Are you looking for a life change by studying in Ireland? Do you want to know how to make sure you have good health coverage in your new home? Read on to learn all you need to know to make sure you’re protected in medical emergencies!

There are lots of things you need to take care of before you move to another country – have an established place to live, find work, understand all the paperwork, buy your plane tickets, dive into learning a new language…

But one of the many to-dos that often gets left to the wayside is sorting out your health insurance.

Studying and working in Ireland is a dream for many people. This is because, among other benefits such as safety and quality of life, it is possible for you to work legally. That means you can take your course and still support yourself financially at your destination. So, for you to study (and work, if you want), you’ll need good health coverage (and that’s exactly how the list of international health insurance plans and companies below can help you).

But before we get to your option for international health insurance as an student in Ireland, let’s first talk a bit about how the health system in Ireland is structured, what the difference is between travel insurance and a student insurance, what the level of coverage that you’ll need is, among other topics.

(And do be sure to stay until the end of the article for info on the different types of visas you can apply for studying in Ireland!)

How does the health system in Ireland works?

Regardless of where you live, you need to make sure you know how the healthcare system works. Especially in a place like Ireland, which requires health insurance, even before applying for a visa.

Non-EU/EEA nationals (third country nationals)

If you want to study in Ireland but are not a European citizen, you are required to have private health insurance before traveling to the country to study. This obligation is based on the regulations of the Irish Naturalization and Immigration Bureau – Irish Naturalization and Immigration Bureau (INIS). Therefore, you will need health insurance before you even apply for a student visa.

In addition, as a student you must take out insurance covering at least the first year of your stay in Ireland. Students who do not belong to the European Union can use travel insurance in this first year, but it must meet certain requirements:

- The duration of travel insurance must be one full year for students who will be staying in Ireland for more than one year. Students stay in Ireland for less than one year, the duration of travel insurance must cover the entire duration of their stay;

- The minimum insurance amount for accidents is 25,000 euros and 25,000 euros for illnesses;

- The insurance must cover any period of hospitalization.

In the case of students staying in Ireland for more than one year, they will be required to have private Irish health insurance when they want to renew their residence card as a student in the country.

Private medical insurance can be obtained:

- College group insurance, or

- Individual medical insurance arranged in Ireland

Note that from the second year onwards, it is not possible to maintain travel insurance only. Students also cannot cancel medical insurance after taking the course, as it will be considered a violation of Irish immigration rules.

Also, it is highly recommended that you keep travel insurance along with your local insurance, as travel insurance will cover many benefits that are not covered by local insurance (or only partially covered).

Some examples are: travel protection, search and rescue, repatriation to the country of origin, emergency dental treatment, assistance or other emergency medical treatment in the Schengen area – which insures you not only in Ireland, but in other European countries.

EU citizens

In the case of candidates who are nationals of the European Union (or have dual nationality of a country in the bloc), they can apply for the European Health Insurance Card (CESD) in their country of origin. With this card, EU citizens can benefit from the same coverage that the Irish national healthcare system offers.

According to EU regulations, students from countries who are on a course are entitled to free hospital services as long as they have Form E.109. To be eligible, you must provide the Irish health authorities with documentation from your country of origin, validating this entitlement.

However, the CESD still does not cover what a private insurance offers, as mentioned earlier. Therefore, private insurance is highly recommended in Ireland also for EU citizens during their entire stay in Ireland.

Do expats need to have health insurance in Ireland?

To put it simply: yes! Before you even apply for your student visa, you need to have your insurance policy in hand, required by law.

That’s why it’s important to make sure you have health insurance coverage like one of the options I list below 😊

But beyond being a requirement, having an international health insurance policy can give you a lot of peace of mind. Especially when you’re in a new and different country from your own, with new laws, systems, and a language that you may not know, plus high healthcare costs.

Therefore, having international health insurance coverage will help keep you safe in any unexpected situations or emergencies. Plus, there are a few other benefits of having an international insurance plan like I’m explaining in the next section.

