If you are going to be an international student in Japan, it is always good to have maximum security and guarantees in case of any unforeseen event. Want to make sure you’re covered with the best health insurance for you? Take a look at the article below for all the answers!

Many students do not pay much attention to ensuring health insurance, but it is essential to ensure peace and security in another country. In addition, you will probably need to provide proof of medical coverage to enroll in the course!

With that in mind, I will list here the best insurance options for students in Japan, along with information on types of student visas, the courses that are available and the Japanease health system.

Check it out!

Why should international students in Japan have health insurance?

Having health insurance coverage abroad is essential if you need any medical care in the new country in which you will live.

In the case of Japan, all residents of the country or persons staying longer than 90 days must have health insurance.

The health system in Japan

Japan has a public health system called the State Health Insurance System of Japan (SHIS), which is considered one of the best in the world for having low infant mortality rates accompanied by an increase in the total life expectancy of the population.

The aid is focused on primary care, with general physicians responsible for most of the care. Most clinics are privately run and have a small portion of government-run public clinics.

All travelers who will stay in Japan for more than 90 days must register with SHIS.

The SHIS allows universal coverage, being financed by taxes and private contributions. It includes hospitals, primary, specialized care, medicines and mental health care.

It is made available to working citizens and to unemployed people aged 74 or less, in addition to coverage for services for the elderly aged 75+.

Most of the population has some form of private health insurance, using the public system only as an aid.

Hiring an international health insurance is important to bring you more ease if medical help is needed, since you will have coverage and good service by the agreement already contracted before traveling.

Every Japan’s resident must have health insurance coverage

Under Japanese law, all students staying more than 90 days will need to apply for a visa and register with the public health system. Even if you can use the public system, I recommend private coverage.

Many students have been attracted to Japan, with the Tokyo 2020 Olympics we all got to know even more about the country’s culture. There are several government incentives for exchange, such as MEXT which is a scholarship opportunity even without knowing Japanese.

The 7 Best and Cheapest Health Insurance for International Students in Japan

As always, I recommend that you make an online quote with all the companies listed here… You will spend a little more time, but you can save a lot of money and make the most of your residence in Japan!

Ah! And to make this process easier for you, there is a table at the end comparing the different health plans for students!

And to learn more about the types of courses that exist and the visas that are required for you to apply for enrollment, continue reading the article after the list of the best international health insurance for students in Japan.

Note: The insurance companies I list are all foreign. But if you want to deal with Brazilian companies, check Seguros Promo and Real Seguros. I’ll talk about them later in the article.

1. Health insurance for international students by IMG

IMG has a large multiplicity of student health insurance profiles (as well as expatriate insurance plans in general).

They have three major student-oriented insurance programs. But, The Patriot Exchange Program, which is one of them, is only available to students who will study in the United States, so let’s just talk about the other two of them here.

Plan # 1: Student Health Advantage

This plan has enough services to meet all the basic health coverage requirements you may need (it is also good to check first if your educational institution has minimum coverage requirement!).

This plan covers many things that other plans don’t have – such as mental health treatments, maternity care, and pre-existing illnesses. IMG also has COVID-19 cost coverage and telemedicine available.

Plan # 2: Student Health Advantage Platinum

This plan is the same as the previous one, but offers double the maximum coverage: $1,000,000 USD.

What I like about IMG’s International Student Insurance:

- The plans are designed for students

- They cover all nationalities of students

- They have more than 17,000 health professionals available worldwide

- Customer service 24 hours a day, every day of the week

- They cover COVID-19 and telemedicine consultations

What I don’t like about IMG’s International Student Insurance:

- Some programs have a 1-year waiting period for coverage analysis of pre-existing conditions

2. International health insurance for Cigna Global students

As one of the world’s largest health insurers, Cigna Global has profiles for expatriates, travelers in general and international students.

They offer 3 main plans: Silver, Gold and Platinum. These plans have coverage not only in Japan but all over the world!

If you have plans to visit other countries during your stay in Japan, you can choose whether you want to have coverage there as well (maybe this will make your policy stay at a higher price, so it may be better to get only a short travel insurance).

Here’s a table comparing the available plan options:

Cigna’s plans have high malleability and allow you to add extra coverages needed for your profile (including dental and ophthalmic treatments or international evacuation and crisis assistance).

The company also offers various payment options such as annual, monthly and quarterly.

