dollars!

All of their plans have the option of extending coverage to your family, and medical evacuations and repatriations are always included.

One of the most common Aetna plans expats and immigrants choose is Aetna Pioneer, which offers a minimum coverage of 1.75 million dollars. However, you can fill out the form on their website to get more info and see pricing for their other plans.

Pros of an international health insurance plan with Aetna:

- They include maternal care expenses

- They offer pre-trip support where you can ask questions (such as questions about regularly-used medications)

- They have an app available to help you find nearby providers

- 24/7 customer service

- You can choose from short- or long-term plans

Cons of an international health insurance plan with Aetna:

- They have few plans available and they do tend to be a little more expensive compared to the other options on this list

5. SafetyWing

Moving to Canada as an expat or immigrant often means navigating the complexities of the healthcare system. While Canada’s public healthcare is renowned for its quality, eligibility can take time, and not all services are covered.

SafetyWing’s Nomad Insurance Complete plan bridges these gaps, offering adaptable, private health coverage tailored for newcomers.

Why SafetyWing Nomad Insurance Complete is perfect for expats and immigrants in Canada

- Emergency and hospital coverage: Protects you during unexpected medical situations, including hospital visits and evacuations.

- Comprehensive benefits: Includes dental care, chronic condition management, and mental health support – crucial for settling into a new country.

- Support for families: Dependents can be added to your plan, with children under 10 covered at no additional cost.

- Bridge to public healthcare: Provides coverage while you wait to qualify for Canada’s public health system or as a supplement for uncovered services.

- COVID-19 treatment: Covers treatment if prescribed by a doctor, ensuring peace of mind during the pandemic.

- Global flexibility: Offers 30 days of free coverage in your home country for every 90 days spent overseas, ideal for maintaining international connections.

- User-friendly platform: Simplifies managing your policy, from sign-up to claims.

- 24/7 customer support: Ensures assistance is always just a call or click away.

Things to Consider

- Higher premiums for global coverage: Plans covering international travel and high-cost regions come at a premium.

- Login required for quotes: Final pricing details are only accessible after creating an account.

The Nomad Insurance Complete plan is an excellent choice for expats or immigrants seeking a private healthcare solution that complements or substitutes public healthcare in Canada. With its robust benefits and flexible coverage, it’s designed to make your transition smoother and stress-free.

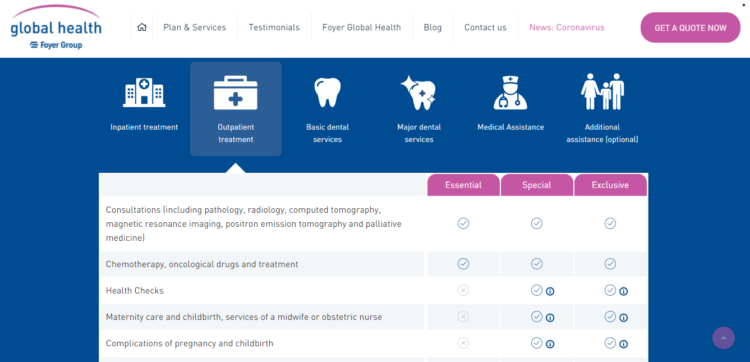

As part of the Foyer Group, a large European corporation, Foyer Global Health specializes in international insurance plans – whether for travelers, students, digital nomads, or expats.

Beyond being a safe and trustworthy company, Foyer Global Health also stands out for offering the greatest variety of plans for travelers and clients of all kinds.

Pros of an international health insurance plan with Foyer Global Health:

- 24/7 customer service by email and phone

- They offer evacuation and repatriation services

- All of their plans cover dental surgeries, appointments, and treatments

- They offer medical support and advice before your trip with vaccinations and the preparation of a first aid kit

Cons of an international health insurance plan with Foyer Global Health:

- Their website doesn’t make their coverage limit very clear

Global Underwriters offer international health insurance plans for a variety of travelers that may need them, including students, expats, and even digital nomads that are adventuring in a new country.

The plans that would probably be the best fit for immigrants in Canada are Diplomat Long Term and Diplomat International.

Pros of an international health insurance plan with Global Underwriters:

- 24/7 customer support

- Up to USD $1,000,000 available in medical coverage in the plans cited above, beyond USD 1,000,000 in coverage for accidental death and dismemberment

- The Diplomat Long Term and the Diplomat International plans offer coverage for emergency dental care, repatriation of mortal remains, and medical evacuations

Cons of an international health insurance plan with Global Underwriters:

- The Diplomat Long Term plan doesn’t cover trips to Iran, Afghanistan, or Cuba

- The Diplomat International plan doesn’t offer coverage for Covid-19 treatment

- They don’t offer coverage to residents of Australia, Iran, New York, Maryland, or South Dakota

Bonus

– GeoBlue

GeoBlue is another big name in international health insurance. They’ve spent more than 20 years helping clients with their digital health services.

However, it is important to mention that it is not possible to hire GeoBlue services if you are a citizen of New York or Washington. If that’s the case for you, I recommend you skip this option and go to the next one in the list.