As a student in Ireland, should you get an international health plan like the ones recommended on the list below?

In the end, this is a completely individual choice as it depends on your specific medical needs, the specific coverage you will need under your insurance and the length of your stay in Ireland.

An international health insurance plan must meet your coverage requirements in Ireland. If you choose to get an international plan, be sure to check the minimum required insurance coverage.

I’ve never lived in Ireland so I don’t know enough about national plans that may be available and so I can’t say much about them.

With that in mind, below are some of the reasons you might want to choose an international health insurance plan:

- Compared to the costs you may incur, international health insurance may have cheaper monthly fees;

- International health insurance may be easier to use if your stay is short in Ireland as you can choose exactly how long you want your plan to be;

- International health insurance has greater flexibility as you can cancel or extend it at any time;

- International health insurance offers coverage in other countries, not just Ireland (that’s why they are “international” health insurance 😀 ).

Who can an international health insurance plan cover?

The health insurance companies that I’ll list below are for the following citizens who live in Ireland as students, immigrants, workers, or even expats:

- Americans

- Canadians

- Australians

- Brazilians

- Citizens of the European Union (Portuguese, French, German, Dutch, Spanish, Polish, Swedish, Belgian)

- Argentinians

- Brits (English, Scottish, Welsh, Irish)

- Kiwis/New Zealanders

- And for citizens of just about any other country

Beyond students who reside in Ireland, these insurance companies also work for residents who live in:

- The United States

- Canada

- Europe (the European Union or the United Kingdom)

- Japan

- Australia

- And for expats who live in just about any other country in the world

In general, since all these plans and insurance companies are international, they can be used by practically any person in any place since they have worldwide coverage!

Why can’t I just get travel insurance for my move to Ireland? What’s the difference between travel insurance and student insurance?

Travel insurance is critical for any trip, given that it won’t just cover you in unexpected medical problems or emergencies, but also for issues with your trip like lost luggage or the cancellation of a flight.

That said, it’s important to know that travel insurance is not ideal for who’s going to study. Although you can find travel insurance policies to cover you for long periods of time, they are made for travelers with temporary stays in a country. Travel insurance coverage isn’t valid for long-term or semi-permanent stays in another country.

Plus, travel insurance won’t meet your health insurance coverage required by law to live na Irlanda.

So, you’ll definitely want to choose a travel insurance plan that specifically covers students. And that’s exactly what I’ll help you with in the list below.

What are the 5 best health insurance options for expats and immigrants in Ireland?

After the table, I’ll give a longer description of each of the companies, their plans, major benefits, and much more!

Cigna Global Cigna Global |

|

|

|

||

| Medical Maximum | Unlimited (for the Platinum plan) | $5,000,000 | There are no limits independent of the plan | US$1,000,000 per year | $1,000,000 |

| Mental Health Benefit | Unspecified | Unlimited for up to 90 days | Included in all plans with a 10-month waiting period | Outpatient: $50 per day max up to $500 in total | Yes |

| Inpatient Prescription Drugs | 80% coverage out-of-network, 100% in the USA and internationally | Unspecified | Coverage available | Name-brand drugs: 50% coinsurance

Generic drugs: 100% coinsurance Special drugs: no coverage |

Yes |

| Outpatient Prescription Drugs | 50% of actual costs, 90 days maximum per dispensation | Unspecified | Unspecified | coinsurance