What I like about international health insurance for Cigna Global students:

- They have quick response to complaints (according to the company, 95% of refund requests are received in 10 days)

- There is a list of over 3,000 hospitals available, plus information guides, in the online help center

- They offer many care options if you need medical care, as they partner with over 1.65 million hospitals, doctors, clinics and experts internationally

- They have service 24 hours a day, every day of the week, for any need

What I don’t like about Cigna Global’s International Student Health Insurance:

- The simplest plan has no coverage of prenatal and postnatal care

- They do not cover outpatient consultations with specialists and doctors

Now Health International is a dominant player in the international insurance market, with a strong commitment to satisfying its clients through affordable and effective plans.

One of the key strengths of this company is its cutting-edge customer service, which ensures swift and practical information delivery.

All the plans offered by Now Health are tailored to meet the diverse needs of expatriates residing in foreign countries, including international students and exchange students worldwide.

Furthermore, these plans are fully customizable, guaranteeing a perfect fit for all your individual requirements.

What I like about Now Health International Student Plans:

- Clear information and 24/7 customer service

- Coverage in over 190 countries and territories

- Various international insurance options and customizable plans

- Some plans offer coverage for maternity routines

What I don’t like about Now Health International Student Plans:

- In some procedures, Now Health works with a reimbursement system

- For plans with routine maternity coverage, you must wait a 12-month waiting period to access this benefit

4. WorldTrips

HCCMIS is a company that provides insurance for full-time students and fellows who study abroad (in addition to having travel insurance plans as well).

The 4 levels of student insurance coverage they provide work very well for your needs in Japan! These levels are:

StudentSecure Elite

- It has the lowest price franchises and the highest maximum coverage, compared to the other companies I listed

- Has 6 months approval wait before a pre-existing condition can be covered

- Offers sports coverage for club/intercollegiate

- Offers coverage of personal liability

StudentSecure Select

- Waiting period of 6 months before coverage of a pre-existing condition

- Optional Crisis Response for ransom, your personal belongings and crisis rates

StudentSecure Budget

- Coverage of pre-existing conditions starts 1 year after purchase of the plan

- Average benefits and the highest franchise (monthly rate lower than the overall)

StudentSecure Smart

- Lower cost (but lower benefits)

- Has the highest franchise of all plans

- No coverage for club sports

- Only covers a pre-existing condition at its acute onset

Below is a comparison of the 4 HCCStudentSecure plans (click to see the full chart):

What I like about HCCMIS StudentSecure plans:

- Have emergency dental coverage of up to $250 maximum per tooth and $500 maximum for the certification period

- They have an economic plan if you pay the full amount in advance

- They have some of the most economical plans on the list

What I don’t like about HCCMIS StudentSecure plans:

- No coverage for pre-existing conditions in the Smart program

- There is a 6-month waiting period to cover pre-existing diseases (even on your Elite plan)

- No vaccine coverage unless you close the Elite plan

- Does not cover maternity and nursery for newborns in the Smart plan

- Your plans are cheaper but may have high franchises

![]()

Visitor Coverage, established in 2006 in the U.S., aims to simplify the process of selecting travel insurance by offering tailored and affordable solutions for tourists, students, expats, and immigrants.

While the company doesn’t issue its own insurance plans, it serves as a broker, connecting customers with trusted insurance providers to ensure coverage during emergencies. With an easy-to-use platform, travelers can quickly compare and purchase the insurance that best suits their needs by entering some basic trip details.

For international students, for instance, users can provide information such as destination country, age, and nationality. The platform then offers the most suitable insurance options, showing costs, coverage details, cancellation options, and coverage extension possibilities. It also provides ratings and in-depth information on each insurance provider and their offers.

