Are you a digital nomad and like to live in different places around the world? Need international health insurance to cover you in multiple countries? Then you need to know the 7 best international health insurance options with the best cost benefit that suits you!

We know that health insurance they are essential requirements, both for our comfort and safety, and for going to a new country – to travel or to live. In this way, many companies extrapolate in prices knowing that their service will be contracted one way or another, as it is a necessity.

So, to help you, I’ve listed the best international health insurance plans for digital nomads. Those privileged people who work online from anywhere in the world… are you one of these?

Living in Portugal offers many advantages: warm climate, Atlantic Ocean, nearby mountains, low crime rate and relatively low cost of living. Medicine and education are well developed, which makes Portugal a great choice for digital nomads!

The 5 Best Cities for Digital Nomads in Portugal

- Lisbon – Famous for its UNESCO sites like Sintra and its rich Moorish history, Lisbon offers many amazing things for digital nomads to enjoy.

- Porto – Porto has a lively vibe and is an ideal choice for digital nomads who want to spend their weekends partying and indulging in delicious food and wine.

- Ponta do Sol – Ponta do Sol is one of the sunniest areas in Portugal and home to many beautiful beaches. You cannot expect to find many digital nomads and tourists in this beach town, allowing you to enjoy calm and tranquility.

- Lagos – Lagos is a beautiful beach town in the south of Portugal, offering great weather, beautiful beaches, lots of fun outdoor activities and good infrastructure. As a compact beach town, getting around is very easy, even without a car.

- Ericeira – For digital nomads who want to spend their free time surfing the waves, you should consider staying in the small town of Ericeira, dubbed the surfing capital of Europe. It has eight kilometers of coastline and is home to many beautiful beaches famous for their world-class waves.

That said, the options of insurance I’ve separated below will help you to research the best health insurance policy that fits your needs!

But first…what is a digital nomad?

The digital nomadism has been around for a few years now, but it has seen a significant increase during the COVID-19 pandemic. During the quarantine, many people stopped working at the office and were relocated into their homes and, as a result, people began to seek a freer routine closer to nature.

So, remote workers who chose to work in other countries and at the same time do leisure and tourism are called digital nomads or digital nomads, in English. These people only use a notebook to carry out their tasks and they are paid for it, so why not be able to travel around the world working?

For those who work in the areas of creativity, such as copywriters, publicists, designers or simply those who have a stressful work routine and want to relax. Is there anything better than working facing the sea, on a paradisiacal beach?

(To be honest, I’ll confess… I can assure you, from personal experience, that working on the beach is not as pleasant or practical as it seems. But although working on the beach may not be as good, what’s great is being able to see the sea from where you are working or being able to go to the beach easily after work )

Several countries thought of possibilities that could stimulate local tourism, favor the economy and make the travelers satisfied! So, countries like Costa Rica, Bermuda, Barbados, Portugal, Georgia (the country, not the state in the US!), Estonia, among many others, began to offer visas to digital nomads or people who were working remotely during the pandemic!

Now that you know what a digital nomad is, a lifestyle that is growing more and more with the rise of remote work, let’s understand the importance of having health insurance before venturing out into the world! In this case, in Portugal!

Why do I need international health insurance as a digital nomad?

Many people who are planning their trips do not give much importance to health insurance for digital nomads or even forget about it. But, to live in Portugal, it is very important that you have yours up to date!

First, it is important to think that the private health service abroad is very expensive and that not all countries have a public health system, not even for citizens, let alone for digital nomads…

You also have to think about the risks of living in a different country, of being in a place you don’t know, living new experiences and the famous “to be in a pickle” (food poisoning, who never?). Better not count on luck, right?

So, pay attention here at this quick list of reasons to be concerned about your health insurance BEFORE you leaving home:

1. You’ll probably need an insurance policy to get a resident or digital nomad visa

It’s true, not all countries require health insurance for expatriates and digital nomads entering the country. However, as I already explained, you will be moving to a new and probably unknown country, which makes you more vulnerable to health or safety issues.