Generic drugs: 100% coinsurance Special drugs: no coverage |

Yes |

| Mental Health Benefit | Inpatient and Outpatient: $5,000 lifetime maximum to paid in full depending on the plan | Inpatient and Outpatient: $50,000 lifetime maximum | None | Inpatient and Outpatient: limit not specified | Inpatient, outpatient, and therapy: limit not specific |

| Outpatient Prescription Drugs | None, unless you buy the International Outpatient Option | Up to $8,000,000 | Full reimbursement | Yes | Yes |

| Repatriation of Remains | $25,000 maximum or $5,000 for cremation | Optional | Optional | $50,000 maximum or $5,000 for cremation | $13,500 maximum |

| Emergency Evacuation | $50,000 | Optional | Optional | $10,000 | Yes |

| Hospital room coverage | Offered up to the average semi-private room rate | Private room | Private Room | Usual | Usual |

| Terrorism | $50,000 | Unspecified | Unspecified | $100,000 | N/A |

| Accidental Death & Dismemberment (AD & D) | Principal sum of $25,000 that is not subject to deduction | $25,000 for main policy holder, $10,000 for spouse on the plan, $5,000 for child on the plan

Total limit of $250,000 |

Optional | $25,000 for main policy holder, $10,000 for spouse on the plan, $5,000 for child on the plan

Total limit of $250,000 |

There is coverage |

| Emergency Dental | $500 per injury for the coverage period | Optional | Optional | $2,500 | Yes |

| Maternity Care | Only covered in Platinum plan | $14,000/€11,000/£9,000 in the Platinum plan | Only available in the Special and Exclusive plans | Within the US: up to 80% coverage with a $25,000 limit within the PPO network/Outside PPO: up to 50% coverage with a $25,000 limit

Outside the United States: Up to 80% coverage with a $25,000 limit. Benefits reduced by 25% if pregnancy is not reported within the first 90 days. |

Not specified |

| Pre-existing condition exclusion period | Maximum limit of $1,500 with a 12-month waiting period | $14,000/€11,000/£9,000 in the Platinum plan | Coverage available | Limited of $250,000 per plan | Unspecified |

| Intensive Care Unit (ICU) | 100% coverage after the deductible has been met | Full coverage with the Platinum plan | Coverage available | Up to $50,000 | Not specified |

| Vaccines | Unspecified | Optional | Only in the Special and Exclusive plans | $200 | Yes, but must be paid as a separate plan |

| Routine care for newborns | Unspecified | Optional | Only in the Special and Exclusive plans | Up to $750 | Yes, but must be paid as a separate plan |

| Pre-existing annual maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Full reimbursement | Unlimited depending on the plan | Depends on the plan |

| Pre-existing lifetime maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Full reimbursement | Unlimited depending on the plan | Depends on the plan |

Worldwide Medical Insurance / Comparison Chart*

Part of the table courtesy of Tokio Marine HCC

In my opinion, the best international health insurance companies for expats are:

- International student health insurance from Cigna Global

- Student Health Advantage from IMG

- Now Health International

- StudentSecure from HCCMIS

- Foyer Global Health

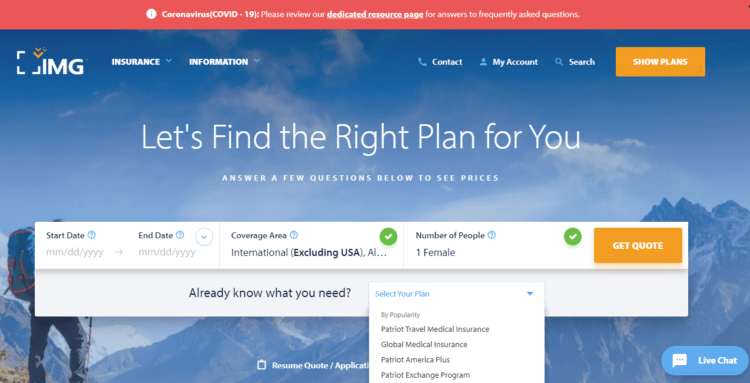

1. IMG

One more well-known company in the world of international insurance is IMG, which has more than 25 years of experience and 3 subsidiaries worldwide.

IMG has several types of plans for you to choose from, whether as an individual or as an entire family. They also have a variety of plans made specifically for various types of travelers, including expats. You’ll see that you’ll have the option for both long-stay plans of a year or more as well as for much shorter time periods.