But to give you some more details, GeoBlue has various plans to choose from based on your reason for travel, such as immigration. In which case, the best option is Xplorer Essential, which is a long-term plan that offers unlimited coverage and includes pre-existing conditions.

Or if you’d rather have a short-term plan, Voyager is another option to look into.

If you want to learn more about the plans and see detailed pricing for GeoBlue, you’ll have to fill out the form online and wait to be contacted by a consultant, which isn’t the most convenient…

Pros of an international health insurance plan with GeoBlue:

- 24/7 customer support

- Some plans offer unlimited coverage plus coverage for pre-existing conditions

- Access to an app and various other tools, such as telemedicine

Cons of an international health insurance plan with GeoBlue:

- Cannot be hired by Washington and New York residents

- You need to speak directly with an insurance consultant to get a quote

- Their plans aren’t very flexible

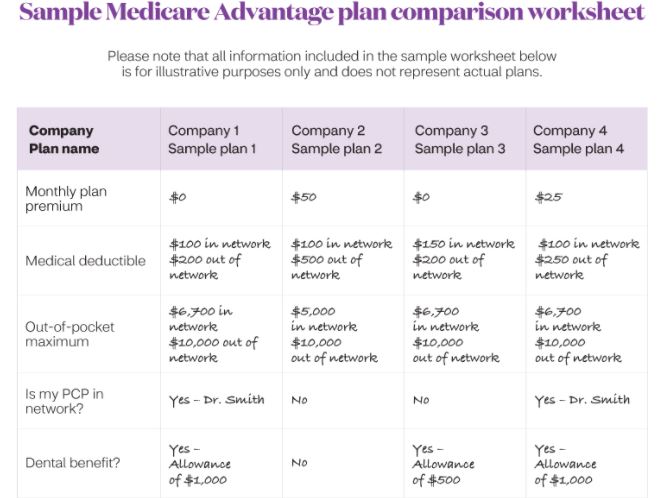

Comparative Table of the 7 Best Health Insurances for Expatriates and Immigrants in Canada

To help you with your decision, below you’ll find a table comparing the heath insurance providers listed above.

This way, you can get a better feel for the advantages and disadvantages of each to see which is right for you.

|

|

|

|

|

|||

| BENEFIT | LIMIT | LIMIT | LIMIT | LIMIT | LIMIT | LIMIT | LIMIT |

| Benefit Information | |||||||

| Medical Maximum | Unlimited (for the Platinum plan) | $8,000,000 | The site doesn’t specify | Unlimited | US$1,000,000 per year | The site doesn’t specify | $1,000,000 |

| U.S. In-Network Coinsurance | You choose. From 70%(100% thereafter) to 100% | 100% | No | 60% for maximum coinsurance and then 100% | Yes, for higher fees | Only in emergencies | Yes |

| U.S. Out-of-Network Coinsurance | You choose. From 70%(100% thereafter) to 100% | 90% to $5,000 (100% thereafter) | Yes, for higher fees | 100% | 100% | 100% | 100% |

| Mental Health Availability | No waiting period | 12-month waiting period | Co-payment of $25 per visit, waived deductible | 75% up to 40 visits / 60% after that | No | Waiting period of 10 months | Depends on the plan |

| Mental Health Benefit | Inpatient and Outpatient: $5,000 lifetime maximum to paid in full depending on the plan | Inpatient and Outpatient: $50,000 lifetime maximum | Co-payment of $250 after deductible | 100% up to 60 days | International and ambulance: limit not specified | ||

| Inpatient Prescription Drugs | $500 to paid in full depending on the plan | Up to $8,000,000 | Yes | Complete reimbursement | Yes | Yes | |

| Outpatient Prescription Drugs | None, unless you buy the International Outpatient Option | Up to $8,000,000 | Complete reimbursement | Yes | Yes | ||

| Evacuation and Repatriation of Remains | Paid in full | Up to $8,000,000 | Yes | Up to $25,000 | No | Up to 10,000 euros | Yes |

| Accidental Death & Dismemberment | Depends on the plan | Rider available, limit depends on age. | $50,000 | Depends on the plan | |||

| Emergency Dental | Paid in full | Up to $8,000,000 | Optional | 1,000 per year, $ 200 per tooth | Yes, however you need to pay an extra fee on top of your plan | Depending on the plan, it’s unlimited | It has coverage in the Diplomat Long Term and Diplomat International plans |

| Treatment Necessary as Result of Terrorism | Up to the amount of the coverage | Rider available up to $50,000-lifetime maximum | Clause available up to maximum of $50,000 in lifetime payments | ||||

| Amateur Sports | Unlimited | Rider available up to $10,000 | No | Yes | No | No | No |

| Newborn Care | |||||||

| Routine Nursery Care of a Newborn Child of a Covered Pregnancy | $25,000 to $156,000 depending on the plan | $1,000 additional deductible, $50,000 lifetime maximum, $200 wellness benefit for first 12 months | Yes | Depends on the plan | Can be unlimited depending on the plan | Can be unlimited depending on the plan | |

| Children born as a result of fertility treatment (such as IVF or surrogacy) | Only after the baby is 90 days old | Excluded | Depends on the plan | Excluded | No | ||