Even if it’s not about the law, it’s essential to take care of your own health and make sure you have medical coverage when you need it. No one wanna move to be in a pickle, right?

2. An international health insurance policy protects your health & well-being

You know that we only really know a service when we see or use it in practice, don’t we? As much as the country you will move to offers a public health system, we can’t be sure how your experience will be when you need it. Specially so if you need some specific service or exclusivity.

An international health insurance gives you the assurance and peace of mind that no matter what happens, you will receive high-quality medical care. That way, you won’t have to worry about emergencies abroad (yours or your family’s).

Also, in most countries in the world, the private healthcare system is better than the public one. And with an insurance policy, you can easily access the private system in Portugal (which can be very expensive without insurance!).

3. A health insurance policy gives you access to better quality medical care

No wonder international health insurance is a requirement in most countries. As mentioned at the beginning of this article, the expenses for private medical services can be VERY high, even for the simplest services… even more so if you are doing telecommuting in the United States where the health system is almost entirely private and costs a fortune! !

It is important to be aware of the fact that, in countries that do not have this requirement, prices are likely to be abusive as well.

So, international health insurance is a guarantee of access to quality health care, but it can also help you avoid incredibly expensive health costs – which could even lead to personal bankruptcy!

Why is it important for digital nomads to take out international health insurance and not just travel insurance?

Yes, with a digital nomad visa you are legalized in the country as a kind of “resident”. But, if you intend to spend a long period in the place or even get the residency through a work visa, you must have an international health insurance itself.

What is important to consider before taking out health insurance for digital nomads?

And finally, we can talk about the best (and cheapest!) international health insurance options.

But you must be thinking: how will I know which health insurance plan is best for me?

Don’t worry, here is a list of questions to consider before making your decision:

- What type of coverage does each plan offer?

- How many hospitals and practices does the plan cover?

- Your specific needs or those of your family.

- Quality of service and customer support

Let’s understand better:

1. The coverage that each international health plan offers

One of the main factors when choosing your international health insurance is to consider coverage. To know whether it is right for you, there are a few questions to keep in mind:

- What is the scope of the plan? Can I have appointments in other cities or countries if

- I’m traveling? If I am an expatriate as a digital nomad, will I be able to use the plan in other countries? Would it cover the entire Portugal?

- Is this the ideal plan for all my family’s needs?

- Is it possible to customize the plan according to my priorities and/or my family’s needs?

- How many people are covered by the plan? How much for additional members?

2. The number of hospitals and practices covered by the international health plan

One more important factor to be taken into consideration before hiring a plan. In addition to quality, it is also essential to pay attention to the number of hospitals and offices that you will have available for use, especially if you are moving to a small town.

The greater the number of options, the easier it is for you to have consultations, exams or emergencies, and you can even choose the hospital closest to your home or that the service is faster.

The last tip, but not least: There are several international health plans that you can use the network’s medical services without paying anything, but there are also others where you pay and only then can you request a refund (we don’t recommend the latter if you can avoid it, as it can be difficult to get insurers to pay what they owe).

Thus, the greater the coverage of the plan, the better.

3. What are your specific health needs or pre-existing conditions for you and your family?

Most of health insurance offers specific coverage for pre-existing conditions, and it is very important to do your research and know the type of coverage from the company you are interested in.

Remembering that not all insurances have unlimited and free coverage for pre-existing illnesses, specific treatments or even pregnancy.

So if there’s a specific type of treatment or medical care you think you might need, make sure the plan you’re considering includes that.

4. How good is the insurance company’s customer support?

Another important factor is the quality of service provided by the contracted company, as if you need to claim your insurance, this will be a differentiating factor in your experience with the insurance company.