What I like about Visitor Coverage student insurance:

- You can compare the most reliable travel insurance on the market

- It brings together detailed information from several insurance companies

- Intuitive platform

- It shows options that suit each traveler’s profile and with different prices

- Support for insured students 24/7

- More than 18 years of experience and more than 1 million customers around the world

What I don’t like about Visitor Coverage student insurance:

- There is no insurance from Visitor Coverage itself

- Your exchange must last at least 30 days and a maximum of 1 year

- It does not cover the following destinations: Belarus, Cuba, Iran, Israel, Lebanon, Mayotte, North Korea, Russia, Syria and Ukraine

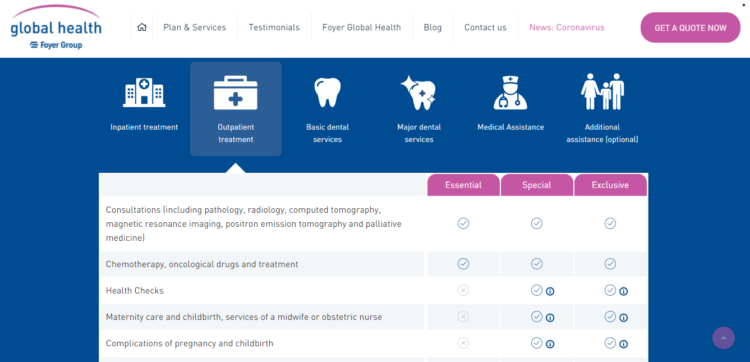

Foyer Global Health has a wide range of plans! Starting from Basic to Premium, with short or long stays, individual or family… Whatever you need in Japan, they have a program for your profile!

The company has 3 different master plans. Here’s a quick overview of what each of these plans has:

ESSENTIAL

- Surgery and anesthetics, in addition to consultations

- Medical devices such as cardiac pacemakers and rescue measures if necessary

- Congenital diseases (up to a maximum of €100,000 per life)

- Has no maternity and childbirth coverage

SPECIAL

- Cover surgeries and anesthetics, as well as consultations

- Aid and therapeutic devices (such as artificial limbs and prostheses) up to €2,000

- Congenital diseases up to a maximum of €150,000 per life

- Maternity and childbirth care (up to €5,000 with 10 months waiting)

EXCLUSIVE

- Coverage of surgery and anesthetics, in addition to consultations

- Therapeutic devices

- Congenital diseases of up to a maximum of €200,000 per life

- Maternity care, childbirth care and midwifery or nursing services in the hospital available (up to €20,000 with 10-month waiting)

What I like about Foyer Global Health plans:

- All plans cover consultations, surgeries and primary dental treatments

- Customer service 24 hours by phone and online platforms such as email with experienced consultants, doctors and experts

- Offer evacuation and repatriation service

- Have medical support and pre-trip advice (such as information about vaccinations and the preparation of a first aid kit)

What I don’t like about Foyer Global Health plans:

- Your simplest plan does not cover prenatal and postnatal care

7. Diplomat Long Term and Diplomat International from Global Underwriters

Global Underwriters offers international health insurance plans with plenty of choice for different profiles of traveler needs, including exchange and international students in another country.

When it comes to GU plans, I recommend Diplomat Long Term and Diplomat International to international students in Japan.

What I like about Global Underwriters plans:

- Student programs have coverage for medical evacuations, emergency dentistry and repatriation of remains

- Diplomat Long Term and Diplomat International have coverage of up to $1,000,000

- Have coverage and assistance in case of lost luggage and travel interruptions

- Customer service 24 hours a day, every day of the week

What I don’t like about Global Underwriters plans:

- The Diplomat International plan is not covered by Covid-19

- The Diplomat Long Term plan does not cater to students residing in Australia and Iran, as well as New York, Maryland, South Dakota (although this is not a problem for you if you have moved to Japan!)

- They are a bit more expensive than the others on this list

2 International Health Insurance Companies that can also be used by International Students in Japan

The two companies I will list below do not offer health insurance made precisely for students, but they do offer international health insurance that (quite possibly) will not have problems of acceptance by your educational institution as proof of coverage.

So, here’s my advice to you: make a quote with them and compare it with the other quotes and simulations you had from the companies above. If you think one of them offers better coverage at a more affordable price than the other options, check with your Portuguese school or university if they accept this type of policy.

– GeoBlue

GeoBlue is a good option if you are looking for a health insurance policy to cover you while in Japan.

What I like about GeoBlue’s international health insurance:

- Their programs have a high adaptation to your needs and are flexible

- Customer service 24 hours, 7 days a week

- Certain plans cover extra costs such as evacuation, preventive medical consultations and maternity care

- There is an option to add ophthalmology and dentistry coverage

- The Xplorer plan covers extreme sports but does not cover maximum medical expenses, does not charge franchises for standard services and has no cancellation fees.

