Going to study in the United States and still not sure which student health insurance to get? Then take a look at the article here for your 7 best options!

As someone who has had the opportunity to study overseas in 3 separate countries, I am a big advocate for studying abroad whenever possible. Especially in a country that’s world-famous for its education like the United States!

But beyond the normal worries about classwork and learning the language, there are also some other details about your exchange you need to think about. And one of those details is international health insurance.

It doesn’t matter if you’re doing an exchange, a semester of high school, a university degree, or a free course in the United States…you still need to get health insurance. Not just to protect yourself from the sky-high costs of medical care in the United States, but also to qualify for your American student visa.

So, that’s why today I’ve created a list of the 5 best and cheapest international health insurance plans with 2 bonus options for students studying abroad in the United States.

But before we get to the plans…

What is international health insurance students?

A student health insurance policy is a guarantee that you’ll be protected if anything happens during your time studying abroad in the United States.

Do you only need insurance if the place you’re going to is dangerous? Definitely not!

Just as we get insurance for cars, travel, and our home country’s medical system, we also need to have health insurance coverage when we’re overseas. Because after all, accidents and health issues can happen anywhere!

But beyond giving you some peace of mind, a good health insurance plan can also help you save a LOT of money. Especially since paying for any kind of medical care (even a simple doctor’s visit) in the United States can be very, very expensive if you don’t have insurance.

Is health insurance needed to get a student visa in the United States?

The short answer is that it depends.

If you’re doing a student exchange on a J-1 visa (or have dependents on a J-2 visa), then you will be required to have medical coverage for the length of your program. If you’re coming on an F visa, then there is not a coverage requirement.

However, the school you’re attending will most likely require you to prove you have insurance when you enroll.

But whether or not you’re required to have insurance is NOT the only reason to buy a plan.

As I’ve said before, beyond knowing that you’ll be covered for potential accidents, illnesses, or other health issues…you also don’t need to worry about getting stuck with huge medical bills.

Unlike many other countries, the United States doesn’t have a public healthcare system like what I have back home in Brazil or in the European Union.

And since 66% of all bankruptcies in the United States are caused by medical expenses…I don’t think you want to take this risk!

What types of student visas are there in the United States?

Before I talk about the cheapest health insurance plans for international students in the United States, I first want to cover the different types of student visas that you might be applying for.

Currently, there are two main types of student visas in the United States:

- Visa for exchange programs in the United States (J-1)

- Visas for university students in the United States (F-1 and M-1)

I’ll explain a bit about each of these visas (and how health insurance works for them) below.

Visa for exchange students in the United States (J-1)

The J-1 visa is given to students who are approved to participate in American exchange programs.

(Ah, and the J-1 visa also works for anyone who plans to be an au pair in the United States!)

To apply, you’ll have to have a visa appointment in the American consulate closest to you. At this appointment, you need to show all the necessary documents (which will usually be given to you by your exchange agency).

If you have any dependents, they can come with you on a J-2 visa.

And as I said above, if you’re on a J visa, you (and your dependents) are required to have medical insurance for the length of your program.

Visas for university students in the United States (F-1 and M-1)

If you plan to do a course in an academic institution, whether a school or a university, you’ll have to apply for an F-1 visa. If you plan to take a professional or other non-degree course, then you’ll have to apply for an M-1 visa.

The documents required for each can vary based on the course that you plan to take. Because of this, I recommend speaking with the institution where you’ll be studying as many of them have specific departments that help students get their visas.

If you have family (spouse or children), you can apply for visas for them as well. In this case, they’ll receive an F-2 or M-2 visa and can enter the United States as dependents of whoever has the main visa.

And as I said above, you’re not technically required to have medical coverage if you’re coming to the United States with an F or M visa. However, many schools will require you to have a health insurance plan. And as we’ve discussed, you really don’t want to get stuck paying U.S. healthcare costs without insurance.

Who is this international health insurance for?

The health insurances below offer their services to these citizens who live in the United States as students:

- Canadians

- Australians

- Chinese

- Germans

- French

- Argentineans

- British people

- Swedes

- New Zealanders

And for citizens of almost every other country living abroad

In addition to students in the US, they also serve students who live in:

- Canada

- China

- Germany

- Sweden

- Spain

- Portugal

- France (European Union/Schengen area as a whole)

- United Kingdom

- China (and Hong Kong)

- Australia

- Switzerland

And for students living in almost any other country in the world

Simply put, regardless of which country you are from or in which destination in the world you want to study, most of the companies mentioned in this list will be able to offer you good coverage and good international health plans.