There are some critical and decisive points when hiring the health insurance service offered by the company: I recommend looking at their response times, successful filed claims and customer reviews (but one thing to keep in mind here: the insurance companies basically always have low ratings, so take them with a grain of salt).

If you do not speak English or the language of the country where you will be moving, it is interesting to find out if the company has services in other languages, including your native language. We know what unforeseen events are like, and when you’re desperate, it’s good to be sure that you can count on a quality and efficient support service – and in a language that you understand.

An indispensable point is to know if the company offers 24/7 service (all plans listed below do), so as not to be caught by surprise and stay on hand when you need it most.

Who does these international health insurances cover?

The international health insurances on this list provide coverage for these citizens who live abroad as digital nomads:

- Americans

- Canadians

- Australians

- Chinese

- Germans

- French

- Argentineans

- British people

- Swedes

- New Zealanders

And for citizens of almost every other country living abroad

For digital nomads residing in:

- U.S

- Canada

- China

- Germany

- Sweden

- Spain

- Portugal

- France (European Union/Schengen area as a whole)

- United Kingdom

- China (and Hong Kong)

- Australia

- Switzerland

And for expats living in almost any other country in the world

In short, no matter where you live or where you want to go, most of these health insurances will be able to offer you a good service, as they are companies with global services.

Tip for Cheap International Transfers: if you are a Digital Nomad and need to send or receive money from abroad, take a look at our article with the 7 Best and Cheapest Apps and Websites for International Transfers.

The 7 Best & Cheapest International Health Insurance Plans for Digital Nomads

Tip: I always recommend that you get a quick quote with all the companies listed below. Despite the work, at the end of your research, you can save a lot of money.

1. Cigna

As an American insurance company, Cigna follows the American standard when it comes to customer service and efficiency. They seek to provide you with access to quality health care without too many bureaucracies, from anywhere in the world. It already has more than 180 million employees and has offices in several countries around the world.

When we were living in Sweden, Nikki got an insurance policy from Cigna to have sufficient coverage and medical help, as well as meet the requirements to get her residency permit.

Because of this, Cigna is a great option if you’re also in search of a health insurance plan to meet your visa or residency requirements.

Of course, this doesn’t mean you should ignore the questions above…and I’d still recommend checking out all the companies on this list to make sure you’re getting the best plan!

That said, we had a good experience with Cigna. It was easy to find the right plan, and it was easy to cancel the policy once Nikki received her residency and got access to the public healthcare system. However, since we never filed a claim with them, we can’t speak on the ease of this process.

Here are some of the positive and negative points about Cigna.

Pros of digital nomad insurance with Cigna:

- They have flexible deductibles (in other words, you can control what you pay in advance)

- You have flexible payment options (monthly, trimester, or annual)

- You don’t need to request a reimbursement/file a claim since the company will pay your health provider directly

- You have 3 types of plans to choose from: Silver, Gold, Platinum

- The basic plan covers some types of cancer screenings and up to $100 in ophthalmology annually

- They have 24-hour customer service, 7 days a week

- They offer medical coverage in the Middle East

- They have plans that include the transplanting and transportation of organs as well as kidney dialysis treatments

- The company’s website has information about the financial system, culture, and schooling system of the country you’re going to

- COVID-19: Cigna covers all potential costs in the treatment of this illness, in compliance with the protocols recommended by the WHO

Cons of digital nomad insurance with Cigna:

- You have to put in a lot of personal info to get a personalized quote

- If you plan to have a child during your stay abroad, you’ll need to invest in a more expensive policy since the basic plan doesn’t cover maternity help

2. Now Health

Now Health is a bonus option worth mentioning, this company is one of the leaders in the international health insurance market and has been serving clients around the world for years.

Now Health’s main mission is to provide a quality service with clear and efficient communication. Therefore, their customer service is exceptional and one of their main qualities.

Another advantage of this company is its varied plans with customizable options available to its customers with the most varied profiles and needs.