IMG’s website is easy to use and search plans on since you can use filters for date, plan length, destination, and much more. Beyond these filters, you can also add in personal details like your age and specific medical needs before seeing your coverage options.

This way, IMG can get you a personalized and detailed quote that lets you easily compare your options for plans and coverage and figure out which is best for you.

Just keep the specific details of each plan in mind since some of them don’t cover certain age groups and not all of them cover Covid-19.

Pros of an international health insurance plan with IMG:

- Customer service is available 24 hours a day, 7 days a week

- Flexibility to customize your plan and coverage limits

- Ability to choose from more than 17,000 in-network doctors

Cons of an international health insurance plan with IMG:

- They don’t have Covid-19 coverage, depending on the plan

- They don’t offer coverage for individuals above 75

2. Cigna

First up, we have Cigna, a large American insurance company that’s also widespread in Europe. Cigna is a great choice when we talk about international health insurance.

With more than 60 years of operating on the market, Cigna is well-known for its insurance and has more than 170 million clients around the world. My partner, Nikki, actually purchased a health insurance plan from Cigna in order to qualify for her residence card in Sweden.

Cigna has a wide range of plans for you to choose from, including plans made specifically for students (and which work great if you’re going to study in Ireland!), plus both individual and family plans).

One of the biggest advantages of an insurance plan with Cigna is that you can add benefits to your plan based on the specific medical care you need to have covered. You can choose from Cigna’s Silver, Platinum, or Gold plan, all of which include coverage in more than 200 countries and territories around the world.

If you’re looking for a cheap health insurance plan for Ireland, a great option is Cigna’s Close Care plan. This plan is the most budget-friendly one that Cigna offers since it only includes coverage for your home country and the country you’re a resident of (Ireland, in this case).

Pros of an international health insurance plan with Cigna:

- Customer service available 24 hours 7 days a week

- Flexibility to make changes to and tailor the plan for your specific medical needs

- Includes coverage for Covid-19 and PRC tests

- No registration needed to get a quote

- They have a digital system that lets you easily find hospitals and clinics near you

- Normally, Cigna will pay health providers directly so you won’t need to request reimbursement

Cons of an international health insurance plan with Cigna:

- Some of their plans don’t cover maternity care.

Now Health International holds a prominent position within the global insurance industry and prioritizes customer satisfaction through effective and cost-effective insurance schemes.

Consequently, a notable benefit offered by this company is its cutting-edge customer support, delivering prompt and convenient access to information.

Every Now Health plan is meticulously crafted to address, assist, and resolve the unique difficulties encountered by individuals living abroad, such as international students and exchange students worldwide.

Furthermore, all plans can be tailored to precisely align with your specific requirements.

What I like about Now Health International Student Plans:

- Clear information and 24/7 customer service

- Coverage in over 190 countries and territories

- Various international insurance options and customizable plans

- Some plans offer coverage for maternity routines

What I don’t like about Now Health International Student Plans:

- In some procedures, Now Health works with a reimbursement system

- For plans with routine maternity coverage, you must wait a 12-month waiting period to access this benefit