The 5 best health insurance companies for international students in the United States

And finally, let’s dive into the best health insurance plans for international students in high school, university, or doing an exchange in the United States.

Tip: As always, I recommend you make an online quote with all the companies listed below. I know this may take some time, but honestly, the amount you’ll be able to save in the end makes it worth the effort.

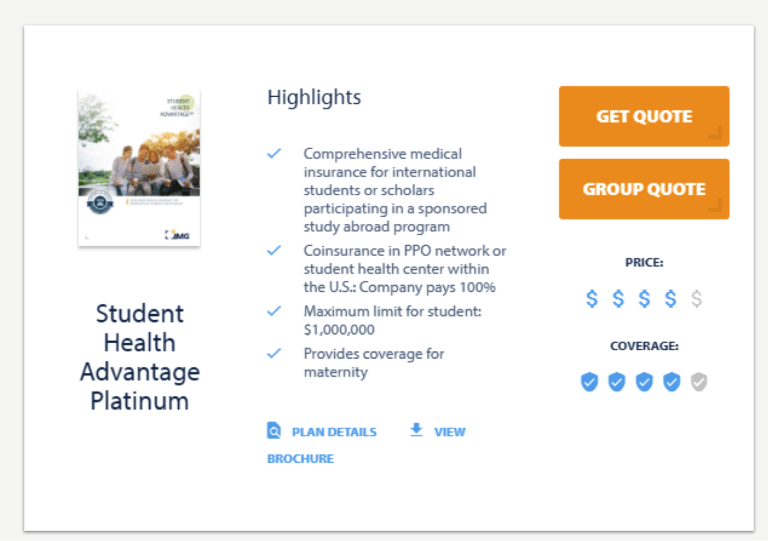

1. IMGlobal

IMGlobal has 3 different plans for students:

- The Patriot Exchange Program

- Student Health Advantage

- Health Advantage Platinum

I’ll talk a bit more about each of them below.

This health insurance plan was made specifically for international students with any of the visas mentioned above. With this plan, you can also include coverage for your family (if they are on an F-2, M-2, or J-2 visa).

You can choose your maximum coverage limit from $50,000 to $500,000 per accident or illness. This plan covers eventual expenses with COVID-19 and telemedicine for non-emergency cases.

This particular plan has two main advantages. The first is that it’s an international health insurance plan that also works for students in Europe, and that you can get individual or group plans.

The second advantage is that IMG’s Student Health Advantage charges for things like mental disorders, maternal care, telemedicine, expenses with COVID-19 and pre-existing conditions, which many of the others do not cover.

Student Health Advantage Platinum

Student Health Advantage Platinum is, as the name suggests, an upgrade to the previous plan. Alongside the same advantages mentioned above, the maximum coverage is increased to $1,000,000 USD.

What I liked most about student health insurance with IMGlobal:

- They have plans made specifically for international students in the US on J-1 or F-1 visas

- They also have plans that cover students in European countries with the Schengen visa

- IMG’s network includes more than 17,000 doctors around the world

- You can get coverage as a student of any nationality

- They have 24/7 customer service (in case of emergencies)

- You can get group plans for 5 or more people

- It covers any expenses with COVID-19 in a similar way to other illnesses and injuries

What I liked least about student health insurance with IMGlobal:

- Some of the plans don’t cover pre-existing conditions or only do so with a 1-year waiting period (which isn’t very helpful for students that are only going to stay in the country for a short time)

2. Cigna Global

Cigna Global is one of the largest health insurance companies in the world. They don’t have plans made specifically for students, but you can still use them for full medical coverage as a student anyways, whether you’re coming on a J-1, M-1, or F-1 visa.

Another nice feature is that you can use this plan for health coverage anywhere in the world, not just the United States. In other words, with your Cigna plan, you’ll have medical coverage even when you’re traveling to other countries (Canada, Mexico, etc.) during your exchange in the United States.