Pros of digital nomad insurance with Now Health:

- Provides coverage in over 190 countries and territories

- Flexible plans with many customizable options

- Options for plans with maternity coverage

- 24/7 service focused on agility and efficiency

Cons of digital nomad insurance with Now Health:

- Some exams and services need to go through the company’s reimbursement system

- To use maternity coverage, you must meet the 12-month grace period of the plan

3. IMG

Considered to be one of the best health insurance companies for digital nomads, IMG has been working with insurance for more than 30 years.

One major advantage of IMG is that they have global customer service and it’s very easy to get in contact with them. With their live chat feature, you can ask questions about the plans and get answers quickly when you need them.

Nikki and I have personally used the “Patriot America Plus” and “Global Medical Insurance” plans and had a good experience. But like Cigna, we also didn’t need to file a claim with IMG so we can’t speak to this part.

Pros of digital nomad insurance with IMG:

- They have extensive coverage with more than 17,000 doctors and clinics around the world

- There are 5 different plans for you to choose from

- If you use your IMG policy with a health provider outside the United States, you can get a 50% reduction on your deductible

- There are special health insurance plans for overseas missionaries

- There’s an automatic debit payment option

- They have an efficient online portal with access to emergency services available 24 hours a day, 7 days a week

- They have coverage for all nationalities

- The company considers COVID-19 as any other illness and injury, subject to the terms and conditions of the policy

Cons of digital nomad insurance with IMG:

- There’s an age limit with no plans available for adults above 75 (however, if you get an insurance policy when you’re 65+, you can sign up for IMG’s lifetime plan instead)

- Only the most expensive plan offers maternity care coverage (and it only offers it at a minimum of 10 months after your policy has begun)

4. Allianz Care Global Assistance

Our final health insurance company on the list today is German insurance company Allianz.

One of the best features about Allianz is that they have a specific program made just for expats.

Pros of digital nomad insurance with Allianz:

- You don’t need to request a reimbursement/file a claim since the company will pay your health provider directly

- They have 24-hour customer service, 7 days a week

- They have a medical phone app that’s available to you 6 months after the start of your contract

- Beyond your plan, they also have a specific program for expats (including info about the specific country you’re moving to)

- They have coverage on all 7 continents

Cons of digital nomad insurance with Allianz:

-

- You don’t have very many plans to choose from

- Although their website has a lot of info about COVID-19, it doesn’t clarify whether or not they offer COVID coverage

5. Global Underwriters

Global Underwriters is another great insurance option for digital nomads, that’s because this company has been in the market for years, always offering plans with different alternatives for travelers around the world.

The most recommended plans for digital nomads are Diplomat Long Term and Diplomat International, in both cases the coverage is very complete and meets the needs of foreigners residing in other countries relatively well.

Pros of digital nomad insurance with Global Underwriters:

- Coverage of up to $1,000,000 in medical care and accidental or dismemberment deaths

- Plans covering medical evacuations, repatriation of remains and emergency dental treatment

- Provides assistance in cases where there are interruptions during your trip due to health reasons or loss of luggage

Cons of digital nomad insurance with Global Underwriters:

- The Diplomat Long Term plan does not have coverage in Cuba, Afghanistan and Iran

- Diplomat International does not provide coverage for covid-19

- The Diplomat Long Term plan does not serve residents of New York, Maryland, South Dakota, Australia and Iran

6. SafetyWing

SafetyWing is a modern insurance company that has quickly adapted to the innovations in the industry – and has today earned a spot as one of the best insurance providers for digital nomads.

All you have to do is look at the website to see how different they are from other insurance companies – featuring a modern, colorful, and intuitive design…plus policy options that cover medical and travel expenses.

They also have a few exclusive and innovative options, such as offering 30 days of health coverage in your home country for every 90 days that you spend overseas.

The website is very “smart” and focuses on self-service. That said, it makes it easy for you to solve any issues you might have quickly and without much hassle.