What I don’t like about GeoBlue’s international health insurance:

- New York and Washington residents have no assistance (although this may not be a problem if you move your official residence to Japan!)

- You need to contact a broker and talk to him personally to get a quote (which complicates the process)

–Aetna (acquired by AllianzCare)

Aetna is a company with great recognition in the area of health insurance.

The advantage of Aetna is the flexibility of their various plans, being able to customize based on what is necessary for you and your profile, as well as great customer service.

What I like about Aetna’s international health insurance:

- They have more than 50 years’ experience in the health insurance industry

- They offer flexible plans and customization possibilities

- They have service 24 hours, 7 days a week

- Plans are covered for emergency evacuations, cancer treatments, repatriation and hospitalization

- It is a company that has won awards such as “Health Insurer of the Year” and “Best Provider of International Private Health Insurance”

- They have a platform that encourages healthier habits with a system of points and prizes

What I don’t like about Aetna’s international health insurance:

- Their website does not make clear about the exact coverage of some of their programs

- Do not have any type of travel insurance plan

Table comparison of the 7 best health insurance plans for international/exchange students in Mexico

|

|

Cigna Global Cigna Global |

|

|

|

|

| Medical Maximum | Unlimited (for the Platinum plan) | $5,000,000 | There are no limits independent of the plan | US$1,000,000 per year | $1,000,000 |

| Mental Health Benefit | Unspecified | Unlimited for up to 90 days | Included in all plans with a 10-month waiting period | Outpatient: $50 per day max up to $500 in total | Yes |

| Inpatient Prescription Drugs | 80% coverage out-of-network, 100% in the USA and internationally | Unspecified | Coverage available | Name-brand drugs: 50% coinsurance

Generic drugs: 100% coinsurance Special drugs: no coverage |

Yes |

| Outpatient Prescription Drugs | 50% of actual costs, 90 days maximum per dispensation | Unspecified | Unspecified | coinsurance

Generic drugs: 100% coinsurance Special drugs: no coverage |

Yes |

| Mental Health Benefit | Inpatient and Outpatient: $5,000 lifetime maximum to paid in full depending on the plan | Inpatient and Outpatient: $50,000 lifetime maximum | None | Inpatient and Outpatient: limit not specified | Inpatient, outpatient, and therapy: limit not specific |

| Outpatient Prescription Drugs | None, unless you buy the International Outpatient Option | Up to $8,000,000 | Full reimbursement | Yes | Yes |

| Repatriation of Remains | $25,000 maximum or $5,000 for cremation | Optional | Optional | $50,000 maximum or $5,000 for cremation | $13,500 maximum |

| Emergency Evacuation | $50,000 | Optional | Optional | $10,000 | Yes |

| Hospital room coverage | Offered up to the average semi-private room rate | Private room | Private Room | Usual | Usual |

| Terrorism | $50,000 | Unspecified | Unspecified | $100,000 | N/A |

| Accidental Death & Dismemberment (AD & D) | Principal sum of $25,000 that is not subject to deduction | $25,000 for main policy holder, $10,000 for spouse on the plan, $5,000 for child on the plan

Total limit of $250,000 |

Optional | $25,000 for main policy holder, $10,000 for spouse on the plan, $5,000 for child on the plan

Total limit of $250,000 |

There is coverage |

| Emergency Dental | $500 per injury for the coverage period | Optional | Optional | $2,500 | Yes |

| Maternity Care | Only covered in Platinum plan | $14,000/€11,000/£9,000 in the Platinum plan | Only available in the Special and Exclusive plans | Within the US: up to 80% coverage with a $25,000 limit within the PPO network/Outside PPO: up to 50% coverage with a $25,000 limit

Outside the United States: Up to 80% coverage with a $25,000 limit. Benefits reduced by 25% if pregnancy is not reported within the first 90 days. |

Not specified |

| Pre-existing condition exclusion period | Maximum limit of $1,500 with a 12-month waiting period | $14,000/€11,000/£9,000 in the Platinum plan | Coverage available | Limited of $250,000 per plan | Unspecified |

| Intensive Care Unit (ICU) | 100% coverage after the deductible has been met | Full coverage with the Platinum plan | Coverage available | Up to $50,000 | Not specified |

| Vaccines | Unspecified | Optional | Only in the Special and Exclusive plans | $200 | Yes, but must be paid as a separate plan |

| Routine care for newborns | Unspecified | Optional | Only in the Special and Exclusive plans | Up to $750 | Yes, but must be paid as a separate plan |

| Pre-existing annual maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Full reimbursement | Unlimited depending on the plan | Depends on the plan |

| Pre-existing lifetime maximum once covered | Unlimited depending on the plan | Up to $8,000,000 | Full reimbursement | Unlimited depending on the plan | Depends on the plan |

Worldwide Medical Insurance / Comparison Chart*

Part of the table courtesy of Tokio Marine HCC

*Note: this table is just for informational purposes and subject to change. It was accurate as of the time we wrote it here, but please check each company’s individual website for updated info.