What I liked most about student health insurance with Cigna:

- You can control what you pay upfront with flexible deductibles

- You can pay monthly, quarterly, or annually

- Their plans cover you worldwide, not just in the United States

- In most cases, you don’t pay the healthcare provider directly (Cigna pays them directly for your consultation so you don’t have to request reimbursement)

- You can choose from 3 plans: Silver, Gold, or Platinum

- They have 24/7 customer service

- They have detailed online help, including a list of more than 3,000 hospitals you can get care from

- Cigna has partnered with more than 1.65 million hospitals, doctors, clinics, and specialists around the world…giving you many options to choose from for medical care

What I liked least about student health insurance with IMGlobal:

- They don’t have plans made specifically for students (though you can still use them to cover you as a student)

- They don’t cover outpatient consultations with specialists and doctors

- You have to add in a lot of personal information before they’ll give you a custom quote

3. Geoblue

Geoblue is also good option when choosing international health insurance that can be used by international students, especially if your destination is the United States. Geoblue has exceptional quality standards and is among the greatest companies in the area.

What I like about Geoblue’s international health insurance:

- Top standards of quality and service

- Adjustable plans for your everyday needs

- 24-hour call service every day of the week

- Some plans can cover evacuation, medical appointments and necessary care during maternity

- They have ophthalmology and dentistry options

- The Xplorer plan has no medical cap, covers extreme and adventure sports and does not charge deductibles for standard services or cancellation fees

What I don’t like about Geoblue’s international health insurance:

- Does not serve residents of New York and Washington states

- It is necessary to contact a broker to quote prices of the plans

Another great option is Now Health International, this company is one of the world market leaders in international insurance and its mission is to provide a satisfactory, accessible and efficient service.

One of the advantages of getting a plan with Now Health International is its exceptional customer service, providing all the necessary information with speed and clarity.

Now Health knows that the daily life of each international student is unique, that’s why all the company’s plans are customizable to meet all the challenges and needs of its customers.

What I liked most about student health insurance with Now Health:

- Focus on customer service and communication

- Provides coverage in more than 194 countries and territories around the world

- Certain plans have maternity coverage

- Various plan options are available and custom options

What I liked least about student health insurance with Now Health:

- Certain services covered by Now Heath plans work with a reimbursement system

- If you want to use maternity coverage, you must have completed the 12-month waiting period of the plan

5. WorldTrips

WorldTrips is another major player in the world of insurance.

Their “StudentSecure” plan works for all types of exchange students in the United States and has 4 levels of coverage to choose from: StudentSecure Elite, StudentSecure Select, StudentSecure Budget, and StudentSecure Smart.

Each of these 4 plans varies slightly, such as with coverage or pre-existing conditions or maternal care.

What I liked most about student health insurance with WorldTrips:

- They have plans made specifically for students

- They are one of the few companies that covers emergency dental care (in case of accidents)

- They offer an investment plan if you pay for your insurance policy in full upfront

- They tend to be one of the cheapest options from all the companies here

- You don’t have to put in a lot of personal info to get a quote

- Each of the plans is quite different from one another, so you have lots of options for coverage

What I liked least about student health insurance with WorldTrips:

- The Smart plan doesn’t cover pre-existing conditions or maternal/newborn care

- The Elite plan has a 6-month waiting period for pre-existing conditions

- The Elite plan is the only plan that covers vaccines

Visitor Coverage, founded in the United States in 2006, aims to simplify the choice of travel insurance. The company offers affordable and personalized solutions for tourists, students, expats and immigrants, facilitating the process of selecting the ideal insurance.

Through an easy-to-use platform, travelers can compare different insurance options according to their profile, simply by providing some basic information about the trip.

Although Visitor Coverage does not offer insurance itself, it acts as an intermediary, presenting options from reliable insurers. This ensures that customers have adequate protection in emergency situations.

When it comes to insurance for international students, the process involves providing the destination country, age and nationality. Based on this information, the platform presents the best options, highlighting prices, coverage, possibility of cancellation or extension, as well as other benefits. It is also possible to check the insurance rating, coverage level and a series of important details about each company.

What I like about Visitor Coverage student insurance:

- You can compare reliable travel insurance on the market

- Offers information from several insurance companies

- Intuitive platform

- Options that adapt to the profile of each traveler and with different prices

- Support for insured students 24/7

- Over 18 years of experience in the market and 1 million customers worldwide

What I don’t like about Visitor Coverage student insurance:

- It doesn’t have its own insurance

- The insured’s exchange must be between 30 days and 1 year

- Does not cover the following destinations: Belarus, Cuba, Iran, Israel, Lebanon, Mayotte, North Korea, Russia, Syria and Ukraine

Another big name in international health insurance is Foyer Global Health.