Pros of digital nomad insurance with SafetyWing:

- As with the other companies, you can personalize your plan based on your coverage needs

- The website is very functional and gives you a clear idea of how much your plan will cost and how the coverage for each plan works

- They cover children under 10 for no extra charge

- You can add extra services to your policy like dental, maternity care, physical therapy, family medicine, deductible expenses, and outpatient services

- They offer $100 in coverage for repatriation after an evacuation

- If you’re treated at a public hospital free of charge OR if your treatment is covered by another insurance, SafetyWing will give you a daily allowance of $125 per night for up to 30 nights

- They offer full value coverage for cancer treatment and reconstructive surgeries

- They have 24-hour customer service, 7 days a week

- They offer total COVID-19 coverage when recommended by your doctor

- Their website has a fun, playful design which is much easier to use than most of its competitors

Cons of digital nomad insurance with SafetyWing:

- The quote you see on the website doesn’t include all the fees (to see the final price, you’ll need to create a login)

- The plans that cover the United States, Singapore, and Hong Kong are much more expensive than those for the other countries

7. GeoBlue

In search of high-quality insurance with extended coverage and class A service? Then GeoBlue is a great option for you!

In an effort to make life easier for those it insures, GeoBlue tries to offer customized service, including a variety of coverage for you to choose from and short- and long-term plans.

Beyond this, GeoBlue also has insurance plans for a wide range of customers such as missionaries, teachers, students, yacht crews, immigrants, or digital nomads.

Pros of digital nomad insurance with GeoBlue:

- They have 24-hour customer service, 7 days a week

- They have a wide range of options for plans

- They have plans that cover accidents from extreme sports

- They don’t charge deductible fees for standard services or cancellations, and have unlimited medical service

- They have plans designed exclusively for digital nomads, immigrants to the U.S., and Americans who live overseas

Cons of digital nomad insurance with GeoBlue:

- They don’t offer coverage for individuals who live in New York or Washington

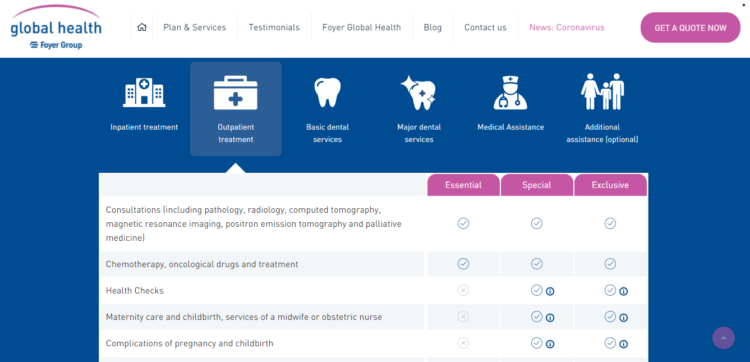

Bonus #1 – Foyer Global Health

Foyer is a large player in the health insurance world and is one of the largest insurance companies in Europe.

They offer many different types of plans and is an ideal company for digital nomads in search of international travel insurance.

Pros of digital nomad insurance with Foyer Health:

- As with the other companies, you can customize Foyer plans based on your characteristics and medical necessities, such as age, country of origin, dental care, vaccines, maternity, young children, etc.

- You can also personalize your level of coverage for each of these elements from nothing to the maximum coverage

- You have the option of selecting an individual plan or a family plan with or without children

- Unlike many other companies, the process for getting a quote is very simple and you don’t need to give much info

- They have multiple options for deductibles

- They have short-term plans for those who don’t plan to spend a long time overseas

- You can easily compare plan prices and coverage to find the one that’s best for you

- They offer travel insurance for digital nomads anywhere in Europe (and the world)

Cons of digital nomad insurance with Foyer Health:

- As with the other companies, Foyer’s most basic plan doesn’t include maternity or newborn care

- Their customer service gets the job done, but isn’t as practical as the others on this list

- The website isn’t very clear about the coverage limits

- Although they have a lot of info about COVID-19 on their website, they don’t make it clear if their plan covers COVID treatments or not

- They charge a 5 euro fee for emergency support

- They don’t have health insurance for digital nomads in the United States (only medical help for emergencies)

Bonus #2 – Aetna (acquired by Allianz)

Beyond the quality of the service and its accessible health solutions, Aetna has been in the world of insurance for more than 50 years.