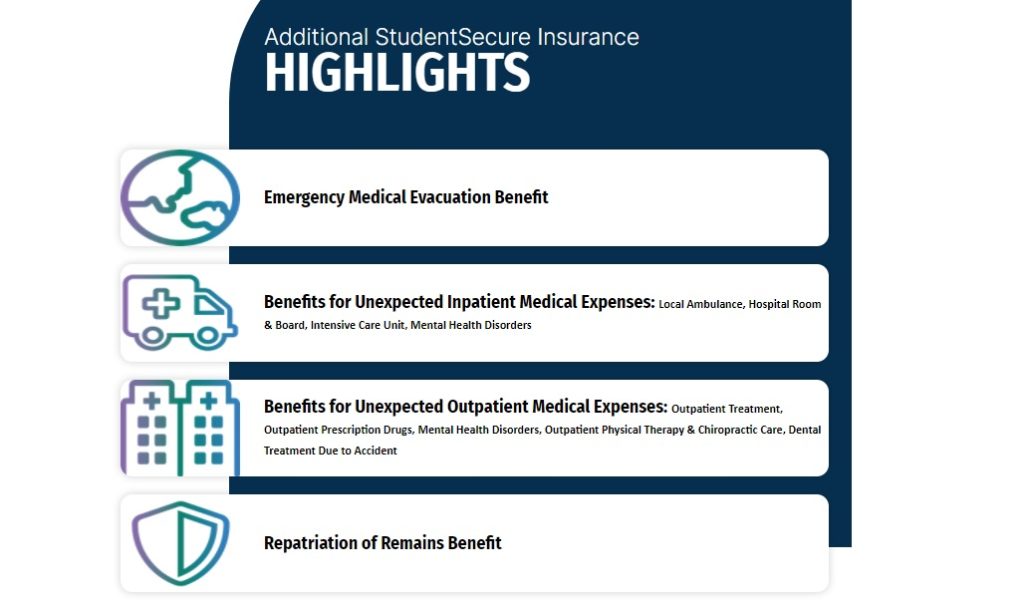

4. WorldTrips

WorldTrips is another provider that offers insurance for full-time students and scholars studying away from home (alongside the usual travel insurance offerings).

These are the 4 levels of student health insurance coverage they offer (all of which work great for Ireland!):

StudentSecure Elite

- Offers the lowest deductibles and the highest maximum coverage

- 6-month waiting period before a pre-existing condition can be covered

- Offers sports coverage for club/intramural/intercollegiate sports

- Covers personal liability

StudentSecure Select

- 6-month waiting period before a pre-existing condition can be covered

- Optional Crisis Response rider for ransom, your personal belongings, and crisis fees

StudentSecure Budget

- Pre-existing condition coverage begins 12 months after purchasing the insurance

- Mid-level benefits & higher deductible (for a lower monthly rate overall)

StudentSecure Smart

- Lowest cost plan (with the lowest benefits to match)

- Highest deductibles of all the plans

- Doesn’t cover club sports

- Can only cover a pre-existing condition on its acute onset

Here is a comparison of the 4 HCC StudentSecure plans (click to see full chart):

What I like about HCCMIS’ StudentSecure plans:

- They offer emergency dental care (in case of an accident) up to $250 maximum per tooth and $500 maximum in the certificate period

- They offer a savings plan if you pay your full premium in advance

- They are some of the most budget-friendly plans on this list

What I don’t like about the HCCMIS’ StudentSecure plans:

- There is no coverage for pre-existing conditions in their Smart plan

- There is a 6-month waiting period for pre-existing condition coverage (even in their Elite plan)

- There is no coverage for vaccinations unless you get the Elite plan

- There is no coverage for maternity and nursery care for newborns in the Smart plan

- Their lower-cost plans can have high deductibles

![]()

Visitor Coverage, established in the U.S. in 2006, aims to make choosing travel insurance hassle-free by offering tailored and affordable solutions for tourists, students, expats, and immigrants.

Although the company doesn’t provide its own insurance policies, it serves as a bridge, linking customers with trusted insurance providers, ensuring peace of mind during emergencies. With a user-friendly platform, travelers can effortlessly compare and purchase insurance that fits their needs by simply inputting a few basic trip details.

For international students, for instance, users can enter info like destination, age, and nationality. Based on that, the platform suggests the best insurance options, highlighting costs, coverage, cancellation policies, extension possibilities, and other perks. It also features ratings and detailed insights on each insurer and their offerings.