One thing that makes Foyer stand out is, at least in my opinion, how much you’re able to customize your plan by choosing limits for individual types of coverage.

As with Cigna, Foyer also doesn’t have plans specifically for students, although any of their plans can cover you as a student. Instead, they have 3 base plans that you can customize as you like (essential, special, and exclusive).

What I liked most about student health insurance with Foyer Global Health:

- They have 24/7 customer service by phone and email with experienced counselors, doctors, and specialists

- You can personalize your coverage based on many factors: your age, country of origin, dental coverage, eye coverage, vaccines, maternity care & children

- You can choose a level of coverage (from nothing to the maximum) for each of these factors

- It’s easy and quick to get a quote (you don’t need to put in a lot of personal info like most other insurance website)

- All of their plans include consultations, surgeries, and basic dental treatments

- They’re one of the few insurance companies that offer evacuation and repatriation

- It’s possible to get medical help and advice before your trip including all vaccines required by your destination country and the preparation of a first aid kit

What I liked least about student health insurance with Foyer Global Health:

- They don’t have plans made specifically for students (though you can still use them to cover you as a student)

- While the customer service does the job, it’s not quite a simple as with the other companies I’ve recommended

- Their website is a little unclear about the coverage limit

- They have some limitations on what things they cover in the United States (so be sure to confirm this coverage before you buy a plan)

2 Bonus International Student Insurances for the US:

German brand Allianz is another well-known insurance company. They don’t have specific student plans, but they still have really good options for health insurance plans for J-1 visa students in the United States (and plans that cover the other types of American visas as well).

Besides their basic plan, Allianz Care, you can also choose from two more robust options: Allianz Care Pro and Allianz Care Plus.

What I liked most about student health insurance with Allianz Care:

- They have 24/7 customer support

- Allianz’s app is easy and simple to use

- You can add other members of your family (spouse or children) to your insurance plan

- They also offer specific mental health help for students with stress or anxiety

- In most cases, you don’t pay the healthcare provider directly (Allianz pays them directly for your consultation so you don’t have to request reimbursement)

What I liked least about student health insurance with Allianz Care:

- The website is quite complicated to navigate if you’re looking for specific info about coverage

- You need to pay extra fees for services like dental assistance or repatriation

- They don’t have many options for plans

Global Underwriters specializes in international health insurance and is another great choice on our list. One of the biggest advantages of GU is that they have different plans for different traveler profiles.

A good choice for students in the US is the Diplomat America plan, focused on foreigners residing in the United States, it serves from digital nomads and missionaries to exchange students and international students.

What I liked most about student health insurance with Global Underwriters:

- The coverage limit of up to $1,000,000 in Diplomat America plan

- Flexible coverage from at least 15 days to 1 year

- Stable and consolidated company in the market

- Coverage available for families or singles

- Plans designed for exchange students and foreign residents in the US

What I liked least about student health insurance with Global Underwriters:

- Do not have coverage for US citizens

- The site does not make the details of the plans clear

- Do not provide coverage for pre-existing conditions

- Compared to the other options mentioned, they have a low emergency dental care limit

Table comparison of the 5 best health insurance plans for international/exchange students in the United States

| Cigna Global | Foyer Global Health | WorldTrips | |||

| Medical Maximum | Unlimited (for the Platinum plan) | $5,000,000 | There are no limits independent of the plan | US$1,000,000 per year | $1,000,000 |

| Mental Health Benefit | Unspecified | Unlimited for up to 90 days | Included in all plans with a 10-month waiting period | Outpatient: $50 per day max up to $500 in total | Yes |

| Inpatient Prescription Drugs | 80% coverage out-of-network, 100% in the USA and internationally | Unspecified | Coverage available | Name-brand drugs: 50% coinsurance Generic drugs: 100% coinsurance

Special drugs: no coverage |

Yes |

| Outpatient Prescription Drugs | 50% of actual costs, 90 days maximum per dispensation | Unspecified | Unspecified | coinsurance Generic drugs: 100% coinsurance