| Neonatal Intensive Care Unit | Check website for updated information | $250,000 maximum for first 31 days | No | Up to $250,000 for the first 31 days | No | ||

| Pre-existing Conditions | |||||||

| Pre-existing condition exclusion period | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness |

| Pre-existing condition look back period | Any time prior to effective date | Any time prior to effective date | Any time prior to effective date | Any time prior to effective date | Any time prior to the effective date | Any time prior to the effective date | Any time prior to the effective date |

| Pre-existing annual maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Unlimited depending on the plan | Unlimited depending on the plan | Full reimbursement | Unlimited depending on the plan | Unlimited depending on the plan |

| Pre-existing lifetime maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Unlimited depending on the plan | Unlimited depending on the plan | Full reimbursement | Unlimited depending on the plan | Unlimited depending on the plan |

Worldwide Medical Insurance / Comparison Chart*

Part of the table courtesy of Tokio Marine HCC

*Note: this table is just for informational purposes and subject to change. It was accurate as of the time we wrote it here, but please check each company’s individual website for updated info.

Who do these international insurance policies work for?

In most cases, the companies above work for the following citizens who live in Canada as expats or immigrants:

- Americans

- Canadians

- Australians

- Chinese

- Germans

- French

- Argentinians

- Brits

- Swedes

- New Zealanders (Kiwis)

Plus for citizens of most of the rest of the world.

Beyond expats and immigrants in Canada, these same insurance providers can also work for individuals with plans to reside in:

- The United States

- Canada

- China

- Hong Kong

- Japan

- Australia

As well as for expats that live in most of the rest of the world.

To make things simple, as the recommendations here are international insurance providers, they work for just about everyone.

Main immigration programs in Canada for foreigners

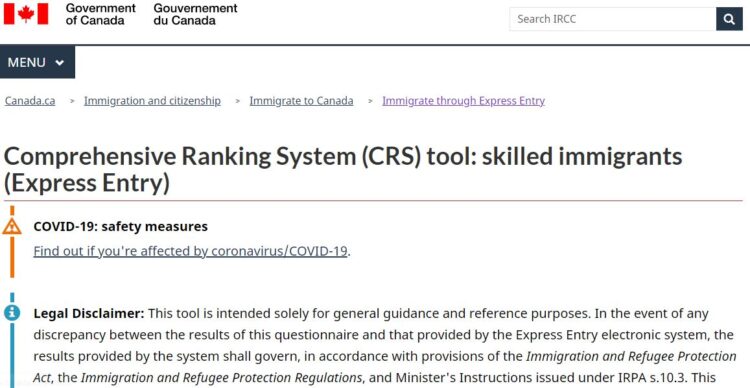

Finally, if you’ve gotten this far, it’s probably because you’ve already heard a bit about some of the immigration programs Canada offers – such as Express Entry (the most common), or the provincial programs from British Columbia or Quebec.

In 2021, the Canadian government announced it was in search of more than 400,000 new residents. With this in mind, it’s safe to say that immigrants in Canada are welcome both by the government and the local population.

So if you’ve ever dreamed of living overseas, Canada can be a great option. Below I’ll share a bit more about Canadian immigration programs and how you can apply.

Federal programs: Express Entry

The federal programs encompass all the Canadian provinces. In other words, if you qualify you can live wherever you like in the country. This is different from the provincial programs, in which you apply directly for a specific region.

Express Entry (EE) isn’t exactly an immigration process, but a system based around points. In which case, your age group will give you a specific number of points, as will your professional experience, your English and French level, your education level, if you already have a job in Canada or if you’ve studied there…

In the end, you’ll have a total score. And it’s this score that determines if you’ll be called to any of the current immigration processes which may include:

- Federal Skilled Trade

- Federal Skilled Worker

- Canadian Experience Class

From there, all profiles go to a “pool.” When a new “cutoff score” is issued for one of the processes above, anyone who has reached this score is called to apply for a visa or permanent residence (PR).

You can see what your current score is on the Express Entry calculator.

Provincial immigration programs

Beyond the federal processes, each province in Canada also has its own immigration program. Some of these programs select their applicants through the Express Entry pool, others don’t.

Some of the most popular provincial programs include:

- BCPNP – British Columbia Provincial Nominee Program: selection is made through the Express Entry pool and is ideal for qualified or semi-qualified professionals in the health field, or for entrepreneurs

- PEQ – Programme de l’expérience québécoise: this program was designed for anyone who already has some work experience in Quebec

- FSSW – French Speaking Skilled Worker Stream: this program from the province of Ontario is aimed at applicants with an excellent level of French and English. Selection is made through the EE pool.

I recommend taking a look at the Express Entry website for more information about how each of these selection processes work.

In sum…

Here are the 7 best health insurance companies for expats and immigrants in Canada:

- Cigna

- IMG

- Now Health

- Aetna

- SafetyWing

- Global Underwriters

- Foyer Global Health

In conclusion…

Well, that’s it! If you have any final questions about any one of these insurance providers recommended here (or about moving abroad in general), just let me know in the comments area below and I’ll get back to you!