It’s one of the biggest health insurance providers in the United States and has one of the cheapest international health insurances that can be used by digital nomads.

They have a pretty decent customer service team that’s available to help 24 hours a day, 7 days a week.

Pros of digital nomad insurance with Aetna:

- They have plans personalized for digital nomads based on your destinations and coverage needs

- They have 50 years of experience and offices in more than 15 countries

- They have 24-hour customer service

- They’ve been named the “Best International Private Health Insurance Provider” and “Health Insurer of the Year” by various magazines

- Most of their plans include coverage for hospitalization, cancer treatment, repatriation, and emergency evacuation

Cons of digital nomad insurance with Aetna:

- Their site doesn’t offer a lot of explanation about what’s actually included in their plans

Table comparison of the 7 best international medical insurance companies for digital nomads

To help you make the most of all the information I gave you above, here’s a table comparing all the companies I talked about. With the help of the table, hopefully you can have a better idea of which insurance company is right for you for your move overseas.

|

|

|

|

|

|

|||

| BENEFIT | LIMIT | LIMIT | LIMIT | LIMIT | LIMIT | LIMIT | LIMIT |

| Medical Maximum | Unlimited (for the Platinum plan) | $8,000,000 | The site doesn’t specify | Unlimited | US$1,000,000 per year | The site doesn’t specify | Depending on the plan, can be up to $1 million |

| U.S. In-Network Coinsurance | You choose. From 70%(100% thereafter) to 100% | 100% | No | 60% for maximum coinsurance and then 100% | Yes, for higher fees | Only in emergencies | Yes |

| U.S. Out-of-Network Coinsurance | You choose. From 70%(100% thereafter) to 100% | 90% to $5,000 (100% thereafter) | Yes, for higher fees | 100% | 100% | 100% | 100% |

| Mental Health Availability | No waiting period | 12-month waiting period | Co-payment of $25 per visit, waived deductible | 75% up to 40 visits / 60% after that | No | Waiting period of 10 months | Yes |

| Mental Health Benefit | Inpatient and Outpatient: $5,000 lifetime maximum to paid in full depending on the plan | Inpatient and Outpatient: $50,000 lifetime maximum | Co-payment of $250 after deductible | 100% up to 60 days | International and ambulance: limit not specified | Inpatient, outpatient, and therapy: limit not specific | |

| Inpatient Prescription Drugs | $500 to paid in full depending on the plan | Up to $8,000,000 | Yes | Complete reimbursement | Yes | Yes | |

| Outpatient Prescription Drugs | None, unless you buy the International Outpatient Option | Up to $8,000,000 | Complete reimbursement | Yes | Yes | ||

| Evacuation and Repatriation of Remains | Paid in full | Up to $8,000,000 | Yes | Up to $25,000 | No | Up to 10,000 euros | Yes |

| Accidental Death & Dismemberment | Depends on the plan | Rider available, limit depends on age. | $50,000 | It has limitations depending on the plan | |||

| Emergency Dental | Paid in full | Up to $8,000,000 | Optional | 1,000 per year, $ 200 per tooth | Yes, however you need to pay an extra fee on top of your plan | Depending on the plan, it’s unlimited | It has limitations depending on the plan |

| Treatment Necessary as Result of Terrorism | Up to the amount of the coverage | Rider available up to $50,000-lifetime maximum | Clause available up to maximum of $50,000 in lifetime payments | N/A | |||

| Amateur Sports | Unlimited | Rider available up to $10,000 | No | Yes | No | No | N/A |