Special drugs: no coverage |

Yes |

| Mental Health Benefit | Inpatient and Outpatient: $5,000 lifetime maximum to paid in full depending on the plan | Inpatient and Outpatient: $50,000 lifetime maximum | None | Inpatient and Outpatient: limit not specified | Inpatient, outpatient, and therapy: limit not specific |

| Outpatient Prescription Drugs | None, unless you buy the International Outpatient Option | Up to $8,000,000 | Full reimbursement | Yes | Yes |

| Repatriation of Remains | $25,000 maximum or $5,000 for cremation | Optional | Optional | $50,000 maximum or $5,000 for cremation | $13,500 maximum |

| Emergency Evacuation | $50,000 | Optional | Optional | $10,000 | Yes |

| Hospital room coverage | Offered up to the average semi-private room rate | Private room | Private Room | Usual | Usual |

| Terrorism | $50,000 | Unspecified | Unspecified | $100,000 | N/A |

| Accidental Death & Dismemberment (AD & D) | Principal sum of $25,000 that is not subject to deduction | $25,000 for main policy holder, $10,000 for spouse on the plan, $5,000 for child on the planTotal limit of $250,000 | Optional | $25,000 for main policy holder, $10,000 for spouse on the plan, $5,000 for child on the planTotal limit of $250,000 | There is coverage |

| Emergency Dental | $500 per injury for the coverage period | Optional | Optional | $2,500 | Yes |

| Maternity Care | Only covered in Platinum plan | $14,000/€11,000/£9,000 in the Platinum plan | Only available in the Special and Exclusive plans | Within the US: up to 80% coverage with a $25,000 limit within the PPO network/Outside PPO: up to 50% coverage with a $25,000 limit Outside the United States:

Up to 80% coverage with a $25,000 limit. Benefits reduced by 25% if pregnancy is not reported within the first 90 days. |

Not specified |

| Pre-existing condition exclusion period | Maximum limit of $1,500 with a 12-month waiting period | $14,000/€11,000/£9,000 in the Platinum plan | Coverage available | Limited of $250,000 per plan | Unspecified |

| Intensive Care Unit (ICU) | 100% coverage after the deductible has been met | Full coverage with the Platinum plan | Coverage available | Up to $50,000 | Not specified |

| Vaccines | Unspecified | Optional | Only in the Special and Exclusive plans | $200 | Yes, but must be paid as a separate plan |

| Routine care for newborns | Unspecified | Optional | Only in the Special and Exclusive plans | Up to $750 | Yes, but must be paid as a separate plan |

| Pre-existing annual maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Full reimbursement | Unlimited depending on the plan | Depends on the plan |

| Pre-existing lifetime maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Full reimbursement | Unlimited depending on the plan | Depends on the plan |

Worldwide Medical Insurance / Comparison Chart*

Part of the table courtesy of Tokio Marine HCC

*Note: this table is just for informational purposes and subject to change. It was accurate as of the time we wrote it here, but please check each company’s individual website for updated info.

In sum…

Here are the best and cheapest international health insurance plans for students studying abroad in the United States:

- IMG

- Cigna Global

- Now Health International

- WorldTrips

- Foyer Global Health

- GeoBlue

- Global Underwriters

In conclusion…

Any chance to study overseas is sure to be a great experience. And among the months you’ll likely spend planning for your trip, determining the best and cheapest insurance for your exchange in the United States will be one thing you don’t want to forget.

After all, studying abroad isn’t cheap…so we want to save money whenever we can (and avoid the risk of ruining your time overseas with unexpected medical bills!).

Do you still have any questions about the insurance companies I talk about above? Or any other concerns about moving overseas in general (I’ve personally studied overseas in 3 separate countries…so I know it can be a little stressful!)? Just let me know in the comments area below and I’ll get back to you!

12 Responses

Everyone should have access to health insurance, whether they’re living locally or abroad. These are good options for students in the United States, providing them with coverage that will keep them well in the long term.

Hey Robert! Thank you for your comment.

I completely agree with you! Not having a proper health insurance is one of the most stressing issues people have to deal with. At least with these ones one can study in the US without worrying about his or her health. 🙂

Please let me know if you have any questions about the options or the article in general.

All the best!

which is best for type 1 diabetes using insulin?

thank you

Hello, thank you for your comment. That’s a very specific question. I would suggest you to quote online with each of the insurance companies and in the section of preexisting conditions, I would add that you have type 1 diabetes. This way you will know exactly which ones would cover you and how much would that cost.

Let me know if you have any other questions! All the best!