What I like about Visitor Coverage student insurance:

- You can compare the most reliable travel insurance on the market

- It brings together detailed information from several insurance companies

- Intuitive platform

- It shows options that suit each traveler’s profile and with different prices

- Support for insured students 24/7

- More than 18 years of experience and more than 1 million customers around the world

What I don’t like about Visitor Coverage student insurance:

- There is no insurance from Visitor Coverage itself

- Your exchange must last at least 30 days and a maximum of 1 year

- It does not cover these destinations: Belarus, Cuba, Iran, Israel, Lebanon, Mayotte, North Korea, Russia, Syria and Ukraine

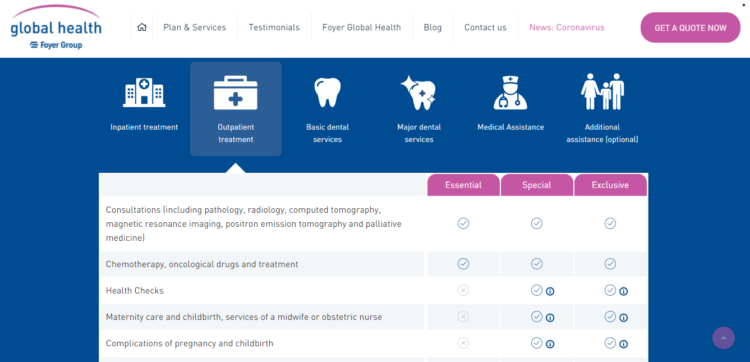

Basic or Premium? Short- or long-term stay in Ireland? Alone or with the family? Regardless of what you need, you can find a plan with Foyer Global Health that works for you.

The company has 3 different plans. Here’s a quick snapshot at what each of these plans includes:

ESSENCIAL

- Consultations, surgery, and anesthetics

- Therapeutic devices (such as cardiac pacemakers) if necessary as a rescue measure

- Congenital diseases (up to a maximum of € 100,000 per life)

- Does not cover maternity and childbirth care

SPECIAL

- Consultations, surgery, and anesthetics

- Therapeutic aids and devices (such as artificial limbs and prosthetics) up to € 2,000

- Congenital diseases up to a maximum of € 150,000 per life

- Maternity and childbirth care (up to € 5,000 with a 10-month waiting period)

EXCLUSIVE

- Consultations, surgery, and anesthetics

- Unlimited therapeutic devices and devices

- Congenital diseases up to a maximum of € 200,000 per life

- Maternity care, childbirth care, and midwife or nurse services at the hospital (up to € 20,000 with a 10-month waiting period)

What I like about Foyer Global Health plans:

- All their plans include consultations, surgeries, and basic dental treatments

- They have 24-hour customer service by phone and email with experienced advisers, doctors, and specialists

- They offer evacuation and repatriation service

- They offer medical support and pre-trip advice (vaccinations, preparation of a first aid kit)

What I don’t like about the Foyer Global Health plans:

- Their most basic plan does not cover prenatal and postnatal care

7. Diplomat Long Term and Diplomat International from Global Underwriters

Global Underwriters offers international health insurance plans for a wide range of travelers, including exchange students and study abroad students.

When it comes to GU’s plans, I recommend Diplomat Long Term and Diplomat International for international students in Ireland.

What I like about Global Underwriters plans:

- Their student plans have coverage for medical evacuations, emergency dentistry, and repatriation of remains

- The Diplomat Long Term and Diplomat International plans offer coverage up to $1,000,000

- They offer coverage and assistance in case of lost luggage and travel interruptions

- They have 24/7 customer service

What I don’t like about the Global Underwriters plans:

- Their Diplomat International plan does not cover Covid-19

- The Diplomat Long Term plan does not serve students residing in Australia and Iran, as well as New York, Maryland, South Dakota (though this won’t be a problem for you if you’ve changed your residency to Ireland!)

- Their plans can be a bit more pricey than the others on this list

2 International Health Insurance Companies That Can Also Be Used by International Students in Ireland

The two final companies I’ll list below don’t offer health insurance specifically for students abroad. That said, they do offer international health insurance that will (most likely) be accepted by your school or university as proof of coverage.

So here’s my advice to you: get a quote for these two companies below and compare it to the quote you get from the companies listed above. If you find that either of these two companies offers good coverage at a lower price than the other options, check in with your Canadian school or university if they accept this type of policy.