| Routine Nursery Care of a Newborn Child of a Covered Pregnancy | $25,000 to $156,000 depending on the plan | $1,000 additional deductible, $50,000 lifetime maximum, $200 wellness benefit for first 12 months | Yes | Depends on the plan | Can be unlimited depending on the plan | Depends on the plan | |

| Children born as a result of fertility treatment (such as IVF or surrogacy) | Only after the baby is 90 days old | Excluded | Depends on the plan | Excluded | No | No | |

| Neonatal Intensive Care Unit | Check website for updated information | $250,000 maximum for first 31 days | No | Up to $250,000 for the first 31 days | No | Depends on the plan (Bloom or Bloom Plus) | |

| Pre-existing condition exclusion period | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness | Conditions that are fully disclosed on the application and have not been excluded or restricted by a rider will be covered as any illness |

| Pre-existing condition look back period | Any time prior to effective date | Any time prior to plan effective date | Any time prior to plan effective date | Any time prior to plan effective date | Any time prior to plan effective date | Any time prior to plan effective date | Any time prior to plan effective date |

| Pre-existing annual maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Unlimited depending on the plan | Unlimited depending on the plan | Full reimbursement | Unlimited depending on the plan | Unlimited depending on the plan |

| Pre-existing lifetime maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Unlimited depending on the plan | Unlimited depending on the plan | Full reimbursement | Unlimited depending on the plan | Unlimited depending on the plan |

Worldwide Medical Insurance / Comparison Chart*

Part of the table courtesy of Tokio Marine HCC

*Note: this table is just for informational purposes and subject to change. It was accurate as of the time we wrote it here, but please check each company’s individual website for updated info.

Visas for Digital Nomads in Portugal

Portugal finally offers a new digital nomad visa called the Portugal Temporary-Stay Visa. The Visa is available to those who can provide proof of an independent income and who want to live in Portugal.

Temporary Stay Visa

This visa is specifically aimed at digital nomads and is granted to those who can prove that they work remotely, with a salary of at least €2,800 per month.

The visa lasts for one year and can be extended up to four times for a maximum of five years. The visa and residence permit also grant you full access to the Schengen area as if you were an EU citizen. You can also bring your spouse and dependent children with you as an extension of the visa, as long as you can support them financially.

That’s the equivalent of a minimum wage, which is €8,460 a year. If you are bringing a spouse, you must show a further 50% in addition (€4,230 per year) and another 30% in addition for a dependent child (€2,538 per year).

Before applying for a Temporary Stay Visa, you must ensure that you are eligible and have all your documentation ready.

The main eligibility requirements for the Temporary Stay Visa are as follows:

You must be a non-EU/EEA/Swiss citizen (these do not require a visa).

You must have a minimum income (from outside Portugal) of at least €2,800 per month.

You (and your dependents) must have a clean criminal record.

You must have proof of accommodation in Portugal for one year (rental agreement, hotel reservation, etc.).

When you arrive in Portugal, you must obtain a Portuguese TIN (Tax Identification Number) and open a Portuguese bank account before making your residency application within 120 days.

Minimum Stay Requirement

When you receive a two-year temporary stay visa, you are expected to stay in Portugal for a minimum of 183 consecutive days (6 months) at some point during the period of your visa.

In sum…

Here are the 7 best (and cheapest!) international health insurance companies for digital nomads:

- Cigna

- Now Health

- IMG

- Allianz

- Global Underwriters

- SafetyWing

- Geoblue

In conclusion…

So? I hope you enjoyed the text and that now it is easier for you to find the perfect health insurance, so that you can take advantage of all the the fun parts of being a digital nomad!

Just remember to take some time looking at each of your options in detail and to purchase your plan BEFORE you begin your adventure.

And if you have any final questions about international health insurance, being a digital nomad, or living abroad in general, let me know in the comments area below and I’ll get back to you!