Types of courses for those who want to study in Japan

Now you already have more knowledge about how the Japanese health system works and the best insurance for students, you need to know which course to apply. But relax! Below I have listed the most popular courses for those who will study in the country. Who knows this does not help you decide.

Japan is very receptive to foreign exchange students, so always try to keep an eye on the scholarships that are made available by the government.

Language course

Japan has a wonderful cultural variety, with ancient traditions, breathtaking landscapes and futuristic metropolises. Tokyo, for example, can be a place for you to study, get to know a technological world and socialize around the city.

To study in Japan in a language school the maximum period is 12 weeks and is used tourist visa (90 days). To be able to study for longer periods it is necessary to be linked to some public institution, and to obtain the student visa by the Dept. of Immigration in Japan.

The student visa is valid for a period of 6 months to 2 years and can be renewed if there is an extension of the course. It allows part-time work (28 hours a week), but there are some restrictions on the type of work allowed.

Higher education

The stimuli for foreign students in Japan encouraged several universities to include and adapt the educational programs, which were already advanced and can now be more diverse.

The scholarship to do college or technical-vocational course in Japan requires one year of preparatory course of Japanese language and other introductory disciplines.

The application process to earn the scholarship to do graduation in Japan is long and complex, so if this is your plan recommend preparing well. First there is the phase of documentary analysis, written tests and interview by the educational institution. Candidates who pass the analysis phase will take in-person tests specific to the area they are looking for. After these tests, the classifieds are called for interviews. Those approved in the interviews are indicated to MEXT, which will analyze the application to study in Japan.

Some institutions may ask you to perform the EJU (Examination for Japanese University Admission for International Students), which is a standardized basic knowledge assessment test applied in much of Japanese universities for the admission of exchange students. It is very likely that if you intend to study abroad in Japan during graduation, you will need to do it.

Visa to study in Japan

Anyone thinking about going abroad to study needs to make sure of the type of visa they should and plan to get and what to do to apply.

The visa is mandatory for students and must provide it before moving to Japan. To get your visa you need to go to the Japanese Embassy in your country and enter the application.

The documents required are:

- Registration form with a photo 3 4;

- Simple copy of identity;

- for those who have completed high school: Transcript and certificate of completion of high school (notarized copy);

- for those in the third year: registration certificate (original) and simple copies of the first year, second year and first two months of the third year;

- For those who have completed high school and are attending higher education: School transcript and certificate of completion of high school (notarized copy); academic history and statement of regular student of higher education (original of institution or notarized copy);

- letter of recommendation from the last school attended (high school, college or college), on letterhead of the institution;

- Letter of motivation (30 to 40 lines, font Arial 12, size A4, typed) explaining the reason for choosing graduation in Japan, the course intended in that country, the reasons for this choice and the professional activity you intend to develop in the future. The title and name of the applicant shall be given;

- Simple copy of the last ENEM result, if any;

- Simple copy of the Certificate of Proficiency in English (TOEFL, TOEIC, IELTS, Cambridge or Duolingo) or proof of language studies documents;

- Simple copy of Japanese proficiency certificates (JLPT, J-Test, BJT) or proof of language studies documents.

In sum

Here are the 7 best and cheapest health insurance policies for international students in Japan:

- Student Health Advantage from IMG

- International student health insurance from Cigna Global

- Now Health International

- StudentSecure from HCCMIS

- Foyer Global Health

In Conclusion…

Overall… in your preparations to be an international student in Japan, make sure that your health insurance is not something you leave for the last minute as it is completely essential.

After all, no one does not want to be paying out of their own pocket all the medical expenses!

If you still have any questions about student health insurance options in Japan (or moving abroad in general), leave a comment below and I will be completely on hand to help!