If so, this is a great chance to save money before venturing to your new home!

– Geoblue

Geoblue is another great option if you’re looking for a health insurance policy to cover you while you study overseas in Ireland.

What I like about Geoblue’s international health insurance:

- Their plans are very adaptable and flexible based on exactly what you need

- They have 24/7 customer service

- Some of their plans cover extras like evacuation, preventative medical appointments, and maternity care

- You can add on ophthalmology and dentistry care

- Their Xplorer plan has no maximum for medical coverage, covers extreme sports, doesn’t charge deductibles for standard services, and doesn’t have cancellation fees

What I don’t like about Geoblue’s international health insurance:

- They don’t serve residents of New York and Washington (though this may not be a problem if you change your official residence to Ireland!)

- You have to contact an insurance broker and speak to them personally to get an exact quote (which is pretty annoying)

– Aetna (acquired by Allianz)

Aetna is a well-known company in the field of health insurance.

One nice advantage of Aetna is that their plans are really flexible (you can customize based on whatever you need covered), and they have quite good customer service (as far as insurance companies goes, that is).

What I like about Aetna’s international health insurance:

- They’ve been in the health insurance industry for 5 decades

- They offer flexible and tailored plans

- They have 24/7 specialized service

- Most of their plans offer coverage for emergency evacuations, cancer treatments, repatriation, and hospitalizations

- They are an insurance company who has won awards such as as “Health Insurer of the Year” and “Best International Private Health Insurance Provider”

- They have an app that encourages clients to maintain healthier habits with a points and awards system

What I don’t like about Aetna’s international health insurance:

- Their website is not very clear about the exact coverage for some of their plans

- They don’t offer any kind of travel insurance plans

Types of Visa to Study in Ireland

Stamp 1G – New Graduates

This is a relatively recent type of visa and is intended for students who have completed their studies at NFQ level 8 to 10, and want to look for a job in Ireland to enter the job market.

With this visa, the recent graduate can stay in the country for up to 1 year, being able to work full time, that is, 40 hours a week.

This visa is a good option for recent graduates who want to stay in the country, because there is always the possibility of getting a Work Permit or any other permit that allows the student to stay permanently in the country.

Stamp 2 – Study visa with work permit

This modality is the most common to enter Irish soil. To be eligible for Stamp 2, an applicant must be enrolled in a course of at least 25 weeks.

Upon entering the country, immigration allows a period, normally one month, for the visa documentation to be organized and the applicant to return to immigration so that their documents are validated and the visa is granted to stay in Ireland.

Stamp 2 allows students to work up to 20 hours a week, or 40 hours between June and September (during the summer, or between December 15 and January 15). This visa is also the most required by people who want to do a degree, master or doctorate in Ireland, but in this case the visa is annual and you will have the right to renew it every year, until you finish your course.

Stamp 2A – Study visa without work permit

This visa allows you to study in Ireland for a short period. They are usually people who are not going to study a full English course or a university course. Therefore, this type of visa allows non-European citizens to stay in the country for a maximum of 6 months.

This type of visa is less common, mainly because it does not give the right to work, even if the process for withdrawing the visa is the same as for Stamp 2, and can only be renewed 2 more times in the same way.

Documentation for student visa:

The documents you need for the issuance of a student visa with a work permit are:

- Letter from the school with the minimum workload required (15 hours per week);

- Proof that the school has Learner Protection;

- Government insurance;

- 3,000 euros as financial proof;

- Proof of address;

- Payment of €300 upon granting the visa.

In sum…

Here are the 7 best health insurance companies for students going to Ireland:

- Cigna

- IMG

- Aetna

- GeoBlue

- SafetyWing

- Global Underwriters

- Foyer Global Health

In conclusion…

Deciding to begin life in a new country can be complicated…Hopefully, this article will help you to simplify a lot some of your doubts about this process!

But if you still have any questions about getting health insurance before your move to Ireland (or about moving overseas in general), comment below and I’ll get back to you!